"FrÉdÉric Bastiat (1801-1850) and Rethinking Classical Economics in the mid-19th Century"

[Created: October 6, 2012]

[Updated: October 6, 2012 ] |

A Brief History of Economic Thought

Institute for Liberal Studies, The University of Toronto, Bahen Centre

Friday 29 September, 2012

Dr. David M. Hart, Liberty Fund, Inc

<dmhart@mac.com>

<www.davidmhart.com

<oll.libertyfund.org>

[see the full slide show in PDF 13.7 MB]

Table of Contents

- Opening Quotes.

- “All Forms of Freedom go Together”

- “Frankly, my good people, you are being robbed.”

- Schools of Economic Thought

- Overview

- Bastiat and the 19thC French School of Political Economy

- The Importance of Frédéric Bastiat (1801-1850)

- Key Members of the First Generation (1803-1842)

- Key Members of the Second Generation (1842-)

- Bastiat and the "Four Musketeers" of French Political Economy

- Brief Bio of Bastiat (1801-1850).

- More Info

- The Early “Unseen” FB: Provincial Magistrate and Landowner (1801-1844)

- The “Seen” Bastiat I: The Free Trade Organizer and Journalist (1844-1848)

- The “Seen” Bastiat II: The Politician during the 1848 Revolution and the Second Republic (1848-1850)

- The “Seen” Bastiat III: The Theorist of Political Economy (1847-1850)

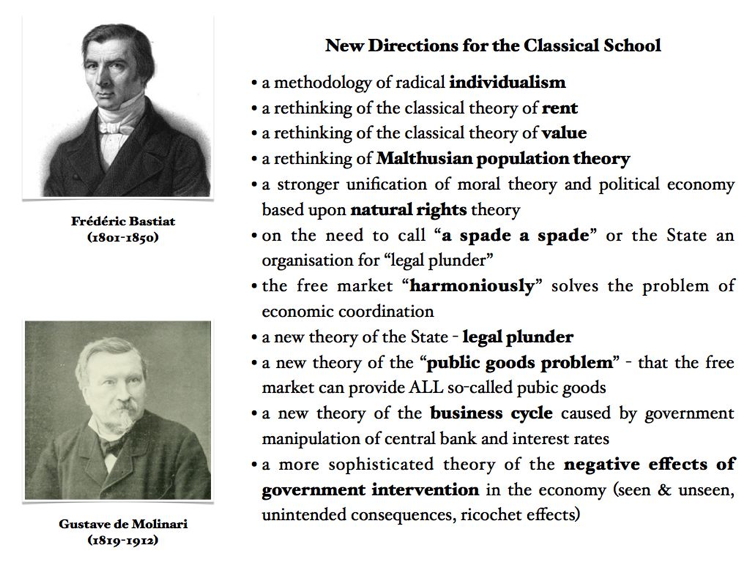

- Bastiat’s Contribution to Rethinking the Classical Tradition

- The Decade of Rethinking the Classical Tradition (1846-1856)

- Some Important New Concepts developed by the Second

Generation (especially Bastiat and Molinari)

- a methodology of radical individualism

- a rethinking of the classical theory of rent

- a rethinking of the classical theory of value

- a rethinking of Malthusian population theory

- a stronger unification of moral theory and political economy based

upon natural rights theory

on the need to call “a spade a spade” or the State an organisation for “legal plunder” - the free market “harmoniously” solves the problem of economic coordination

- a new theory of the State - legal plunder

- a new theory of the “public goods problem” - that the free market can provide ALL so-called pubic goods

- a new theory of the business cycle caused by government manipulation of central bank and interest rates

- a more sophisticated theory of the negative effects of government intervention in the economy (unintended consequences)

Opening Quotes

“All Forms of Freedom go Together”

[Draft Preface for the Harmonies (1847)]

My dear Frédéric [FB writing to himself],

Like you I love all forms of freedom; and among these, the one that is the most universally useful to mankind, the one you enjoy at each moment of the day and in all of life’s circumstances, is the freedom to work and to trade. I know that making things one’s own is the fulcrum of society and even of human life. I know that trade is intrinsic to property and that to restrict the one is to shake the foundations of the other. I approve of your devoting yourself to the defense of this freedom whose triumph will inevitably usher in the reign of international justice and consequently the extinction of hatred, prejudices between one people and another, and the wars that come in their wake.

I love freedom of trade as much as you do. But is all human progress encapsulated in that freedom? In the past, your heart beat for the freeing of thought and speech which were still bound by their university shackles and the laws against free association. You enthusiastically supported parliamentary reform and the radical division of that sovereignty, which delegates and controls, from the executive power in all its branches. All forms of freedom go together. All ideas form a systematic and harmonious whole, and there is not a single one whose proof does not serve to demonstrate the truth of the others. But you act like a mechanic who makes a virtue of explaining an isolated part of a machine in the smallest detail, not forgetting anything. The temptation is strong to cry out to him, “Show me the other parts; make them work together; each of them explains the others ”

“Frankly, my good people, you are being robbed.”

[ES2 IX “Theft by Subsidy” (January 1846) (LF ed.)]

People find my small volume of Sophisms too theoretical, scientific and metaphysical. So be it. Let us try a mundane, banal and, if necessary, brutal style. Since I am convinced that the general public are easily taken in as far as protection is concerned, I wanted to prove it to them. They prefer to be shouted at. So let us shout:

Midas, King Midas has ass’s ears! [i.e. “The Emperor has no clothes]

An explosion of plain speaking often has more effect than the politest circumlocutions. Do you remember Oronte and the difficulty that the Misanthropist, as misanthropic as he is, has in convincing him of his folly?

Alceste: We risk playing the wrong character.

Oronte: Are you trying to tell me by that that I am wrong in wanting …

Alceste: I am not saying that, but …

Oronte: Do I write badly?

Alceste: I am not saying that, but in the end …

Oronte: But can I not know what there is in my sonnet …?

Alceste: Frankly it is fit to be flushed away.

Frankly, my good people, you are being robbed. That is plain speaking but at least it is clear.

The words, theft, to steal and thief seem to many people to be in bad taste. Echoing the words of Harpagon to Elise, I ask them: Is it the word or the thing that makes you afraid?

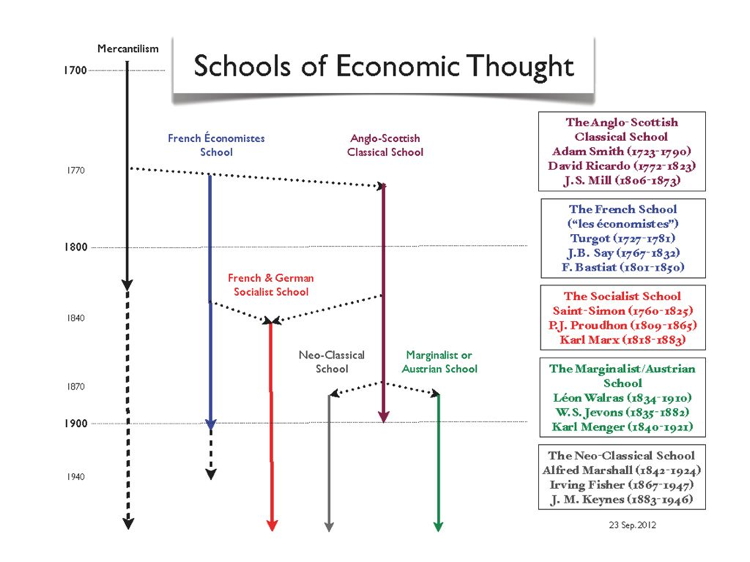

Schools of Economic Thought

Overview

Mercantilism or “Colbertism”:

emerged during 17th and 18thC

J.B. Colbert (1619-1683)

The Classical School:

2 schools of free market economic thought emerged out of 18thC

The Anglo-Scottish Classical School

- Adam Smith (1723-1790)

- David Ricardo (1772-1823)

- J.S. Mill (1806-1873)

The French School (“les économistes”)

- Turgot (1727-1781) - Physiocrat School of 18thC

- J.B. Say (1767-1832) - 1st generation of 19thC

- Bastiat (1801-1850) - 2nd generation of 19thC

The Socialist School

emergence in 1830s-1850s of Socialist schools of thought (Proudhon, Marx)

- H. de Saint-Simon (1760-1825)

- P.J. Proudhon (1809-1865)

- Karl Marx (1818-1883)

The Marginalist School (Austrian School)

emergence in 1870s of Marginalist School (Jevons, Menger, Walras)

- Léon Walras (1834-1910)

- W.S. Jevons (1835-1882)

- Karl Menger (1840-1921)

The Neo-Classical School

emergence in 1890s of Neo-Classical School (Marshall)

- Alfred Marshall (1842-1924)

- Irving Fisher (1867-1947)

- John Maynard Keynes (1883-1946)

Bastiat and the 19thC French School of Political Economy

The Importance of Frédéric Bastiat (1801-1850)

- profound impact on the French CL movement in mid-19th century - on the political economists in Paris, translation of his books into most European languages, influence Michel Chevalier who signed French free trade treaty with Cobden 1860

- he was a brilliant stylist and polemicist against protectionism and government intervention - no one his equal until Milton Friedman’s (1912-2006) Newsweek column (1966-1984) and TV documentaries (Free to Choose, 1980) and Don Boudreaux’s “Letters to the Editor”

- radical natural rights approach to individual liberty

- combined single-issue activism, journalism (1844-1848), election to political office (1848-1850), theoretical work (1848-1850) in a coherent whole

- courageous man of principle who was active of the streets of Paris in the middle of a revolution -- Paris February and June 1848 - trying to convert the workers to free market ideas, stop the troops shooting the workers in the streets and on the barricades

- proto-Austrian economist in his theoretical writing -key transitional figure between classical and marginal/Austrian schools

- proto-public choice analysis of politics

- tried to integrate his ideas on free trade into an all-encompassing theory of individual liberty based upon natural rights: constitutional limited government, peace, and free markets

- rediscovery of FB in the modern libertarian movement - Leonard Read (FEE), Henry Hazlit (WSJ and NYT), Murray Rothbard

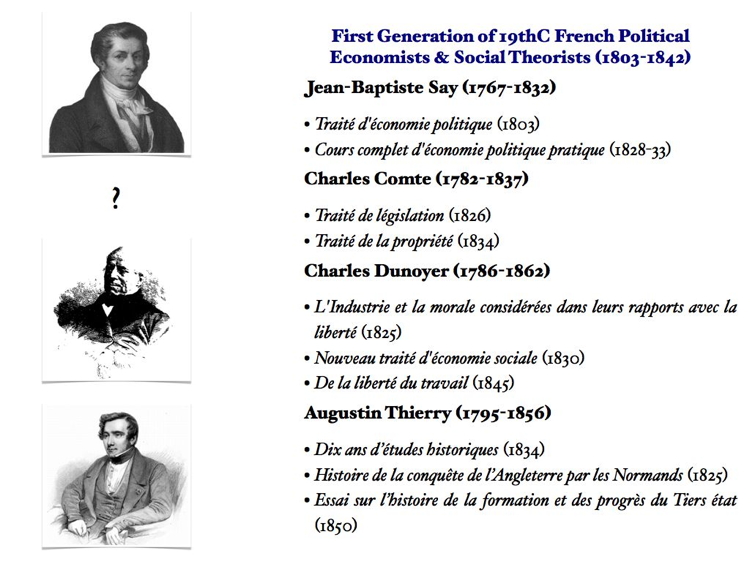

Key Members of the First Generation (1803-1842)

Building upon the foundation laid by Physiocratic School of 18th Century:

- François Quesnay (1694-1774)

- Anne-Robert-Jacques Turgot (1727-1781)

- Mercier de la Rivière (1720-1794)

- Vincent de Gournay (1712-1759)

- the Marquis de Mirabeau (1715-1789)

- Pierre Samuel du Pont de Nemours (1739-1817)

First Generation of 19thC French Political Economists & Social Theorists (1803-1842)

Jean-Baptiste Say (1767-1832)

- Traité d'économie politique (1803)

- Cours complet d'économie politique pratique (1828-33)

Charles Comte (1782-1837)

- Traité de législation (1826)

- Traité de la propriété (1834)

Charles Dunoyer (1786-1862)

- L'Industrie et la morale considérées dans leurs rapports avec la liberté (1825)

- Nouveau traité d'économie sociale (1830)

- De la liberté du travail (1845)

Augustin Thierry (1795-1856)

- Dix ans d’études historiques (1834)

- Histoire de la conquête de l’Angleterre par les Normands (1825)

- Essai sur l’histoire de la formation et des progrès du Tiers état (1850)

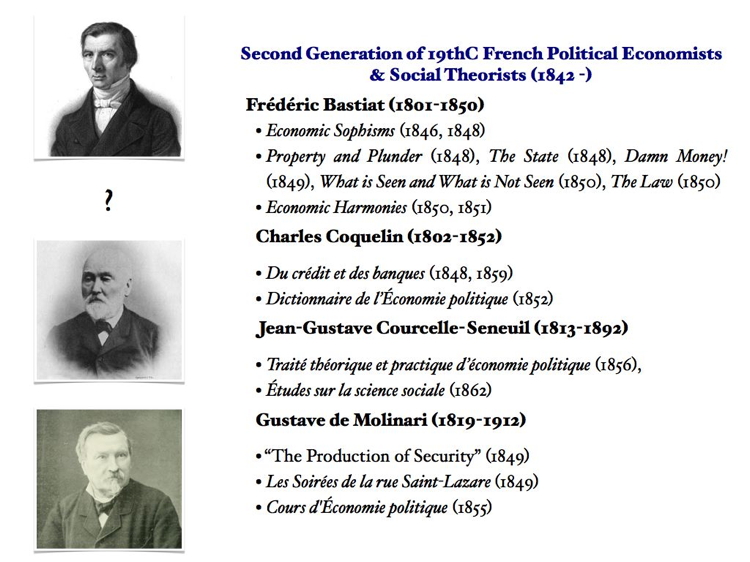

Key Members of the Second Generation (1842-)

Frédéric Bastiat (1801-1850)

- Economic Sophisms (1846, 1848)

- Property and Plunder (1848), The State (1848), Damn Money! (1849), What is Seen and What is Not Seen (1850), The Law (1850)

- Economic Harmonies (1850, 1851)

Charles Coquelin (1802-1852)

- Du crédit et des banques (1848, 1859)

- Dictionnaire de l’Économie politique (1852)

Jean-Gustave Courcelle-Seneuil (1813-1892)

- Traité théorique et practique d’économie politique (1856),

- Études sur la science sociale (1862)

Gustave de Molinari (1819-1912)

- “The Production of Security” (1849)

- Les Soirées de la rue Saint-Lazare (1849)

- Cours d'Économie politique (1855)

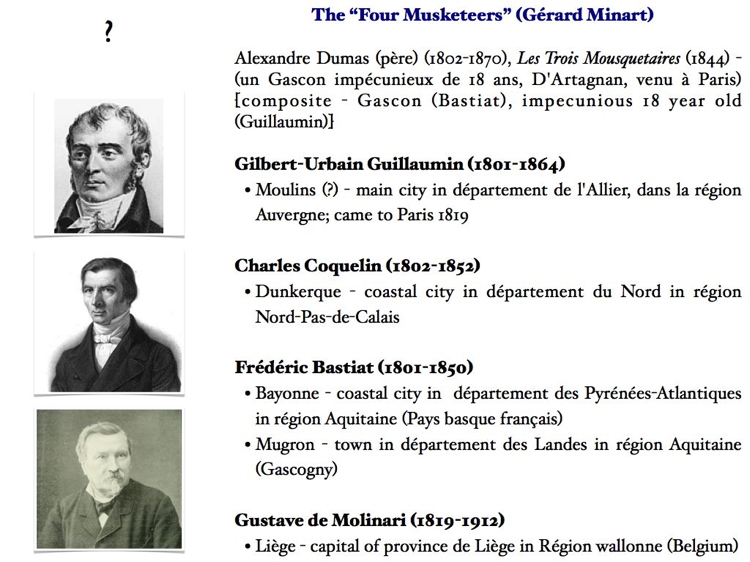

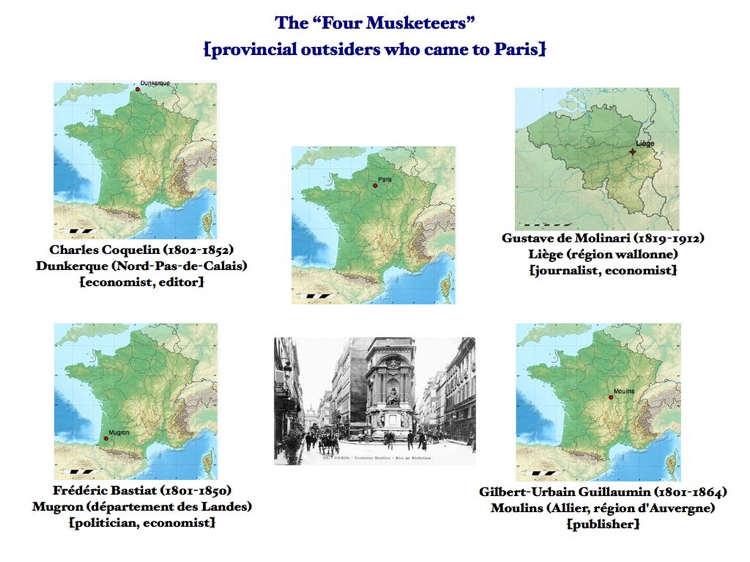

Bastiat and “The Four Musketeers” of French Political Economy

Bastiat was one of “The Four Musketeers” as described by Gérard Minart in his biography of Molinari.

- 4 young men from the provinces who went to Paris in the 1830s (Guillaumin) or 1840s and who transformed political economy with their organizational skills and their new ideas. As ambitious, immigrants and outsiders they brought a new perspective to thinking about political economy and change [compare Vienna in late 19thC]

- Gilbert-Urbain Guillaumin (1801-1864). Book seller, publisher, movemnet organizer and facilitator. From Moulins (?) - main city in département de l'Allier, dans la région Auvergne; came to Paris 1819

- Charles Coquelin (1802-1852). Industrialist, economist, editor. From Dunkerque - coastal city in département du Nord in région Nord-Pas-de-Calais

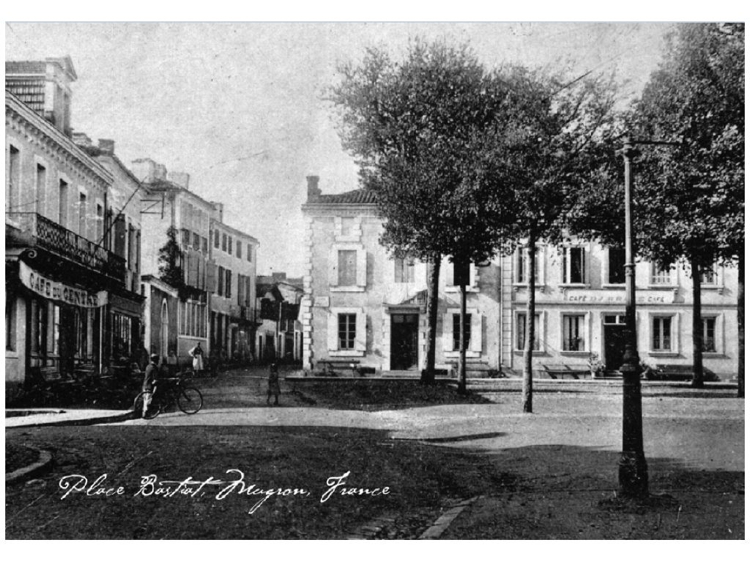

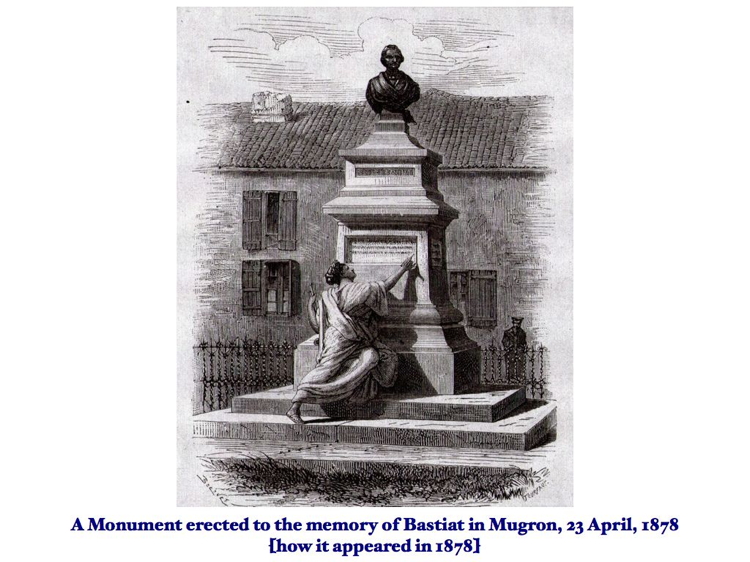

- Frédéric Bastiat (1801-1850). Magistrate, free trade activist, journalist, politician, economist. Born in Bayonne - coastal city in département des Pyrénées-Atlantiques in région Aquitaine (Pays basque français). Lived in Mugron - town in département des Landes in région Aquitaine (Gascogny)

- Gustave de Molinari (1819-1912). Jounalist, economist. Born in Liège - capital of province de Liège in Région wallonne (Belgium)

Brief Bio of Bastiat (1801-1850)

More Info

For more information about Bastiat’s life and work, as well as access to his works online, see <http://oll.libertyfund.org/person/25> and <http://davidmhart.com/FrenchClassicalLiberals/Bastiat/index.html>.

A detailed chronology of his life (in French) can be found here "Chronologie de la vie et des oeuvres Frédéric Bastiat" by Jean-Claude Paul-Dejean at the Bastiat Circle website <http://bastiat.net/fr/biographie/chronologie.html>.

A shorter one in English can be found here <http://davidmhart.com/FrenchClassicalLiberals/Bastiat/Lecture/Chronology.html>.

An expanded one based upon Paul-Dejean’s (in English) here <http://davidmhart.com/FrenchClassicalLiberals/Bastiat/ExpandedChronology.html>.

The Early “Unseen” FB: Provincial Magistrate and Landowner (1801-1844)

- born 30 June 1801 in Bayonne in SW France [died 24 December 1850, Rome]; father Pierre B merchant in Spanish trade; grew up in town at mouth of Ardour R. where it enters Atlantic Ocean; major artery for wine trade, trade with neighbouring Spain [See maps]

- enjoyed an innovative education at College of Saint-Sever and then Benedictine École de Sorèze (1814-1818) where school encouraged study of modern subjects (languages English, Italian, Spanish) and not Greek and Roman classics

- entered uncle’s business in 1818 before completing school

- inherited grandfather’s estate in 1825 and became gentleman farmer in Mugron

- 1830 - participates in 1830 Revolution by joining protests in Bayonne in favour of the new regime which becomes the July Monarchy [famous story about garrison of Bayonne and drinking wine and signing songs]

- 28 May 1831 - appointed justice of the peace in Mugron canton

- 17 Nov. 1833 - elected Councillor General for Mugron canton; reelected Nov. 1839

- continued education with voracious reading and study of literature and economics (read English, Italian, Spanish); joined town reading and discussion group; close to friend Félix Coudroy with whom he discussed everything during long walks in country-side. Read

- went to Spain in 1840 to set up insurance company (unsuccessful)

- discovered RC’s Anti-Corn Law League while preparing for his discussion group; wrote article in 1844 on the impact of tariffs in France and England which he submitted as complete unknown to JDE (Oct 1844) ; became instantly famous in political eco. circles

This begins the next tumultuous phase of FB’s life - The “Seen” Bastiat

The “Seen” Bastiat I: The Free Trade Organizer and Journalist (1844-1848)

- 1845 - trip to Paris to make contact with SEP and then England to visit Cobden and League

- 1845 - 1st book published on Cobden et al ligue

- success of JDE article leads to other articles which become Economic Sophisms (1st Series) (1845) followed by part 2 in 1848)

- FB writes articles for local newspapers and helps start Bordeaux Free Trade Association 23 February 1846

- goes to Paris to form national Free Trade Association 10 May 1846

- 29 Nov. 1846 1st issue of magazine Le libre échange - 4-8 page free trade weekly paper (lasts until 16 Apr. 1848)

- 1847 - French Chamber debates bill to cut French tariffs but it defeated by protectionist lobby; debate in Committee April-July 1847

- July 1847 gives a course on political economy at the School of Law (foundation of Ec. Harmonies)

- outbreak of Feb1848 Revolution sees rise of socialist movements; free trade movement in France discouraged; holds last public meeting 15 March 1848; Libre-Échange last issue 16 April 1848

The “Seen” Bastiat II: The Politician during the 1848 Revolution and the Second Republic (1848-1850)

- abdication of Louis Philippe 24 Feb. 1848; declaration of 2nd Republic 25 Feb

- FB immediately founds La République française after outbreak of revolution; designed to appeal to ordinary people and to show them the dangers of socialism and protectionism

- 23 April 1848 FB elected deputy of Les Landes to Constituent Assembly

- 13 May 1848 reelected to Legislative Assembly and appointed vice-president of Finance Committee

- June 1848 - founds second revolutionary journal Jacques Bonhomme ed. by Charles Coquelin and G. de Molinari

- Aug. 1949 attends Paris Peace Congress organised by V. Hugo

- legislative activities

- supports motion to prevent civil servants also serving as elected representatives

- opposes government motions for “right to work”, limiting working day to 10 hours, unemployment subsidies in National Workshops

- opposes govt policy to convict socialist Louis Blanc for activities during June Days uprising

- votes in favour of new constitution and Gen. Cavaignac for president

- votes against ban on voluntary trade unions

- votes against imposition of martial law

- opposes govt. proposal to send troops to Rome to protect Pope

- opposes govt. education policy (Falloux Law)

The “Seen” Bastiat III: The Theorist of Political Economy (1847-1850)

- attends meetings of the Société d’économie politique - controversial positions on nature of rent (landed rent) and ultra-minimalist size of government provoke spirited debates within the SEP

- July 1847 gives a course on political economy at the School of Law (foundation of Ec. Harmonies)

- writes many articles for the Journal des économistes 1844-1850; offered job of editing JDE but turns it down

- the rush to finish the Economic Harmonies (part 1 Feb. 1850, 2nd part appears posthumously)

Bastiat’s Contribution to Rethinking the Classical Tradition

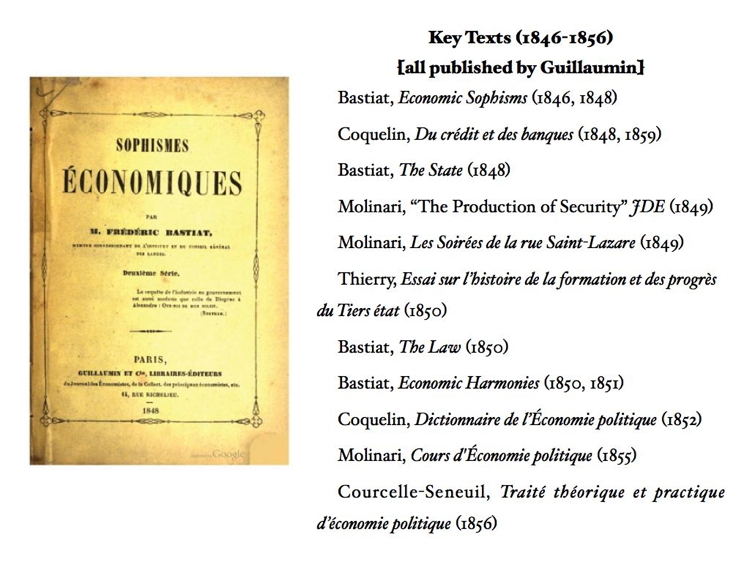

The Decade of Rethinking the Classical Tradition (1846-1856)

Radical Moment in French CL Thought 1842-1855

- second generation of CL economists and social theorists - 1842 key date with founding of Soc Pol Ec and JDE and Guillaumin firm

- radical libertarianism began to emerge -

- Coquelin on free banking

- Bastiat on theory of plunder, subjective value theory, free trade and peace

- Molinari on anarcho-capitalism

- challenge to classical school orthodoxy -

- Bastiat on rent and value and Malthusianism,

- Molinari on the private provision of public goods,

- Coquelin on free competitive banking

- first attempts to write one volume account of CL theory as a whole. First time an attempt was made to sum up in one volume a complete world-view based upon a small number of basic principles [individual liberty, private property, voluntary (not coercive) interaction with others] which are applied universally. First before Mises, Liberalism (1960?) adn Rothbard, For a New Liberty (1974).

- GdM’s SRSL (1849),

- Herbert Spencer Social Statics (1851)

Key Texts (1846-1856)

- Bastiat, Economic Sophisms (1846, 1848)

- Coquelin, Du crédit et des banques (1848, 1859)

- Bastiat, The State (1848)

- Molinari, “The Production of Security” (1849)

- Molinari, Les Soirées de la rue Saint-Lazare (1849)

- Thierry, Essai sur l’histoire de la formation et des progrès du Tiers état (1850)

- Bastiat, The Law (1850)

- Bastiat, Economic Harmonies (1850, 1851)

- Coquelin, Dictionnaire de l’Économie politique (1852)

- Molinari, Cours d'Économie politique (1855)

- Courcelle-Seneuil, Traité théorique et practique d’économie politique (1856)

Additional Important Pamphlets by Bastiat (1848-1850)

1848

- “Propriété et loi” - Property and Law

- “Propriété et spoliation” - Property and Plunder

- “L’État” - The State

1849

- “Capitle et rente” - Capital and Rent

- “Maudit l’argent!” - Damn Money

1850

- “Spoliation et la loi” - Plunder and the Law

- “La loi” - The Law

- “Ce qu’on voit et ce qu’on ne voit pas” - What is Seen and What is Not Seen

Some Important New Concepts developed by the Second Generation (especially Bastiat)

These ideas pushed the Classical School into new directions. Especially work of Bastiat and Molinari: [with quotes]

- a methodology of radical individualism

- a rethinking of the classical theory of rent

- a rethinking of the classical theory of value

- a rethinking of Malthusian population theory

- a stronger unification of moral theory and political economy based upon natural rights theory

- on the need to call “a spade a spade” or the State an organisation for “legal plunder”

- the free market “harmoniously” solves the problem of economic coordination

- a new theory of the State - legal plunder

- a new theory of the “public goods problem” - that the free market can provide ALL so-called pubic goods

- a new theory of the business cycle caused by government manipulation of central bank and interest rates

- a more sophisticated theory of the negative effects of government intervention in the economy (unintended consequences)

A methodology of radical individualism

- began as “consumer-centric” view of economics [not State, monarch, or producers]

- invented “Crusoe economics” to explain pure logic of individual choice

Quote from ES2 XIV “Something Else” (March 1847) (LF ed.)

"Please explain the mechanism and effects of protection to me."

"That is not easy. Before moving on to complicated examples, we would have to study it in its simplest form."

"Take the simplest example you want."

"Do you remember how Robinson Crusoe set about making a plank when he had no saw?"

"Yes, he felled a tree and, trimming the trunk with his axe first on its left and then on its right side, he reduced it to the thickness of a beam."

"And did that take him a great deal of work?"

"Two whole weeks."

"And what did he live on during this time?"

"His provisions."

"And what became of the axe?"

"It became very blunt."

"Very well. But perhaps you did not know this. Just when he was about to give the first stroke of his axe, Robinson Crusoe saw a plank cast up by the waves on the beach."

"Oh, what a coincidence! Did he run to pick it up?"

"This was his first reaction, but then he stopped for the following reason:

“If I pick up this plank, it will cost me only the fatigue of carrying it and the time to go down the cliff and climb it again.

But if I make a plank with my axe, firstly I will give myself enough work for two weeks, secondly I will wear out my axe, which will give me the opportunity of repairing it, and then I will eat up my provisions, a third source of work, since I will need to replace them. Now, work is wealth. It is clear that I will ruin myself by going to pick up the plank washed up on the beach. It is important for me to protect my personal labor and now that I think of it, I can create further work for myself by going to push this plank back into the sea!”

"But this line of reasoning is absurd!"

"So it is! It is nevertheless the one followed by any nation that protects itself through prohibition. It rejects the plank offered to it for little work in order to give itself more work. There is no work up to and including the work of the Customs Officer in which it does not see advantage. This is illustrated by the trouble taken by Robinson Crusoe to return to the sea the gift it wished to make him. Think of the nation as a collective being and you will find not an atom of difference between its way of reasoning and that of Robinson Crusoe."

"Did Robinson not see that the time he saved he could devote to doing something else?"

A rethinking of the classical theory of rent (i.e. Ricardo)

- Physiocrats and Ricardo believed there was something unique about the productivity of land and the rent that came from land

- productivity of land a “gift of God/Nature” and not the result of human labour, hence charging rent was “unjust” or “unearned” and should be taxed or regulated in some way [opened door to Marxist/socialist critique]

- FB challenged this view with his controversial idea that rent was like any other “service” provided in the market [exchange of “service for service”] Provoked strong exchange of views in SEP. FB thought similar arguments could be brought against steam power - that benefits of steam were a gift of nature and not the result of human labour. FB argued that human contribution lay in understanding, harnessing and organising these natural resources to produce things of value to people; in taking the risk of producing these things without guarantee of future payment; in advancing payment to the workers for their wages. All these things were “services” provided by the industrialist or the agriculturalist.

- theory of value based not upon amount of labour used to create a product or service, but upon a form of “opportunity cost”, i.e. how much trouble a consumer saves himself by not having to produce it himself (this is individual and subjective - but he did not use these exact words)

A rethinking of the classical theory of value

- classical economists tied themselves up in knots on the question of “value” - what gave something value, how it could be measured, how it affected something’s price in the market, etc.

- they agreed that value was an objective and absolute “thing” which could be measured; that labour played a vital role in creating value (the most extreme version of this was a Ricardian and later Marxist notion of “the labour theory of value”; and that things that were exchanged were things “of equal value.” But recongnized that there was a difference between “use value” and “exchange value” and other problems in their theory

- FB challenged these ideas in the late 1840s which what might be called a “proto-Austrian” subjective theory of value 20 years before the Marginal Revolution of the 1870s. FB argued that individuals valued the same things differently, that something’s value depended on one’s time and place, that relative scarcity played an important role. Still believed that “equal” things were exchanged in a transaction but they were “services” not “labor”.

A rethinking of Malthusian population theory

- nearly all classical economists were Malthusians, in that they believed in the “iron law” that the geometric increase in human population would always run into the absolute limit of the arithmetical increase of productive capacity, causing famine, falling wages, and hardship

- this pessimistic view was challenged by Bastiat who argued that economists underestimated the productive capacity of the free market, industry, and free trade. He was confident that history would show that it too expanded “geometrically” (he was correct).

- He also thought that they underestimated the ability of free people to “check” their population growth by means of “moral restraint”. Other avenues included free immigration to less populated parts of the world.

- Note: the Church placed the DEP (1852) on the Index of banned books for its statements about the limiting the size of families

- early notion of the value of “human capital”, that more human beings are an asset not a liability

A stronger unification of moral theory and political economy based upon natural rights theory

- the classical school for the most past was strongly influenced by Bentham’s theory of utilitarianism which permitted considerable intervention by the state (especially “enlightened” legislators and experts). The early Benthamites (James and John Stuart Mill) believed in laissez-faire and a minimal state but later Benthamites became increasingly interventionist, even socialist.

- the French economists still based their economic theory on ideas of natural law and natural rights, especially the right to individual liberty and private property. This gave them a much harder anti-interventionist edge than their English colleagues.

- thus FB’s and GdM’s opposition to protectionism, government subsidies to industry, and interventionism in general was based firstly on moral arguments that this was “unjust”, and then secondly that this was “inefficient” or “more costly” or “harmed” the material interests of consumers.

- FB believed that if economists admitted utilitarian arguments to justify government intervention, say on behalf of large landowners and manufacturers, then these same arguments could and would be used by socialists to justify the creation of the welfare state and massive government intervention in the economy.

On the need to call “a spade a spade” [appeler un chat un chat] or the State a ‘thief” and a “plunderer”

- FB raised two interesting questions: (1) whether or not political economy can be a “value free” science [though not in these words] and (2) what is the appropriate language to use when criticising the state and the vested interest groups who depend on it.

- given the fact he thought political economy was founded upon moral principles regarding the right to own property and the right not be coerced by force or fraud, he obviously did not believe it was “value free”. But could it be?

- recall opening quote from ES2 “Theft by Subsidy” and his call for blunt and brutal language when describing government policies.

- if economists advise the government what tariff level it should set, then they are implicitly accepting the fact that the government has the right and moral duty to set tariff levels

- if economists advise the government what the rate of tax should be, then they are implicitly accepting the fact that the government has the right and moral duty to set tax levels

- if economists advise the government how it can best manage the costs of maintaing slavery in the colonies,, then they are implicitly accepting the fact that the government has the right and moral duty to maintain slavery in the colonies

- FB would say that all these “economic” positions are also “moral” positions and that economists cannot be “value free”

- FB wanted to raise the temperature of the economic debate by using words such as "dépouiller"(to dispossess), "spolier" (to plunder), "voler" (to steal), "piller" (to loot or pillage), "filouter" (filching), “violer” (rape); and variants such as "le vol de grand chemin" (highway robbery). He thought these were “scientific” terms which accurately described what the government was doing and how it was doing it.

- His strategy was to speak plainly in order to enlighten “the dupes” who had been mislead by “sophisms” so they could be better “plundered”.

Quote from “Theft by Subsidy”

Since the opportunity has so kindly been offered to us, let us examine theft by subsidy. What can be said of it applies just as well to theft by tariffs, and while theft by tariffs is slightly better disguised, direct filching will help us understand indirect filching. The mind moves forward in this way from the simple to the compound.

What then! Is there no type of theft that is simpler still? Oh, yes, there is highway robbery: all it needs is to be legalized, monopolized or, as we say nowadays, organized.

Quote from Conclusion to ES1 (November 1845)

Let us end this monograph on sophistry with a final and important thought:

The world is not sufficiently aware of the influence that sophistry exercises on it.

If I have to say what I think, when the right of the strongest was dethroned, sophistry handed empire to the right of the most subtle, and it would be difficult to say which of these two tyrants has been the most disastrous for the human race.

Men have an immoderate love for pleasure, influence, esteem, and power, in a word, for wealth.

And at the same time, they are driven by an immense urge to procure these things for themselves at the expense of others.

But these others, who are the general public, have no less an urge to keep what they have acquired, provided that they can and they know how to.

Plunder, which plays such a major role in the affairs of the world, has thus only two things which promote it: force and fraud , and two things which limit it: courage and enlightenment.

Force used for plunder forms the bedrock upon which the annals of human history rest.Retracing its history would be to reproduce almost entirely the history of every nation: the Assyrians, the Babylonians, the Medes, the Persians, the Egyptians, the Greeks, the Romans, the Goths, the Francs, the Huns, the Turks, the Arabs, the Mongols, and the Tartars, not to mention the Spanish in America, the English in India, the French in Africa, the Russians in Asia, etc., etc.

But at least in civilized nations, the men who produce the wealth have become sufficiently numerous and strong to defend it. Is this to say that they are no longer dispossessed? Not at all; they are just as dispossessed as ever and, what is more, they mutually dispossess each other.

Only, the thing which promotes it has changed; it is no longer by force but by fraud that public wealth can be seized.

In order to steal from the public it it first necessary to deceive them. To deceive them it is necessary to persuade them that they are being robbed for their own good; it is to make them accept imaginary services and often worse in exchange for their possessions. This gives rise to sophistry. Theocratic sophistry, economic sophistry, political sophistry and financial sophistry. Therefore, ever since force has been held in check, sophistry has been not only a source of harm, it has been the very essence of harm. It must in its turn be held in check. And to do this the public must become cleverer than the clever, just as it has become stronger than the strong.

Quote ES2 I “The Physiology of Plunder”

In fact, there comes a time when, in its gradual acceleration, the loss of wealth is so great that Plunderers are less rich than they would have been if they had remained honest.

An example of this is a nation for which the cost of war is greater than the value of its booty;

A master who pays more for slave labor than for free labor;

A Theocracy that has so stupefied the people and sapped their energy that it can no longer wring anything out of them;

A Monopoly that has to increase its efforts to suck consumers dry as there is less to be sucked up, just as the effort needed to milk a cow increases as the udder dries up.

As we see, Monopoly is a Species of the Genus, Plunder. There are several Varieties of it, including Sinecure, Privilege and Trade Restriction.

Among the forms it takes, there are some that are simple and naïve. Such were feudal rights. Under this regime the masses were plundered and knew it. It involved the abuse of force and perished with it.

Others are highly complex. In this case, the masses are often plundered unaware. It may even happen that they think they owe everything to Plunder; what is left to them, as well as what is taken from them and what is lost in the operation. Further than that I would propose as time goes on, and given the highly ingenious mechanism of custom, many Plunderers are plunders without knowing it and without wishing it. Monopolies of this type are generated through Fraud and they feed on Error. They only disappear with Enlightenment.

I have said enough to show that Political Economy has an obvious practical use. It is the flame that destroys this social disorder which is Plunder, by unveiling Fraud and dissipating Error. Someone, I believe it was a woman and she was perfectly right, defined political economy thus: It is the safety lock on popular savings.

Quote ES2 I “The Physiology of Plunder”

I will review briefly a few of the forms of plunder that are exercised by Fraud on a grand scale.

The first to come forward is Plunder by theocratic fraud.

What is this about? To get people to provide real services, in the form of foodstuffs, clothing, luxury, consideration, influence and power, in return for imaginary ones.

If I said to a man “I am going to provide you with some immediate services”, I would have to keep my word, otherwise this man would know what he was dealing with and my fraud would be promptly unmasked.

But if I told him “In exchange for your services, I will provide you with immense services, not in this world but in the next. After this life, you will be able to be eternally happy or unhappy and this all depends on me; I am an intermediary between God and his creation and can, at will, open the gates of heaven or hell to you.” Should this man believe me at all, he is in my power.

This type of imposture has been practiced widely since the beginning of the world, and we know what degree of total power Egyptian priests achieved.

It is easy to see how impostors behave. You have to only ask yourself what you would do in their place.

If I came, with ideas like this in mind, amongst an ignorant clan and succeeded by dint of some extraordinary act and an amazing appearance to be taken for a supernatural being, I would pass for an emissary of God with absolute discretion over the future destiny of men.

I would then forbid any examination of my titles. I would go further; since reason would be my most dangerous enemy, I would forbid the use of reason itself, at least when applied to this awesome subject. I would make this question, and all those relating to it, taboo, as the savages say. To solve them, discuss them or even think of them would be an unpardonable crime.

It would certainly be the height of skill to set up a taboo as a barrier across all the intellectual avenues that might lead to the discovery of my deception. What better guarantee of its longevity is there than to make doubt itself a sacrilege?

However, to this fundamental guarantee I would add ancilliary ones. For example, in order that enlightenment is never able to reach down to the masses, I would grant to my accomplices and myself the monopoly of all knowledge. I would hide it under the veils of a dead language and a hieroglyphic script and, so that I would never be taken by surprise by any danger, I would take care to invent an institution which would, day after day, enable me to enter into the secret of all consciences.

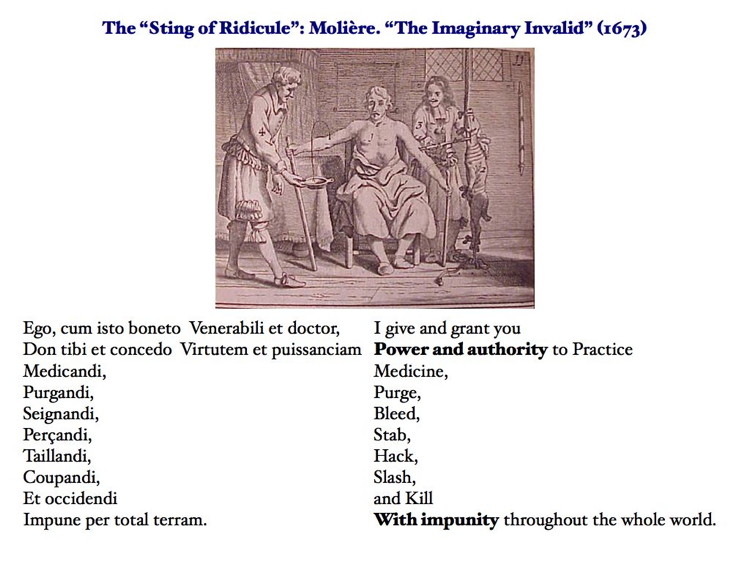

Quote: FB’s parody of Molière’s parody of medical quacks

Sometimes Bastiat goes beyond quoting a famous scene from a well-known classic work and adapts it for his own purposes by rewriting it as a parody. A good example of this is Molière’s parody of the granting of a degree of doctor of medicine in the last play he wrote Le malade imaginaire (The Imaginary Invalid, or the Hypocondriac) (1673) which Bastiat quotes in “Theft by Subsidy” (JDE January 1846). Molière is suggesting that doctors in the seventeenth century were quacks who did more harm to their patients than good, as this translation of his dog Latin clearly suggests:

I give and grant you

Power and authority to Practice medicine,

Purge,

Bleed,

Stab,

Hack,

Slash,

and Kill

With impunity

Throughout the whole world.

Bastiat’s takes Molière’s Latin and writes his own pseudo-Latin, this time with the purpose of mocking French tax collectors. In his parody Bastiat is suggesting that government officials, tax collectors, and customs officials were thieves who did more harm to the economy than good, so Bastiat writes a mock “swearing in” oath which he thinks they should use to induct new officials into government service:

I give to you and I grant

virtue and power

to steal

to plunder

to filch

to swindle

to defraud

At will, along this whole road

The free market “harmoniously” solves the problem of economic coordination

- FB’s unfinished but best known work of theory was called Economic Harmonies (1850, 1851) which had as its foundation the idea that when individuals are able to interact freely and without coercion in the market place then they can create “a harmonious social pattern” (FEE xxi) [“Tous les intérêts légitimes sont harmoniques” (All legitimate interests are harmonious.) (LF)] in which their different economic needs and desires can be satisfied. FB thought that this new order was a “natural” one as opposed to the “artificial order” the socialists wanted to create.

- FB has a “deist” view of Providence and the natural laws created by him/it which are “harmonious”. But observation of the world by economists and others confirms this view.

- The market allows the self-interest of each individual to operate for the benefit of the whole - incentives to profit and the mutual benefits from trade.

- “Disharmony” is caused when the State introduces coercion or violence to benefit a privileged group at the expense of others. FB lists a number of “disturbing factors” which can interfere with the “social mechanism” (FEE 4) such as Plunder, War, Slavery, Theocracy, Monopoly, Government Exploitation, False Brotherhood or Communism. His Economic Sophisms and the never written History of Plunder were designed to show how “economic disharmonies” occur and the harm they cause.

- To illustrate the benefits of social and economic cooperation FB tells a story of a village cabinetmaker and a student. Shows how the division of labour, international trade, and the self-interest of producers create all the things we take for granted in a modern society (FEE pp. 3-6). Similar to Leonard Read’s “I, Pencil” story - “”a natural and wise order that operates without our knowledge” (p. 6).

- No need for a central planner to supply a large city like Paris every day with its requirements. This is done by myriads of exchanges between millions of individuals who seek their own ends and betterment, yet produces a complex, largely harmonious order. Asks what is this “the resourceful and secret power” - answer is “the principle of free exchange”. This is disrupted by government intervention (prohibitions, monopolies, taxes). Implies key Austrian insight - “the impossibility of rational economic planning under socialism” (Hayek, Mises)

Quote from Ec Harmonies (LF ed.) - cabinet maker and the student

We would be shutting our eyes to the light if we refused to acknowledge that society cannot present such complicated combinations, in which civil and penal laws play so little a part, without obeying a prodigiously ingenious mechanism. This mechanism is the subject matter of political economy.

One more thing worthy of comment is that, in this truly incalculable number of transactions which have contributed to keeping alive one student for one day, there is perhaps not a millionth part which has been made directly. The countless things he has enjoyed today are the work of men a great number of whom have long since disappeared from the face of the earth. Nevertheless they were remunerated as they wished, although he who is benefiting today from the product of their work has done nothing for them. He did not know them and will never know them. He who reads this page, at the very moment at which he reads it, has the power, although he perhaps does not realize this, to set in motion men in all countries, of all races, and I might almost say, of all periods of time; white men, black men, red men and yellow men. He causes generations that have died away and generations not yet born to contribute to his current satisfactions, and he owes this extraordinary power to the services his father rendered in the past to other men who on the face of it have nothing in common with those whose labor is being set in motion today. However, the balance is such that in time and space, each one is reimbursed and has received what he calculated he should receive.

In truth, can all this have been possible, can such extraordinary phenomena have been achieved without there having been in society a natural and knowing organization which acts, so to speak, without our knowledge?

Quote from ES1 XVII “The are no Absolute Principles” (1845) about supplying large city like Paris (LF ed.)

On entering Paris, which I had come to visit, I said to myself: Here there are a million human beings who would all die in a few days if supplies of all sorts did not flood into this huge metropolis. The mind boggles when it tries to assess the huge variety of objects that have to enter through its gates tomorrow if the lives of its inhabitants are not to be snuffed out in convulsions of famine, uprisings, and pillage. And in the meantime everyone is asleep, without their peaceful slumber being troubled for an instant by the thought of such a frightful prospect. On the other hand, eighty departments have worked today without being in concert and without agreement to supply Paris. How does it happen that every day what is needed and no more or less is brought to this gigantic market? What is thus the ingenious and secret power that presides over the astonishing regularity of such complicated movements, a regularity in which everyone has such blind faith, although well-being and life depend on it? This power is an absolute principle, the principle of free commerce. We have faith in this intimate light that Providence has placed in the hearts of all men to whom it has entrusted the indefinite preservation and progress of our species, self-interest, for we must give it its name, that is so active, vigilant, and farsighted when it is free to act. Where would you be, you inhabitants of Paris, if a minister took it into his head to substitute the arrangements he had thought up, however superior they are thought to be, for this power? Or if he took it into his head to subject this stupendous mechanism to his supreme management, to gather together all these economic activities in his own hands, to decide by whom, how, or under what conditions each object has to be produced, transported, traded and consumed? Oh! Although there are a good many causes of suffering within your city, although destitution, despair, and perhaps starvation are causing more tears to flow than your ardent charity can stem, it is probable or, I dare to say, even certain, that the arbitrary intervention of the government would infinitely increase these sufferings and extend to you all the misfortunes that are only affecting a small number of your fellow citizens.

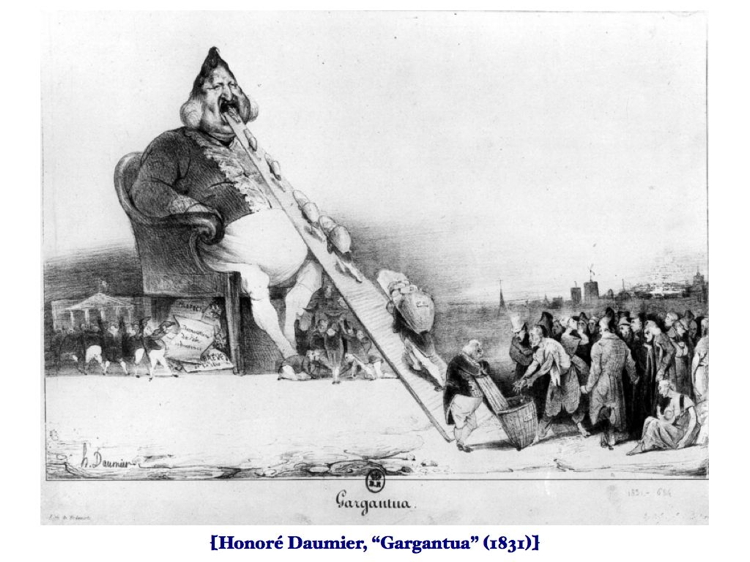

A new theory of the State - legal plunder

- since his economic theory was based upon ideas of natural rights regarding individual liberty and property FB and GdM regarded the activities of the State in a different light to most classical economists, namely that taxation (with the exception of providing police and defence) was theft and hence immoral, that government regulation of economic activities was a form of tyranny because it violated an individual’s individual liberty to engage in trade with others, and that conscription into the army and war were forms of slavery and murder.

- FB developed the idea of “legal plunder” in a series of essays in late 1847, early 1848. He believed there was no real difference between the act of a highway robber taking your property at gunpoint and a State imposing taxes. One’s property rights are violated when a person or group of persons uses force or the threat of force to acquire another person’s property (in other words “exploitation” occurs).

- Wanted to write a whole book on “A History of Plunder” but died before he could do so. Developed many historical categories of plunder which he wanted to explore: primitive warfare, slavery, theocracy (“theocratic plunder”), monopoly and protectionism.

- Develops a sociology of the state which includes idea: that the ruling elite can no longer use force alone to impose their rule over others; that therefore they need to trick or deceive (“la ruse”) the people (“les dupes”) into accepting their rule as just and inevitable; they do this by using “sophisms” to justify intervention in the economy, taxation, war, colonies, etc.

- Role of the economist is to expose these self-interested false arguments for what they are by using a range of rhetorical tools: “the sting of ridicule”, reductio ad absurdum counter examples, simple economic tales and stories (plays) - Economic Sophisms do this.

- Develops interesting “Malthusian” theory of the limits to the growth of state power: states will grow geometrically to consume all the resources they are able to tax until they are checked by countervailing forces (slowing economic growth, reluctance of the ordinary taxpayers and consumers to pay these taxes, active resistance as the Dupes see through the Sophisms).

- develops a classical liberal class theory of history based upon idea that exploitation by one class of another class drives much of history

Quote from “The State” (June, September 1848) (LF ed.).

FB’s was an advocate of a strictly limited government which operated under a constitution and the rule of law. notion of the proper functions of the state. One might call him an advocated of “the ultra-minimalist state”.

At the height of the 1848 Revolution in June 1848 just prior to the bloody repression of Parisian protestors and rioters by the army, FB wrote a short article in his newspaper Jacques Bonhomme which he stood on street corners distributing to ordinary working people. He wanted to show them that their socialist-inspired demands for a more interventionist sate were both immoral and counterproductive. He later expanded it into a longer essay and then a pamphlet. Here is his conclusion:

Fellow citizens, since time immemorial two political systems have confronted one another and both have good arguments to support them. According to one, the State has to do a great deal, but it also has to take a great deal. According to the other, its twin action should be little felt. A choice has to be made between these two systems. But as for the third system, which takes from the two others and which consists in demanding everything from the state while giving it nothing, this is illusionary, absurd, puerile, contradictory and dangerous. Those who advocate it to give themselves the pleasure of accusing all forms of government of impotence, and of thus exposing them to your blows, those people are flattering and deceiving you, or at the very least they are deceiving themselves.

As for us, we consider that the state is not, nor should it be, anything other than a common force, instituted not to be an instrument of mutual oppression and plunder between all of its citizens, but on the contrary to guarantee to each person his own property and ensure the reign of justice and security.

Earlier in the article he notes that the French have a misconception of the state: they “personify” it seeing it as a great benefactor (or father) who can and will solve their problems. FB reminds them that what the state “gives” it has to “take” away first:

If I have taken the liberty of criticizing the opening words of our Constitution, it is because it is not a question, as one might believe, of wholly metaphysical subtlety. I claim that this personification of the state has been in the past and will be in the future a rich source of calamities and revolutions.

Here is the public on one side and the state on the other, considered to be two distinct beings, the latter obliged to spread over the former and the former having the right to claim from the latter a flood of human happiness. What is bound to happen?

In fact, the state is not and cannot be one-handed. It has two hands, one to receive and the other to give; in other words, the rough hand and the gentle hand. The activity of the second is of necessity subordinate to the activity of the first. Strictly speaking, The state is able to take and not give back. This has been seen and is explained by the porous and absorbent nature of its hands, which always retain part and sometimes all of what they touch. But what has never been seen, will never be seen and cannot even be conceived is that the state will give to the general public more than it has taken from them. It is therefore a sublime folly for us to adopt toward it the humble attitude of beggars. It is radically impossible for it to confer a particular advantage on some of the individuals who make up the community without inflicting greater damage on the community as a whole.

Which leads him to formulate one of his most memorably statements:

The state is the great fiction by which everyone endeavors to live at the expense of everyone else.

Quote from ES2 I “The Physiology of Plunder” (1848) (LF ed.)

It has been and still is such an important part of human existence that it should be studied by political economy. Existence of plunder is main reason why society does not progress faster. Plunder becomes institutionalised and becomes what FB calls “legal plunder” (as opposed to commonly accepted “illegal plunder” of petty criminals which is prohibited). His physiology includes “war” (killing and looting), “slavery” (forced labour), “theocracy” (fraudulent threats to behave now or lose afterlife), and “monopoly” (legal privileges to grant benefits to some at expence of others, such as “sinecures, privileges, and trade restriction”:

There are only two ways of acquiring the things that are necessary for the preservation, improvement and betterment of life: PRODUCTION and PLUNDER.

Some people say: “PLUNDER is an accident, a local and transitory abuse, stigmatized by moral philosophy, condemned by law and unworthy of the attentions of Political Economy.”

But whatever the benevolence and optimism of one’s heart one is obliged to acknowledge that PLUNDER is exercised on too a vast scale in this world, that it is too universally woven into all major human events, for any social science, above all Political Economy, to feel justified in disregarding it.

I will go further. What separates the social order from a state of perfection (at least from the degree of perfection it can attain) is the constant effort of its members to live and progress at the expense of one another.

So that, if PLUNDER did not exist, society would be perfect and the social sciences would be superfluous.

I will go even further. When PLUNDER has become the means of existence of a large group of men mutually linked by social ties, they soon contrive to pass a law that sanctions it and a moral code that glorifies it.

You need name only a few of the most clear-cut forms of Plunder to show the place it occupies in human affairs.

First of all, there is WAR. Among savage peoples, the victor kills the vanquished in order to acquire a right to hunt game that is if not incontestable, at least uncontested.

Then there is SLAVERY. Once man grasps that it is possible to make land fertile through work, he strikes this bargain with his fellow: “You will have the fatigue of work and I will have its product.”

Next comes THEOCRACY. “Depending on whether you give me or refuse to give me your property, I will open the gates of heaven or hell to you.”

Lastly, there is MONOPOLY. Its distinctive characteristic is to allow the great social law, a service for a service, to continue to exist, but to make force part of the negotiations and thus distort the just relationship between the service received and the service rendered.

Plunder always carries within it the deadly seed that kills it. Rarely does the majority plunder the minority. In this case, the minority would immediately be reduced to the point where it could no longer satisfy the greed of the majority, and Plunder would die for want of sustenance.

It is almost always the majority that is oppressed, and Plunder is also destined in this case as well to receive a death sentence.

For if the use of Force is Plunder’s agent, as it is for War and Slavery, it is natural for Force to go over to the side of the majority in the long run.

And if the agent is Fraud, as in Theocracy and Monopoly, it is natural for the majority to become informed on this score, or intelligence would not be intelligence.

Quote from “The Law” (June 1850) (LF ed.)

Further discussion in “The Law” where FB distinguished between “illegal plunder” and “legal plunder”:

But what form of Plunder was he wishing to talk about? For there are two forms. There is plunder outside the law and legal plunder.

As for plunder against the law, which we call theft or fraud and which is defined, provided for and punished by the Penal Code, I really do not think this can be cloaked in the name of socialism. It is not this that systematically threatens the very foundations of society. Besides, the war against this sort of plunder has not waited for a signal from M. de Montalembert or M. Carlier. It has been waged since the beginning of time. France had already provided for it, a long time before the February revolution, long before the apparition of socialism, by a whole apparatus of magistrates, police, gendarmes, prisons, convict settlements and scaffolds. It is the Law itself that wages this war, and what we should be hoping for, in my opinion, is that the law will always retain this attitude with regard to plunder.

But this is not the case. Sometimes the law takes the side of plunder. Sometimes it carries it out with its own hands, in order to spare the blushes, the risk and scruples of its beneficiary. Sometimes it mobilizes this whole system of magistrates, police, gendarmes and prison to serve the plunderer and treats the victim who defends himself as a criminal. In a word, there is legal plunder and it is doubtless to this that M. de Montalembert is referring.

Such plunder may be just an exceptional stain on the legislation of a people and, in this case, the best thing to do, without undue oratory and lamentation, is to remove it as quickly as possible, in spite of the outcry from those it favors. How do we recognize it? It is easy; we need to see whether the law takes property owned by some to give to others what they do not own. We need to see whether the Law carries out an act that a citizen cannot carry out himself without committing a crime, for the benefit of one citizen and at the expense of others. Make haste to repeal a law like this; it is not only an iniquity, it is a fruitful source of iniquity, for it generates reprisals, and if you are not careful an exceptional act will become widespread, more frequent and part of a system. Doubtless, those who benefit from it will make a loud outcry; they will invoke acquired rights. They will say that the state owes their particular product protection and support. They will claim that it is a good thing for the State to make them richer because, as they are richer, they spend more and thus rain down earnings on their poor workers. Be careful not to listen to these sophists for it is exactly the systematizing of these arguments that legal plunder becomes systematic.

This is what has happened. The illusion of the day is to make all sectors richer at each other’s expense; this is generalizing plunder on the pretext of organizing it. Well, legal plunder can be carried out in an infinite number of ways. This gives rise to an infinite number of plans for organizing it, through tariffs, protectionism, premiums, subsidies, motivation, progressive taxes, free education, the right to work, the right to assistance, the right to tools for work, free credit, etc. etc. And all of these plans, insofar as they have legal plunder in common, come under the name of socialism.

Well, what type of war do you wish to wage against socialism, as thus defined and as it forms a body of doctrine, if not a doctrinal war? Do you find this doctrine wrong, absurd or abominable? Refute it. This will be all the easier the more erroneous, absurd or abominable it is. Above all, if you wish to be strong, start by rooting out from your legislation everything relating to socialism that has managed to creep into it – no small task.

M. de Montalembert has been reproached for wanting to turn brute force against socialism. This is a reproach from which he should be cleared, since he formally stated, “The war against socialism should be in accordance with the law, honor and justice.”

But how has M. de Montalembert not seen that he has placed himself in a vicious circle? Do you want to oppose socialism by means of the law? But it is precisely socialism that invokes the law. It does not aim to carry out plunder against the law, but legal plunder. It is of the law itself that it claims to be the instrument, like monopolists of all stripes, and once it has the law on its side, how do you hope to turn the Law against it? How do you hope to bring it within striking power of your courts, your gendarmes or your prisons?

So what do you do? You want to prevent it from having any say in making laws. You want to keep it out of the legislative chamber. I dare to predict that you will never succeed in this, while laws are being passed inside it on the principle of legal plunder. It is too iniquitous and too absurd.

It is absolutely necessary for this question of legal plunder to be settled and there are just three alternatives:

That the minority despoils the majority;

That everyone despoils everyone else;

That nobody despoils anyone.

You have to choose between partial plunder, universal plunder, and no plunder at all. The law can pursue one of these three alternatives only.

Partial plunder – this is the system that prevailed for as long as the electorate was partial and is the system to which people return to avoid the invasion of socialism.

Universal plunder – this is the system that threatened us when the electorate became universal with the masses having conceived the idea of making laws along the same lines as their legislative predecessors.

Absence of plunder–this is the principle of justice, peace, order, stability, conciliation, and common sense that I will proclaim with all my strength which is, alas, very inadequate and with my lungs until my final breath.

A new theory of the “public goods problem” - that the free market can provide ALL so-called pubic goods

- Ch. Coquelin argued in mid-1840s that money could and should be provided by private banks competing for business, not the State (because it led to business cycles)

- GdM had a more thoroughgoing critique in Les Soirées (1849) where he argued in favour of private education; canal, road, and railway building; the provision of water to cities and towns; and most famoulsy the private “production of security” (i.e. police and defence). This latter proposal sparked a big controversy in the SEP and GdM was alone in supporting this view.

A new theory of the business cycle caused by government manipulation of central bank and interest rates

- Charles Coquelin in 1846-48 develops ideas about free banking, where he blames the government central bank for causing business cycles through its control of interest rates and interference in the supply of money. Another proto-Austrian insight ahead of its time.

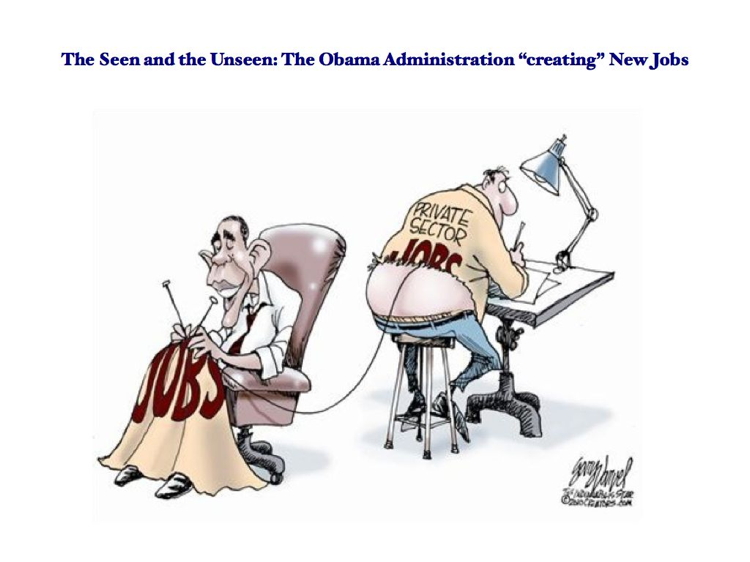

A more sophisticated theory of the negative effects of government intervention in the economy (unintended consequences)

- “The Seen and the Unseen” - FB develops as a result of his critique of economic sophisms a whole theory about “unintended” or “unseen” consequences of economic activity, e.g. that government can stimulate economic activity by means of subsidies and tariffs and thereby create new jobs. FB points out that every economic action has consequences which are not immediately apparent (unseen at first sight or on the surface). In this case that subsidies to one industry come by taxing another with no net benefit to the economy.

- “The Broken Window” fallacy - idea of “the double incidence of loss”. Broken window stimulates business of glazier, but Jacques has lost an asset and has to replace it (causing loss to him) and cannot then spend that money of a new pair of shoes or a book (those sellers also lose out) - hence “double incidence of loss”. Net effect is 2 losses to 1 gain (glazier).

- “Positive and Negative Ricochet Effects” - a theory he was working on in the last few months of his life. The idea that the economy is an inter-related whole and that every economic action has “flow on” effects (ricochet) which cascade throughout the economy. These can be either good or bad, positive or negative.

- NRE - An example of the former is a tax or tariff which raises the price of a particular commodity. It may have been designed to benefit a particular favoured industry and its employees (who may have been promised higher wages as a side benefit) but it has a ricochet effect in that the higher price flows though eventually to all consumers, including the protected or subsidized workers, and even other producers. If many other industries also receive benefits from the state in the form of subsidies and tariffs the cost structure of the entire economy is eventually raised as a result of similar ricochet effects.

- PRE - Examples of a “Positive Ricochet Effect” include the benefits of international free trade and technological inventions such as steam powered transport. According to Bastiat, international free trade in the medium and long term has the effect of dramatically lowering costs for consumers and increasing their choice of things to buy. These lower costs and greater choice eventually flow on to all consumers thereby improving their standard of living. Technological inventions like steam powered locomotives or ships lower the cost of transport for every consumer and industry in an economy, thus lowering the overall cost structure and having an economy-wide PRE.

Quote from WSWNS “The Broken Window” (1850) (LF ed.)

Intro;

In the sphere of economics an action, a habit, an institution or a law engenders not just one effect but a series of effects. Of these effects only the first is immediate; it is revealed simultaneously with its cause, it is seen. The others merely occur successively, they are not seen; we are lucky if we foresee them.

The entire difference between a bad and a good Economist is apparent here. A bad one relies on the visible effect while the good one takes account both of the effect one can see and of those one must foresee.

However, the difference between these is huge, for it almost always happens that when the immediate consequence is favorable the later consequences are disastrous, and vice versa. From which it follows that a bad Economist will pursue an small current benefit that is followed by a large disadvantage in the future, while a true Economist will pursue a large benefit in the future at the risk of suffering an small disadvantage immediately.

Broken Window:

If you suppose that it is necessary to spend six francs to repair the damage, if you mean that the accident provides six francs to the glazing industry and stimulates the said industry to the tune of six francs, I agree and I do not query in any way that the reasoning is accurate. The glazier will come, do his job, be paid six francs, rub his hands and in his heart bless the dreadful child. This is what is seen.

But if, by way of deduction, as is often the case, the conclusion is reached that it is a good thing to break windows, that this causes money to circulate and therefore industry in general is stimulated, I am obliged to cry: “Stop!” Your theory has stopped at what is seen and takes no account of what is not seen.

What is not seen is that since our bourgeois has spent six francs on one thing, he can no longer spend them on another What is not seen is that if he had not had a window to replace, he might have replaced his down-at-heel shoes or added a book to his library. In short, he would have used his six francs for a purpose that he will no longer be able to.

Let us therefore draw up the accounts of industry in general.

As the window was broken, the glazing industry is stimulated to the tune of six francs; this is what is seen.

If the window had not been broken, the shoemaking industry (or any other) would have been stimulated to the tune of six francs; this is what is not seen.

And if we took into consideration what is not seen, because it is a negative fact, as well as what is seen, because it is a positive fact, we would understand that it makes no difference to national output and employment, taken as a whole, whether window panes are broken or not.

Quote from Ec. Harmonies on Negative Ricochet Effect of taxes (LF ed.)

(late 1850 - not 1st ed. but 1851 ed.) - Harmonies économiques. Chap. XI. Producteur. - Consommateur (Producer, Consumer) [OC, vol. 6] [CW, vol. 5, forthcoming]

[Bastiat uses another word which has a connection to water, “glisser” (to slip or slide, or flow over) in this passage.]

It is by way of such ricochet that the harmful effects tend to pass from the producer to the consumer. Immediately after the tax and the obstruction come into force, the producer tends to have himself compensated. However, since consumer demand as well as the quantity of wine remain the same, he cannot raise the price. Initially, he does not make more after the tax than before. And since before the tax he obtained only a normal reward for it, determined by the value of the services exchanged freely, he finds himself losing by the total amount of the tax. In order for prices to rise, there has to be a reduction in the quantity of wine produced.

In relation to the profit or loss that initially affect this or that class of producers, the consumer, the general public, is what earth is to electricity: the great common reservoir. Everything comes out of this reservoir, and after a few more or less long detours, after the generation of a more or less great variety of phenomena, everything returns to it.

We have just noted that the economic results just flow over producers, to put it this way, before reaching consumers, and that consequently all the major questions have to be examined from the point of view of consumers if we wish to grasp their general and permanent consequences.

Endnotes

Draft Preface for the Harmonies [addressed to himself and written at the end of 1847.], CW1, p. 318, 320. Online at <http://oll.libertyfund.org/title/2393/226010>.

Bastiat uses a variety of words in his attempt to speak plainly and brutally in this chapter. Here is a list with our preferred translation for each: "dépouiller"(to dispossess), "spolier" (to plunder), "voler" (to steal), "piller" (to loot or pillage), "filouter" (filching); and variants such as "le vol de grand chemin" (highway robbery). See the "Note on the translation" for details.