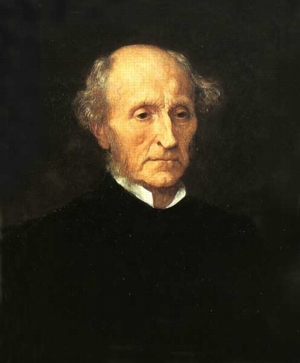

JOHN STUART MILL,

Principles of Political Economy (1871)

Volume Two

|

|

| John Stuart Mill (1806-1873) |

[Created: 1 March, 2021]

[Updated: 23 October, 2023 ] |

The Guillaumin Collection

|

This title is part of “The Guillaumin Collection” within “The Digital Library of Liberty and Power”. It has been more richly coded and has some features which other titles in the library do not have, such as the original page numbers, formatting which makes it look as much like the original text as possible, and a citation tool which makes it possible for scholars to link to an individual paragraph which is of interest to them. These titles are also available in a variety of eBook formats for reading on portable devices. |

Source

, Principles of Political Economy with some of their Applications to Social Philosophy. By John Stuart Mill. In Two Volumes. Seventh Edition. (London: Longmans, Green, Reader And Dyer, 1871). Volume 2.http://davidmhart.com/liberty/EnglishClassicalLiberals/MilJS/PrinciplesPoliticalEconomy/1871edition/PPE1.html

John Stuart Mill, Principles of Political Economy with some of their Applications to Social Philosophy. By John Stuart Mill. In Two Volumes. Seventh Edition. (London: Longmans, Green, Reader And Dyer, 1871).

This title is also available in a facsimile PDF of the original and various eBook formats - HTML, PDF, and ePub. See the facs. PDF and HTML of Volume 1 and the enhanced HTML version of the comined "Two Volumes in One".

This book is part of a collection of works by John Stuart Mill (1806-1873).

Table of Contents

CONTENTS OF THE SECOND VOLUME.

BOOK III. EXCHANGE.—(Continued.)

- Chapter VII. Of Money.

- § 1. Purposes of a Circulating Medium, p. 3

- 2. Gold and Silver, why fitted for those purposes, p. 5

- 3. Money a mere contrivance for facilitating exchanges, which does not affect the laws of Value, p. 8

- Chapter VIII. Of the Value of Money, as dependent on Demand and Supply.

- § 1. Value of Money, an ambiguous expression, p. 11

- 2. The value of money depends, cæteris paribus, on its quantity, p. 12

- 3. —together with the rapidity of circulation, p. 17

- 4. Explanations and limitations of this principle, p. 19

- Chapter IX. Of the Value of Money, as dependent on Cost of Production.

- § 1. The value of money, in a state of freedom, conforms to the value of the bullion contained in it, p. 23

- 2. —which is determined by the cost of production, p. 26

- 3. This law, how related to the principle laid down in the preceding chapter, p. 28

- Chapter X. Of a Double Standard, and Subsidiary Coins.

- § 1. Objections to a double standard, p. 32

- 2. The use of the two metals as money, how obtained without making both of them legal tender, p. 34

- Chapter XI. Of Credit as a Substitute for Money.

- § 1. Credit not a creation but a transfer of the means of production, p. 36

- 2. In what manner it assists production, p. 37

- 3. Function of credit in economizing the use of money, p. 40

- 4. Bills of exchange, p. 41

- 5. Promissory notes, p. 47

- 6. Deposits and cheques, p. 48

- Chapter XII. Influence of Credit on Prices.

- § 1. The influence of bank notes, bills, and cheques, on price, a part of the influence of Credit, p. 51

- 2. Credit a purchasing power similar to money, p. 52

- 3. Effects of great extensions and contractions of credit. Phenomena of a commercial crisis analyzed, p. 54

- 4. Bills a more powerful instrument for acting on prices than book credits, and bank notes than bills, p. 59

- 5. — the distinction of little practical importance, p. 62

- 6. Cheques an instrument for acting on prices, equally powerful with bank notes, p. 68

- 7. Are bank notes money?, p. 70

- 8. No generic distinction between bank notes and other forms of credit, p. 72

- Chapter XIII. Of an Inconvertible Paper Currency.

- § 1. The value of an inconvertible paper, depending on its quantity, is a matter of arbitrary regulation, p. 75

- 2. If regulated by the price of bullion, an inconvertible currency might be safe, but not expedient, p. 78

- 3. Examination of the doctrine that an inconvertible currency is safe if representing actual property, p. 80

- 4. Examination of the doctrine that an increase of the currency promotes industry, p. 83

- 5. Depreciation of currency a tax on the community, and a fraud on creditors, p. 86

- 6. Examination of some pleas for committing this fraud, p. 87

- Chapter XIV. Of Excess of Supply.

- § 1. Can there be an oversupply of commodities generally?, p. 92

- 2. The supply of commodities in general cannot exceed the power of purchase, p. 94

- 3. —never does exceed the inclination to consume, p. 95

- 4. Origin and explanation of the notion of general oversupply, p. 97

- Chapter XV. Of a Measure of Value.

- § 1. A Measure of Exchange Value, in what sense possible, p. 101

- 2. A Measure of Cost of Production, p. 103

- Chapter XVI. Of some Peculiar Cases of Value.

- § 1. Values of Commodities which have a joint cost of production, p. 107

- 2. Values of the different kinds of agricultural produce, p. 110

- Chapter XVII. Of International Trade.

- § 1. Cost of production not the regulator of international values, p. 113

- 2. Interchange of commodities between distant places, determined by differences not in their absolute, but in their comparative, cost of production, p. 115

- 3. The direct benefits of commerce consist in increased efficiency of the productive powers of the world, p. 118

- 4. —not in a vent for exports, nor in the gains of merchants, p. 119

- 5. Indirect benefits of commerce, economical and moral; still greater than the direct, p. 121

- Chapter XVIII. Of International Values.

- § 1. The values of imported commodities depend on the terms of international interchange, p. 124

- 2. —which depend on the Equation of International Demand, p. 126

- 3. Influence of cost of carriage on international values, p. 131

- 4. The law of values which holds between two countries and two commodities, holds of any greater number, p. 132

- 5. Effect of improvements in production on international values, p. 136

- 6. The preceding theory not complete, p. 140

- 7. International values depend not solely on the quantities demanded, but also on the means of production available in each country for the supply of foreign markets, p. 142

- 8. The practical result little affected by this additional element, p. 147

- 9. The cost to a country of its imports, on what circumstances dependent, p. 150

- Chapter XIX. Of Money, considered as an Imported Commodity.

- § 1. Money imported in two modes; as a commodity, and as a medium of exchange, p. 154

- 2. As a commodity, it obeys the same laws of value as other imported commodities, p. 155

- 3. Its value does not depend exclusively on its cost of production at the mines, p. 158

- Chapter XX. Of the Foreign Exchanges.

- § 1. Purposes for which money passes from country to country as a medium of exchange, p. 160

- 2. Mode of adjusting international payments through the exchanges, p. 160

- 3. Distinction between variations in the exchanges which are self-adjusting, and those which can only be rectified through prices, p. 166

- Chapter XXI. Of the Distribution of the Precious Metals through the Commercial World.

- § 1. The substitution of money for barter makes no difference in exports and imports, nor in the law of international values, p. 169

- 2. The preceding theorem further illustrated, p. 173

- 3. The precious metals, as money, are of the same value, and distribute themselves according to the same law, with the precious metals as a commodity, p. 177

- 4. International payments of a non-commercial character, p. 179

- Chapter XXII. Influence of the Currency on the Exchanges and on Foreign Trade.

- § 1. Variations in the exchange which originate in the currency, p. 181

- 2. Effect of a sudden increase of a metallic currency, or of the sudden creation of bank notes or other substitutes for money, p. 182

- 3. Effect of the increase of an inconvertible paper currency. Real and nominal exchange, p. 187

- Chapter XXIII. Of the Rate of Interest.

- § 1. The rate of interest depends on the demand and supply of loans, p. 191

- 2. Circumstances which determine the permanent demand and supply of loans, p. 192

- 3. Circumstances which determine the fluctuations, p. 196

- 4. The rate of interest, how far, and in what sense connected with the value of money, p. 199 5. The rate of interest determines the price of land and of securities, p. 205

- Chapter XXIV. Of the Regulation of a Convertible Paper Currency.

- § 1. Two contrary theories respecting the influence of bank issues, p. 207

- 2. Examination of each, p. 210

- 3. Reasons for thinking that the Currency Act of 1844 produces a part of the beneficial effect intended by it, p. 214

- 4. — but produces mischiefs more than equivalent, p. 220

- 5. Should the issue of bank notes be confined to a single establishment?, p. 235

- 6. Should the holders of notes be protected in any peculiar manner against failure of payment?, p. 238

- Chapter XXV. Of the Competition of different Countries in the same Market.

- § 1. Causes which enable one country to undersell another, p. 240

- 2. Low wages one of those causes, p. 248

- 3. —when peculiar to certain branches of industry, p. 245

- 4. —but not when common to all, p. 247

- 5. Some anomalous cases of trading communities examined, p. 249

- Chapter XXVI. Of Distribution, as affected by Exchange.

- § 1. Exchange and Money make no difference in the law of wages, p. 252

- 2. —in the law of rent, p. 255

- 3. —nor in the law of profits, p. 256

BOOK IV. INFLUENCE OF THE PROGRESS OF SOCIETY ON PRODUCTION AND DISTRIBUTION.

- Chapter I. General Characteristics of a Progressive State of Wealth.

- § 1. Introductory Remarks, p. 263

- 2. Tendency of the progress of society towards increased command over the powers of nature; increased security; and increased capacity of co-operation, p. 264

- Chapter II. Influence of the Progress of Industry and Population on Values and Prices.

- § 1. Tendency to a decline of the value and cost of production of all commodities, p. 270

- 2. —except the products of agriculture and mining, which have a tendency to rise, p. 272

- 3. —that tendency from time to time counteracted by improvements in production, p. 274

- 4. Effect of the progress of society in moderating fluctuations of value, p. 275

- 5. Examination of the influence of speculators, and in particular of corn dealers, p. 277

- Chapter III. Influence of the Progress of Industry and Population on Rents, Profits, and Wages.

- § 1. First case; population increasing, capital stationary, p. 282

- 2. Second case; capital increasing, population stationary, p. 286

- 3. Third case; population and capital increasing equally, the arts of production stationary, p. 287

- 4. Fourth case; the arts of production progressive, capital and population stationary, p. 288

- 5. Fifth case; all the three elements progressive, p. 295

- Chapter IV. Of the Tendency of Profits to a Minimum.

- § 1. Doctrine of Adam Smith on the competition of capital, p. 300

- 2. Doctrine of Mr. Wakefield respecting the field of employment, p. 302

- 3. What determines the minimum rate of profit, p. 304

- 4. In opulent countries, profits habitually near to the minimum, p. 307

- 5. — prevented from reaching it by commercial revulsions, p. 310

- 6. — by improvements in production, p. 312

- 7. — by the importation of cheap necessaries and instruments, p. 314

- 8. — by the emigration of capital, p. 316

- Chapter V. Consequences of the Tendency of Profits to a Minimum.

- § 1. Abstraction of capital not necessarily a national loss, p. 319

- 2. In opulent countries, the extension of machinery not detrimental but beneficial to labourers, p. 322

- Chapter VI. Of the Stationary State.

- § 1. Stationary state of wealth and population, dreaded and deprecated by writers, p. 326

- 2. — but not in itself undesirable, p. 328

- Chapter VII. On the Probable Futurity of the Labouring Classes.

- § 1. The theory of dependence and protection no longer applicable to the condition of modern society, p. 333

- 2. The future well-being of the labouring classes principally dependent on their own mental cultivation, p. 338

- 3. Probable effects of improved intelligence in causing a better adjustment of population — Would be promoted by the social independence of women, p. 340

- 4. Tendency of society towards the disuse of the relation of hiring and service, p. 341

- 5. Examples of the association of labourers with capitalists, p. 345

- 6. — of the association of labourers among themselves, p. 352

- 7. Competition not pernicious, but useful and indispensable, p. 376

BOOK V. ON THE INFLUENCE OF GOVERNMENT

- Chapter I. Of the Functions of Government in general.

- § 1. Necessary and optional functions of government distinguished, p. 381

- 2. Multifarious character of the necessary functions of government, p. 382

- 3. Division of the subject, p. 388

- Chapter II. Of the General Principles of Taxation.

- § 1. Four fundamental rules of taxation, p. 390

- 2. Grounds of the principle of Equality of Taxation, p. 392

- 3. Should the same percentage be levied on all amounts of income?, p. 395

- 4. Should the same percentage be levied on perpetual and on terminable incomes?, p. 400

- 5. The increase of the rent of land from natural causes a fit subject of peculiar taxation, p. 407

- 6. A land tax, in some cases, not taxation, but a rent-charge in favour of the public, p. 410

- 7. Taxes falling on capital, not necessarily objectionable, p. 412

- Chapter III. Of Direct Taxes.

- § 1. Direct taxes either on income or on expenditure, p. 415

- 2. Taxes on rent, p. 415

- 3. —on profits, p. 417

- 4. —on wages, p. 420

- 5. An Income Tax, p. 422

- 6. A House Tax, p. 426

- Chapter IV. Of Taxes on Commodities.

- § 1. A Tax on all Commodities would fall on profits, p. 432

- 2. Taxes on particular commodities fall on the consumer, p. 433

- 3. Peculiar effects of taxes on necessaries, p. 435

- 4. —how modified by the tendency of profits to a minimum, p. 439

- 5. Effects of discriminating duties, p. 444

- 6. Effects produced on international exchange by duties on exports and on imports, p. 448

- Chapter V. Of some other Taxes.

- § 1. Taxes on contracts, p. 458

- 2. Taxes on communication, p. 461

- 3. Law Taxes, p. 463

- 4. Modes of taxation for local purposes, p. 464

- Chapter VI. Comparison between Direct and Indirect Taxation.

- § 1. Arguments for and against direct taxation, p. 466

- 2. What forms of indirect taxation most eligible, p. 471

- 3. Practical rules for indirect taxation, p. 473

- Chapter VII. Of a National Debt.

- § 1. Is it desirable to defray extraordinary public expenses by loans?, p. 477

- 2. Not desirable to redeem a national debt by a general contribution, p. 481

- 3. In what cases desirable to maintain a surplus revenue for the redemption of debt, p. 483

- Chapter VIII. Of the Ordinary Functions of Government considered as to their Economical Effects.

- § 1. Effects of imperfect security of person and property, p. 487

- 2. Effects of over-taxation, p. 489

- 3. Effects of imperfection in the system of the laws, and in the administration of justice, p. 491

- Chapter IX. The same subject continued.

- § 1. Laws of Inheritance, p. 497

- 2. Law and Custom of Primogeniture, p. 499

- 3. Entails, p. 504

- 4. Law of compulsory equal division of inheritances, p. 506

- 5. Laws of Partnership, p. 508

- 6. Partnerships with limited liability. Chartered Companies, p. 510

- 7. Partnerships in commandite, p. 515

- 8. Laws relating to Insolvency, p. 521

- Chapter X. Of Interferences of Government grounded on Erroneous Theories.

- § 1. Doctrine of Protection to Native Industry, p. 530

- 2. Usury Laws, p. 542

- 3. Attempts to regulate the prices of commodities, p. 548

- 4. Monopolies, p. 550

- 5. Laws against Combination of Workmen, p. 552

- 6. Restraints on opinion or on its publication, p. 558

- Chapter XI. Of the Grounds and Limits of the Laisser-faire or Non-interference Principle.

- § 1. Governmental intervention distinguished into authoritative and unauthoritative, p. 561

- 2. Objections to government intervention the compulsory character of the intervention itself, or of the levy of funds to support it, p. 563

- 3. increase of the power and influence of government, p. 565

- 4. — increase of the occupations and responsibilities of government, p. 566

- 5. — superior efficiency of private agency, owing to stronger interest in the work, p. 568

- 6. — importance of cultivating habits of collective action in the people, p. 570

- 7. Laisser-faire the general rule, p. 572

- 8. — but liable to large exceptions. Cases in which the consumer is an incompetent judge of the commodity. Education, p. 576

- 9. Case of persons exercising power over others. Protection of children and young persons; of the lower animals. Case of women not analogous, p. 580

- 10. Case of contracts in perpetuity, p. 584

- 11. Cases of delegated management, p. 585

- 12. Cases in which public intervention may be necessary to give effect to the wishes of the persons interested. Examples: hours of labour; disposal of colonial lands, p. 588

- 13. Case of acts done for the benefit of others than the persons concerned. Poor Laws, p. 593

- 14. — Colonization, p. 596

- 15. — other miscellaneous examples, p. 603

- 16. Government intervention may be necessary in default of private agency, in cases where private agency would be more suitable, p. 606

BOOK III.

EXCHANGE (CONTINUED).

[II-3]

CHAPTER VII.

OF MONEY↩

§ 1. Having proceeded thus far in ascertaining the general laws of Value, without introducing the idea of Money (except occasionally for illustration,) it is time that we should now superadd that idea, and consider in what manner the principles of the mutual interchange of commodities are affected by the use of what is termed a Medium of Exchange.

In order to understand the manifold functions of a Circulating Medium, there is no better way than to consider what are the principal inconveniences which we should experience if we had not such a medium. The first and most obvious would be the want of a common measure for values of different sorts. If a tailor had only coats, and wanted to buy bread or a horse, it would be very troublesome to ascertain how much bread he ought to obtain for a coat, or how many coats he should give for a horse. The calculation must be recommenced on different data, every time he bartered his [II-4] coats for a different kind of article; and there could be no current price, or regular quotations of value. Whereas now each thing has a current price in money, and he gets over all difficulties by reckoning his coat at 4l. or 5l., and a four-pound loaf at 6d. or 7d. As it is much easier to compare different lengths by expressing them in a common language of feet and inches, so it is much easier to compare values by means of a common language of pounds, shillings, and pence. In no other way can values be arranged one above another in a scale; in no other can a person conveniently calculate the sum of his possessions; and it is easier to ascertain and remember the relations of many things to one thing, than their innumerable cross relations with one another. This advantage of having a common language in which values may be expressed, is, even by itself, so important, that some such mode of expressing and computing them would probably be used even if a pound or a shilling did not express any real thing, but a mere unit of calculation. It is said that there are African tribes in which this somewhat artificial contrivance actually prevails. They calculate the value of things in a sort of money of account, called macutes. They say, one thing is worth ten macutes, another fifteen, another twenty. [1] There is no real thing called a macute: it is a conventional unit, for the more convenient comparison of things with one another.

This advantage, however, forms but an inconsiderable part of the economical benefits derived from the use of money. The inconveniences of barter are so great, that without some more commodious means of effecting exchanges, the division of employments could hardly have been carried to any considerable extent. A tailor, who had nothing but coats, might starve before he could find any person having bread to sell who wanted a coat: besides, he would not want as much bread at a time as would be worth a coat, and the coat could not be divided. Every person, therefore, would at all times [II-5] hasten to dispose of his commodity in exchange for anything which, though it might not be fitted to his own immediate wants, was in great and general demand, and easily divisible, so that he might be sure of being able to purchase with it whatever was offered for sale. The primary necessaries of life possess these properties in a high degree. Bread is extremely divisible, and an object of universal desire. Still, this is not the sort of thing required: for, of food, unless in expectation of a scarcity, no one wishes to possess more at once, than is wanted for immediate consumption; so that a person is never sure of finding an immediate purchaser for articles of food; and unless soon disposed of, most of them perish. The thing which people would select to keep by them for making purchases, must be one which, besides being divisible and generally desired, does not deteriorate by keeping. This reduces the choice to a small number of articles.

§ 2. By a tacit concurrence, almost all nations, at a very early period, fixed upon certain metals, and especially gold and silver, to serve this purpose. No other substances unite the necessary qualities in so great a degree, with so many subordinate advantages. Next to food and clothing, and in some climates even before clothing, the strongest inclination in a rude state of society is for personal ornament, and for the kind of distinction which is obtained by rarity or costliness in such ornaments. After the immediate necessities of life were satisfied, every one was eager to accumulate as great a store as possible of things at once costly and ornamental; which were chiefly gold, silver, and jewels. These were the things which it most pleased every one to possess, and which there was most certainty of finding others willing to receive in exchange for any kind of produce. They were among the most imperishable of all substances. They were also portable, and containing great value in small bulk, were easily hid; a consideration of much importance in an age of insecurity. [II-6] Jewels are inferior to gold and silver in the quality of divisibility; and are of very various qualities, not to be accurately discriminated without great trouble. Gold and silver are eminently divisible, and when pure, always of the same quality; and their purity may be ascertained and certified by a public authority.

Accordingly, though furs have been employed as money in some countries, cattle in others, in Chinese Tartary cubes of tea closely pressed together, the shells called cowries on the coast of Western Africa, and in Abyssinia at this day blocks of rock salt; though even of metals, the less costly have sometimes been chosen, as iron in Lacedæmon from an ascetic policy, copper in the early Roman republic from the poverty of the people; gold and silver have been generally preferred by nations which were able to obtain them, either by industry, commerce, or conquest. To the qualities which originally recommended them, another came to be added, the importance of which only unfolded itself by degrees. Of all commodities, they are among the least influenced by any of the causes which produce fluctuations of value. No commodity is quite free from such fluctuations. Gold and silver have sustained, since the beginning of history, one great permanent alteration of value, from the discovery of the American mines; and some temporary variations, such as that which, in the last great war, was produced by the absorption of the metals in hoards, and in the military chests of the immense armies constantly in the field. In the present age the opening of new sources of supply, so abundant as the Ural mountains, California, and Australia, may be the commencement of another period of decline, on the limits of which it would be useless at present to speculate. But on the whole, no commodities are so little exposed to causes of variation. They fluctuate less than almost any other things in their cost of production. And from their durability, the total quantity in existence is at all times so great in proportion to the annual supply, that the effect on value even of a change in the cost of production is not [II-7] sudden: a very long time being required to diminish materially the quantity in existence, and even to increase it very greatly not being a rapid process. Gold and silver, therefore, are more fit than any other commodity to be the subject of engagements for receiving or paying a given quantity at some distant period. If the engagement were made in corn, a failure of crops might increase the burthen of the payment in one year to fourfold what was intended, or an exuberant harvest sink it in another to one-fourth. If stipulated in cloth, some manufacturing invention might permanently reduce the payment to a tenth of its original value. Such things have occurred even in the case of payments stipulated in gold and silver; but the great fall of their value after the discovery of America, is as yet, the only authenticated instance; and in this case the change was extremely gradual, being spread over a period of many years.

When gold and silver had become virtually a medium of exchange, by becoming the things for which people generally sold, and with which they generally bought, whatever they had to sell or to buy; the contrivance of coining obviously suggested itself. By this process the metal was divided into convenient portions, of any degree of smallness, and bearing a recognised proportion to one another; and the trouble was saved of weighing and assaying at every change of possessors, an inconvenience which on the occasion of small purchases would soon have become insupportable. Governments found it their interest to take the operation into their own hands, and to interdict all coining by private persons; indeed, their guarantee was often the only one which would have been relied on, a reliance however which very often it ill deserved; profligate governments having until a very modern period seldom scrupled, for the sake of robbing their creditors, to confer on all other debtors a licence to rob theirs, by the shallow and impudent artifice of lowering the standard; that least covert of all modes of knavery, which consists in calling a shilling a pound, that a debt of one hundred pounds may be [II-8] cancelled by the payment of a hundred shillings. It would have been as simple a plan, and would have answered the purpose as well, to have enacted that "a hundred" should always be interpreted to mean five, which would have effected the same reduction in all pecuniary contracts, and would not have been at all more shameless. Such strokes of policy have not wholly ceased to be recommended, but they have ceased to be practised; except occasionally through the medium of paper money, in which case the character of the transaction, from the greater obscurity of the subject, is a little less barefaced.

§ 3. Money, when its use has grown habitual, is the medium through which the incomes of the different members of the community are distributed to them, and the measure by which they estimate their possessions. As it is always by means of money that people provide for their different necessities, there grows up in their minds a powerful association leading them to regard money as wealth in a more peculiar sense than any other article; and even those who pass their lives in the production of the most useful objects, acquire the habit of regarding those objects as chiefly important by their capacity of being exchanged for money. A person who parts with money to obtain commodities, unless he intends to sell them, appears to the imagination to be making a worse bargain than a person who parts with commodities to get money; the one seems to be spending his means, the other adding to them. Illusions which, though now in some measure dispelled, were long powerful enough to overmaster the mind of every politician, both speculative and practical, in Europe.

It must be evident, however, that the mere introduction of a particular mode of exchanging things for one another, by first exchanging a thing for money, and then exchanging the money for something else, makes no difference in the essential character of transactions. It is not with money that things [II-9] are really purchased. Nobody's income (except that of the gold or silver miner) is derived from the precious metals. The pounds or shillings which a person receives weekly or yearly, are not what constitutes his income; they are a sort of tickets or orders which he can present for payment at any shop he pleases, and which entitle him to receive a certain value of any commodity that he makes choice of. The farmer pays his labourers and his landlord in these tickets, as the most convenient plan for himself and them; but their real income is their share of his corn, cattle, and hay, and it makes no essential difference whether he distributes it to them directly, or sells it for them and gives them the price; but as they would have to sell it for money if he did not, and as he is a seller at any rate, it best suits the purposes of all, that he should sell their share along with his own, and leave the labourers more leisure for work and the landlord for being idle. The capitalists, except those who are producers of the precious metals, derive no part of their income from those metals, since they only get them by buying them with their own produce: while all other persons have their incomes paid to them by the capitalists, or by those who have received payment from the capitalists, and as the capitalists have nothing, from the first, except their produce, it is that and nothing else which supplies all incomes furnished by them. There cannot, in short, be intrinsically a more insignificant thing, in the economy of society, than money; except in the character of a contrivance for sparing time and labour. It is a machine for doing quickly and commodiously, what would be done, though less quickly and commodiously, without it: and like many other kinds of machinery, it only exerts a distinct and independent influence of its own when it gets out of order.

The introduction of money does not interfere with the operation of any of the Laws of Value laid down in the preceding chapters. The reasons which make the temporary or market value of things depend on the demand and supply, [II-10] and their average and permanent values upon their cost of production, are as applicable to a money system as to a system of barter. Things which by barter would exchange for one another, will, if sold for money, sell for an equal amount of it, and so will exchange for one another still, though the process of exchanging them will consist of two operations instead of only one. The relations of commodities to one another remain unaltered by money: the only new relation introduced, is their relation to money itself; how much or how little money they will exchange for; in other words, how the Exchange Value of money itself is determined. And this is not a question of any difficulty, when the illusion is dispelled, which caused money to be looked upon as a peculiar thing, not governed by the same laws as other things. Money is a commodity, and its value is determined like that of other commodities, temporarily by demand and supply, permanently and on the average by cost of production. The illustration of these principles, considered in their application to money, must be given in some detail, on account of the confusion which, in minds not scientifically instructed on the subject, envelopes the whole matter; partly from a lingering remnant of the old misleading associations, and partly from the mass of vapoury and baseless speculation with which this, more than any other topic of political economy, has in latter times become surrounded. I shall therefore treat of the Value of Money in a chapter apart.

[II-11]

CHAPTER VIII.

OF THE VALUE OF MONEY, AS DEPENDENT ON DEMAND AND SUPPLY. ↩

§ 1. It is unfortunate that in the very outset of the subject we have to clear from our path a formidable ambiguity of language. The Value of Money is to appearance an expression as precise, as free from possibility of misunderstanding, as any in science. The value of a thing, is what it will exchange for: the value of money, is what money will exchange for; the purchasing power of money. If prices are low, money will buy much of other things, and is of high value; if prices are high, it will buy little of other things, and is of low value. The value of money is inversely as general prices: falling as they rise, and rising as they fall.

But unhappily the same phrase is also employed, in the current language of commerce, in a very different sense. Money, which is so commonly understood as the synonyme of wealth, is more especially the term in use to denote it when it is the subject of borrowing. When one person lends to another, as well as when he pays wages or rent to another, what he transfers is not the mere money, but a right to a certain value of the produce of the country, to be selected at pleasure; the lender having first bought this right, by giving for it a portion of his capital. What he really lends is so much capital; the money is the mere instrument of transfer. But the capital usually passes from the lender to the receiver through the means either of money, or of an order to receive money, and at any rate it is in money that the capital is computed and estimated. Hence, borrowing capital is universally called borrowing money; the loan market is called the money market: those who have their capital disposable for investment [II-12] on loan are called the monied class: and the equivalent given for the use of capital, or in other words, interest, is not only called the interest of money, but, by a grosser perversion of terms, the value of money. This misapplication of language, assisted by some fallacious appearances which we shall notice and clear up hereafter, [2] has created a general notion among persons in business, that the Value of Money, meaning the rate of interest, has an intimate connexion with the Value of Money in its proper sense, the value or purchasing power of the circulating medium. We shall return to this subject before long: at present it is enough to say, that by Value I shall always mean Exchange Value, and by money the medium of exchange, not the capital which is passed from hand to hand through that medium.

§ 2. The value or purchasing power of money depends, in the first instance, on demand and supply. But demand and supply, in relation to money, present themselves in a somewhat different shape from the demand and supply of other things.

The supply of a commodity means the quantity offered for sale. But it is not usual to speak of offering money for sale. People are not usually said to buy or sell money. This, however, is merely an accident of language. In point of fact, money is bought and sold like other things, whenever other things are bought and sold for money. Whoever sells corn, or tallow, or cotton, buys money. Whoever buys bread, or wine, or clothes, sells money to the dealer in those articles. The money with which people are offering to buy, is money offered for sale. The supply of money, then, is the quantity of it which people are wanting to lay out; that is, all the money they have in their possession, except what they are hoarding, or at least keeping by them as a reserve for future [II-13] contingencies. The supply of money, in short, is all the money in circulation at the time.

The demand for money, again, consists of all the goods offered for sale. Every seller of goods is a buyer of money, and the goods he brings with him constitute his demand. The demand for money differs from the demand for other things in this, that it is limited only by the means of the purchaser. The demand for other things is for so much and no more; but there is always a demand for as much money as can be got. Persons may indeed refuse to sell, and withdraw their goods from the market, if they cannot get for them what they consider a sufficient price. But this is only when they think that the price will rise, and that they shall get more money by waiting. If they thought the low price likely to be permanent, they would take what they could get. It is always a sine quâ non with a dealer to dispose of his goods.

As the whole of the goods in the market compose the demand for money, so the whole of the money constitutes the demand for goods. The money and the goods are seeking each other for the purpose of being exchanged. They are reciprocally supply and demand to one another. It is indifferent whether, in characterizing the phenomena, we speak of the demand and supply of goods, or the supply and the demand of money. They are equivalent expressions.

We shall proceed to illustrate this proposition more fully. And in doing this, the reader will remark a great difference between the class of questions which now occupy us, and those which we previously had under discussion respecting Values. In considering Value, we were only concerned with causes which acted upon particular commodities apart from the rest. Causes which affect all commodities alike, do not act upon values. But in considering the relation between goods and money, it is with the causes that operate upon all goods whatever, that we are specially concerned. We are [II-14] comparing goods of all sorts on one side, with money on the other side, as things to be exchanged against each other.

Suppose, everything else being the same, that there is an increase in the quantity of money, say by the arrival of a foreigner in a place, with a treasure of gold and silver. When he commences expending it (for this question it matters not whether productively or unproductively), he adds to the supply of money, and by the same act, to the demand for goods. Doubtless he adds, in the first instance, to the demand only for certain kinds of goods, namely, those which he selects for purchase; he will immediately raise the price of those, and so far as he is individually concerned, of those only. If he spends his funds in giving entertainments, he will raise the prices of food and wine. If he expends them in establishing a manufactory, he will raise the prices of labour and materials. But at the higher prices, more money will pass into the hands of the sellers of these different articles; and they, whether labourers or dealers, having more money to lay out, will create an increased demand for all the things which they are accustomed to purchase: these accordingly will rise in price, and so on until the rise has reached everything. I say everything, though it is of course possible that the influx of money might take place through the medium of some new class of consumers, or in such a manner as to alter the proportions of different classes of consumers to one another, so that a greater share of the national income than before would thenceforth be expended in some articles, and a smaller in others; exactly as if a change had taken place in the tastes and wants of the community. If this were the case, then until production had accommodated itself to this change in the comparative demand for different things, there would be a real alteration in values, and some things would rise in price more than others, while some perhaps would not rise at all. These effects, however, would evidently proceed, not from the mere increase of money, but from accessory circumstances attending it. We are now [II-15] only called upon to consider what would be the effect of an increase of money, considered by itself. Supposing the money in the hands of individuals to be increased, the wants and inclinations of the community collectively in respect to consumption remaining exactly the same; the increase of demand would reach all things equally, and there would be an universal rise of prices. We might suppose, with Hume, that some morning, every person in the nation should wake and find a gold coin in his pocket: this example, however, would involve an alteration of the proportions in the demand for different commodities; the luxuries of the poor would, in the first instance be raised in price, in a much greater degree than other things. Let us rather suppose, therefore, that to every pound, or shilling, or penny, in the possession of any one, another pound, shilling, or penny, were suddenly added. There would be an increased money demand, and consequently an increased money value, or price, for things of all sorts. This increased value would do no good to any one; would make no difference, except that of having to reckon pounds, shillings, and pence, in higher numbers. It would be an increase of values only as estimated in money, a thing only wanted to buy other things with; and would not enable any one to buy more of them than before. Prices would have risen in a certain ratio, and the value of money would have fallen in the same ratio.

It is to be remarked that this ratio would be precisely that in which the quantity of money had been increased. If the whole money in circulation was doubled, prices would be doubled. If it was only increased one-fourth, prices would rise one-fourth. There would be one-fourth more money, all of which would be used to purchase goods of some description. When there had been time for the increased supply of money to reach all markets, or (according to the conventional metaphor) to permeate all the channels of circulation, all prices would have risen one-fourth. But the general rise of price is independent of this diffusing and equalizing [II-16] process. Even if some prices were raised more, and others less, the average rise would be one-fourth. This is a necessary consequence of the fact, that a fourth more money would have been given for only the same quantity of goods. General prices, therefore, would in any case be a fourth higher.

The very same effect would be produced on prices if we suppose the goods diminished, instead of the money increased: and the contrary effect if the goods were increased or the money diminished. If there were less money in the hands of the community, and the same amount of goods to be sold, less money altogether would be given for them, and they would be sold at lower prices; lower, too, in the precise ratio in which the money was diminished. So that the value of money, other things being the same, varies inversely as its quantity; every increase of quantity lowering the value, and every diminution raising it, in a ratio exactly equivalent.

This, it must be observed, is a property peculiar to money. We did not find it to be true of commodities generally, that every diminution of supply raised the value exactly in proportion to the deficiency, or that every increase lowered it in the precise ratio of the excess. Some things are usually affected in a greater ratio than that of the excess or deficiency, others usually in a less: because, in ordinary cases of demand, the desire, being for the thing itself, may be stronger or weaker: and the amount of what people are willing to expend on it, being in any case a limited quantity, may be affected in very unequal degrees by difficulty or facility of attainment. But in the case of money, which is desired as the means of universal purchase, the demand consists of everything which people have to sell; and the only limit to what they are willing to give, is the limit set by their having nothing more to offer. The whole of the goods being in any case exchanged for the whole of the money which comes into the market to be laid out, they will sell for less or more of it, exactly according as less or more is brought.

[II-17]

§ 3. From what precedes, it might for a moment be supposed, that all the goods on sale in a country at any one time, are exchanged for all the money existing and in circulation at that same time: or in other words, that there is always in circulation in a country, a quantity of money equal in value to the whole of the goods then and there on sale. But this would be a complete misapprehension. The money laid out is equal in value to the goods it purchases; but the quantity of money laid out is not the same thing with the quantity in circulation. As the money passes from hand to hand, the same piece of money is laid out many times, before all the things on sale at one time are purchased and finally removed from the market: and each pound or dollar must be counted for as many pounds or dollars, as the number of times it changes hands in order to effect this object. The greater part of the goods must also be counted more than once, not only because most things pass through the hands of several sets of manufacturers and dealers before they assume the form in which they are finally consumed, but because in times of speculation (and all times are so, more or less) the same goods are often bought repeatedly, to be resold for a profit, before they are bought for the purpose of consumption at all.

If we assume the quantity of goods on sale, and the number of times those goods are resold, to be fixed quantities, the value of money will depend upon its quantity, together with the average number of times that each piece changes hands in the process. The whole of the goods sold (counting each resale of the same goods as so much added to the goods) have been exchanged for the whole of the money, multiplied by the number of purchases made on the average by each piece. Consequently, the amount of goods and of transactions being the same, the value of money is inversely as its quantity multiplied by what is called the rapidity of circulation. And the quantity of money in circulation, is equal to the money value of all the goods sold, divided [II-18] by the number which expresses the rapidity of circulation.

The phrase, rapidity of circulation, requires some comment. It must not be understood to mean, the number of purchases made by each piece of money in a given time. Time is not the thing to be considered. The state of society may be such, that each piece of money hardly performs more than one purchase in a year; but if this arises from the small number of transactions—from the small amount of business done, the want of activity in traffic, or because what traffic there is, mostly takes place by barter—it constitutes no reason why prices should be lower, or the value of money higher. The essential point is, not how often the same money changes hands in a given time, but how often it changes hands in order to perform a given amount of traffic. We must compare the number of purchases made by the money in a given time, not with the time itself, but with the goods sold in that same time. If each piece of money changes hands on an average ten times while goods are sold to the value of a million sterling, it is evident that the money required to circulate those goods is 100,000l. And conversely, if the money in circulation is 100,000l., and each piece changes hands by the purchase of goods ten times in a month, the sales of goods for money which take place every month must amount on the average to 1,000,000l.

Rapidity of circulation being a phrase so ill adapted to express the only thing which it is of any importance to express by it, and having a tendency to confuse the subject by suggesting a meaning extremely different from the one intended, it would be a good thing if the phrase could be got rid of, and another substituted, more directly significant of the idea meant to be conveyed. Some such expression as "the efficiency of money," though not unexceptionable, would do better; as it would point attention to the quantity of work done, without suggesting the idea of estimating it by time. Until an appropriate term can be devised, we must be content [II-19] when ambiguity is to be apprehended, to express the idea by the circumlocution which alone conveys it adequately, namely, the average number of purchases made by each piece in order to effect a given pecuniary amount of transactions.

§ 4. The proposition which we have laid down respecting the dependence of general prices upon the quantity of money in circulation, must be understood as applying only to a state of things in which money, that is, gold or silver, is the exclusive instrument of exchange, and actually passes from hand to hand at every purchase, credit in any of its shapes being unknown. When credit comes into play as a means of purchasing, distinct from money in hand, we shall hereafter find that the connexion between prices and the amount of the circulating medium is much less direct and intimate, and that such connexion as does exist, no longer admits of so simple a mode of expression. But on a subject so full of complexity as that of currency and prices, it is necessary to lay the foundation of our theory in a thorough understanding of the most simple cases, which we shall always find lying as a groundwork or substratum under those which arise in practice. That an increase of the quantity of money raises prices, and a diminution lowers them, is the most elementary proposition in the theory of currency, and without it we should have no key to any of the others. In any state of things, however, except the simple and primitive one which we have supposed, the proposition is only true other things being the same: and what those other things are, which must be the same, we are not yet ready to pronounce. We can, however, point out, even now, one or two of the cautions with which the principle must be guarded in attempting to make use of it for the practical explanation of phenomena; cautions the more indispensable, as the doctrine, though a scientific truth, has of late years been the foundation of a greater mass of false theory, and erroneous interpretation of [II-20] facts, than any other proposition relating to interchange. From the time of the resumption of cash payments by the Act of 1819, and especially since the commercial crisis of 1825, the favourite explanation of every rise or fall of prices has been "the currency;" and like most popular theories, the doctrine has been applied with little regard to the conditions necessary for making it correct.

For example, it is habitually assumed that whenever there is a greater amount of money in the country, or in existence, a rise of prices must necessarily follow. But this is by no means an inevitable consequence. In no commodity is it the quantity in existence, but the quantity offered for sale, that determines the value. Whatever may be the quantity of money in the country, only that part of it will affect prices, which goes into the market of commodities, and is there actually exchanged against goods. Whatever increases the amount of this portion of the money in the country, tends to raise prices. But money hoarded does not act on prices. Money kept in reserve by individuals to meet contingencies which do not occur, does not act on prices. The money in the coffers of the Bank, or retained as a reserve by private bankers, does not act on prices until drawn out, nor even then unless drawn out to be expended in commodities.

It frequently happens that money, to a considerable amount, is brought into the country, is there actually invested as capital, and again flows out, without having ever once acted upon the markets of commodities, but only upon the market of securities, or, as it is commonly though improperly called, the money market. Let us return to the case already put for illustration, that of a foreigner landing in the country with a treasure. We supposed him to employ his treasure in the purchase of goods for his own use, or in setting up a manufactory and employing labourers; and in either case he would, cæteris paribus, raise prices. But instead of doing either of these things, he might very probably prefer to invest his fortune at interest; which we shall suppose him to do in [II-21] the most obvious way, by becoming a competitor for a portion of the stock, exchequer bills, railway debentures, mercantile bills, mortgages, &c., which are at all times in the hands of the public. By doing this he would raise the prices of those different securities, or in other words would lower the rate of interest; and since this would disturb the relation previously existing between the rate of interest on capital in the country itself, and that in foreign countries, it would probably induce some of those who had floating capital seeking employment, to send it abroad for foreign investment rather than buy securities at home at the advanced price. As much money might thus go out as had previously come in, while the prices of commodities would have shown no trace of its temporary presence. This is a case highly deserving of attention: and it is a fact now beginning to be recognised, that the passage of the precious metals from country to country is determined much more than was formerly supposed, by the state of the loan market in different countries, and much less by the state of prices.

Another point must be adverted to, in order to avoid serious error in the interpretation of mercantile phenomena. If there be, at any time, an increase in the number of money transactions, a thing continually liable to happen from differences in the activity of speculation, and even in the time of year (since certain kinds of business are transacted only at particular seasons); an increase of the currency which is only proportional to this increase of transactions, and is of no longer duration, has no tendency to raise prices. At the quarterly periods when the public dividends are paid at the Bank, a sudden increase takes place of the money in the hands of the public; an increase estimated at from a fifth to two-fifths of the whole issues of the Bank of England. Yet this never has any effect on prices; and in a very few weeks, the currency has again shrunk into its usual dimensions, by a mere reduction in the demands of the public (after so copious a supply of ready money) for accommodation from the Bank [II-22] in the way of discount or loan. In like manner the currency of the agricultural districts fluctuates in amount at different seasons of the year. It is always lowest in August: "it rises generally towards Christmas, and obtains its greatest elevation about Lady-day, when the farmer commonly lays in his stock, and has to pay his rent and summer taxes," and when he therefore makes his principal applications to country bankers for loans. "Those variations occur with the same regularity as the season, and with just as little disturbance of the markets as the quarterly fluctuations of the notes of the Bank of England. As soon as the extra payments have been completed, the superfluous" currency, which is estimated at half a million, "as certainly and immediately is reabsorbed and disappears." [3]

If extra currency were not forthcoming to make these extra payments, one of three things must happen. Either the payments must be made without money, by a resort to some of those contrivances by which its use is dispensed with; or there must be an increase in the rapidity of circulation, the same sum of money being made to perform more payments; or if neither of these things took place, money to make the extra payments must be withdrawn from the market for commodities, and prices, consequently, must fall. An increase of the circulating medium, conformable in extent and duration to the temporary stress of business, does not raise prices, but merely prevents this fall.

The sequel of our investigation will point out many other qualifications with which the proposition must be received, that the value of the circulating medium depends on the demand and supply, and is in the inverse ratio of the quantity; qualifications which, under a complex system of credit like that existing in England, render the proposition an extremely incorrect expression of the fact.

[II-23]

CHAPTER IX.

OF THE VALUE OF MONEY, AS DEPENDENT ON COST OF PRODUCTION. ↩

§ 1. But money, no more than commodities in general, has its value definitively determined by demand and supply. The ultimate regulator of its value is Cost of Production.

We are supposing, of course, that things are left to themselves. Governments have not always left things to themselves. They have undertaken to prevent the quantity of money from adjusting itself according to spontaneous laws, and have endeavoured to regulate it at their pleasure; generally with a view of keeping a greater quantity of money in the country, than would otherwise have remained there. It was, until lately, the policy of all governments to interdict the exportation and the melting of money; while, by encouraging the exportation and impeding the importation of other things, they endeavoured to have a stream of money constantly flowing in. By this course they gratified two prejudices; they drew, or thought that they drew, more money into the country, which they believed to be tantamount to more wealth; and they gave, or thought that they gave, to all producers and dealers, high prices, which, though no real advantage, people are always inclined to suppose to be one.

In this attempt to regulate the value of money artificially by means of the supply, governments have never succeeded in the degree, or even in the manner, which they intended. Their prohibitions against exporting or melting the coin have never been effectual. A commodity of such small bulk in proportion to its value is so easily smuggled, and still more easily melted, that it has been impossible by the most stringent measures to prevent these operations. All the risk [II-24] which it was in the power of governments to attach to them, was outweighed by a very moderate profit. [4] In the more indirect mode of aiming at the same purpose, by throwing difficulties in the way of making the returns for exported goods in any other commodity than money, they have not been quite so unsuccessful. They have not, indeed, succeeded in making money flow continuously into the country; but they have to a certain extent been able to keep it at a higher than its natural level; and have, thus far, removed the value of money from exclusive dependence on the causes which fix the value of things not artificially interfered with.

We are, however, to suppose a state, not of artificial regulation, but of freedom. In that state, and assuming no charge to be made for coinage, the value of money will conform to the value of the bullion of which it is made. A pound weight of gold or silver in coin, and the same weight in an ingot, will precisely exchange for one another. On the supposition of freedom, the metal cannot be worth more in the state of bullion than of coin; for as it can be melted without any loss of time, and with hardly any expense, this would of course be done until the quantity in circulation was so much diminished as to equalize its value with that of the same weight in bullion. It may be thought however that the coin, though it cannot be of less, may be, and being a manufactured article will naturally be, of greater value than the bullion contained in it, on the same principle on which linen cloth is of more value than an equal weight of linen yarn. This would be true, were it not that Government, in this country, and in some others, coins money gratis for any one who furnishes the metal. The labour and [II-25] expense of coinage, when not charged to the possessor, do not raise the value of the article. If Government opened an office where, on delivery of a given weight of yarn, it returned the same weight of cloth to any one who asked for it, cloth would be worth no more in the market than the yarn it contained. As soon as coin is worth a fraction more than the value of the bullion, it becomes the interest of the holders of bullion to send it to be coined. If Government, however, throws the expense of coinage, as is reasonable, upon the holder, by making a charge to cover the expense (which is done by giving back rather less in coin than has been received in bullion, and is called levying a seignorage), the coin will rise, to the extent of the seignorage, above the value of the bullion. If the Mint kept back one per cent, to pay the expense of coinage, it would be against the interest of the holders of bullion to have it coined, until the coin was more valuable than the bullion by at least that fraction. The coin, therefore, would be kept one per cent higher in value, which could only be by keeping it one per cent less in quantity, than if its coinage were gratuitous.

The Government might attempt to obtain a profit by the transaction, and might lay on a seignorage calculated for that purpose; but whatever they took for coinage beyond its expenses, would be so much profit on private coining. Coining, though not so easy an operation as melting, is far from a difficult one, and, when the coin produced is of full weight and standard fineness, is very difficult to detect. If, therefore, a profit could be made by coining good money, it would certainly be done: and the attempt to make seignorage a source of revenue would be defeated. Any attempt to keep the value of the coin at an artificial elevation, not by a seignorage, but by refusing to coin, would be frustrated in the same manner. [5]

[II-26]

§ 2. The value of money, then, conforms, permanently, and, in a state of freedom, almost immediately, to the value of the metal of which it is made; with the addition, or not, of the expenses of coinage, according as those expenses are borne by the individual or by the state. This simplifies extremely the question which we have here to consider: since gold and silver bullion are commodities like any others, and their value depends, like that of other things, on their cost of production.

To the majority of civilized countries, gold and silver are foreign products: and the circumstances which govern the values of foreign products, present some questions which we are not yet ready to examine. For the present, therefore, we must suppose the country which is the subject of our inquiries, to be supplied with gold and silver by its own mines, reserving for future consideration how far our conclusions require modification to adapt them to the more usual case.

Of the three classes into which commodities are divided—those absolutely limited in supply, those which may be had in unlimited quantity at a given cost of production, and those which may be had in unlimited quantity, but at an increasing cost of production—the precious metals, being the produce of mines, belong to the third class. Their natural value, therefore, is in the long run proportional to their cost of production in the most unfavourable existing circumstances, that is, at the worst mine which it is necessary to work in order to obtain the required supply. A pound weight of gold will, in the gold-producing countries, ultimately tend to exchange [II-27] for as much of every other commodity, as is produced at a cost equal to its own; meaning by its own cost the cost in labour and expense, at the least productive sources of supply which the then existing demand makes it necessary to work. The average value of gold is made to conform to its natural value, in the same manner as the values of other things are made to conform to their natural value. Suppose that it were selling above its natural value; that is, above the value which is an equivalent for the labour and expense of mining, and for the risks attending a branch of industry in which nine out of ten experiments have usually been failures. A part of the mass of floating capital which is on the look out for investment, would take the direction of mining enterprise; the supply would thus be increased, and the value would fall. If, on the contrary, it were selling below its natural value, miners would not be obtaining the ordinary profit; they would slacken their works; if the depreciation was great, some of the inferior mines would perhaps stop working altogether: and a falling off in the annual supply, preventing the annual wear and tear from being completely compensated, would by degrees reduce the quantity, and restore the value.

When examined more closely, the following are the details of the process. If gold is above its natural or cost value—the coin, as we have seen, conforming in its value to the bullion—money will be of high value, and the prices of all things, labour included, will be low. These low prices will lower the expenses of all producers; but as their returns will also be lowered, no advantage will be obtained by any producer, except the producer of gold: whose returns from his mine, not depending on price, will be the same as before, and his expenses being less, he will obtain extra profits, and will be stimulated to increase his production. E converso if the metal is below its natural value: since this is as much as to say that prices are high, and the money expenses of all producers unusually great: for this, however, all other producers will be compensated by increased money returns: the miner [II-28] alone will extract from his mine no more metal than before, while his expenses will be greater: his profits therefore being diminished or annihilated, he will diminish his production, if not abandon his employment.

In this manner it is that the value of money is made to conform to the cost of production of the metal of which it is made. It may be well, however, to repeat (what has been said before) that the adjustment takes a long time to effect, in the case of a commodity so generally desired and at the same time so durable as the precious metals. Being so largely used not only as money but for plate and ornament, there is at all times a very large quantity of these metals in existence: while they are so slowly worn out, that a comparatively small annual production is sufficient to keep up the supply, and to make any addition to it which may be required by the increase of goods to be circulated, or by the increased demand for gold and silver articles by wealthy consumers. Even if this small annual supply were stopt entirely, it would require many years to reduce the quantity so much as to make any very material difference in prices. The quantity may be increased, much more rapidly than it can be diminished; but the increase must be very great before it can make itself much felt over such a mass of the precious metals as exists in the whole commercial world. And hence the effects of all changes in the conditions of production of the precious metals are at first, and continue to be for many years, questions of quantity only, with little reference to cost of production. More especially is this the case when, as at the present time, many new sources of supply have been simultaneously opened, most of them practicable by labour alone, without any capital in advance beyond a pickaxe and a week's food; and when the operations are as yet wholly experimental, the comparative permanent productiveness of the different sources being entirely unascertained.

§ 3. Since, however, the value of money really conforms, [II-29] like that of other things, though more slowly, to its cost of production, some political economists have objected altogether to the statement that the value of money depends on its quantity combined with the rapidity of circulation; which, they think, is assuming a law for money that does not exist for any other commodity, when the truth is that it is governed by the very same laws. To this we may answer, in the first place, that the statement in question assumes no peculiar law. It is simply the law of demand and supply, which is acknowledged to be applicable to all commodities, and which, in the case of money as of most other things, is controlled, but not set aside, by the law of cost of production, since cost of production would have no effect on value if it could have none on supply. But, secondly, there really is, in one respect, a closer connexion between the value of money and its quantity, than between the values of other things and their quantity. The value of other things conforms to the changes in the cost of production, without requiring, as a condition, that there should be any actual alteration of the supply: the potential alteration is sufficient; and if there even be an actual alteration, it is but a temporary one, except in so far as the altered value may make a difference in the demand, and so require an increase or diminution of supply, as a consequence, not a cause, of the alteration in value. Now this is also true of gold and silver, considered as articles of expenditure for ornament and luxury; but it is not true of money. If the permanent cost of production of gold were reduced one-fourth, it might happen that there would not be more of it bought for plate, gilding, or jewellery, than before; and if so, though the value would fall, the quantity extracted from the mines for these purposes would be no greater than previously. Not so with the portion used as money; that portion could not fall in value one-fourth, unless actually increased one-fourth; for, at prices one-fourth higher, one-fourth more money would bo required to make the accustomed purchases; and if [II-30] this were not forthcoming, some of the commodities would be without purchasers, and prices could not be kept up. Alterations, therefore, in the cost of production of the precious metals, do not act upon the value of money except just in proportion as they increase or diminish its quantity; which cannot be said of any other commodity. It would therefore, I conceive, be an error both scientifically and practically, to discard the proposition which asserts a connexion between the value of money and its quantity.

It is evident, however, that the cost of production, in the long run, regulates the quantity; and that every country (temporary fluctuations excepted) will possess, and have in circulation, just that quantity of money, which will perform all the exchanges required of it, consistently with maintaining a value conformable to its cost of production. The prices of things will, on the average, be such that money will exchange for its own cost in all other goods: and, precisely because the quantity cannot be prevented from affecting the value, the quantity itself will (by a sort of self-acting machinery) be kept at the amount consistent with that standard of prices—at the amount necessary for performing, at those prices, all the business required of it.

"The quantity wanted will depend partly on the cost of producing gold, and partly on the rapidity of its circulation. The rapidity of circulation being given, it would depend on the cost of production: and the cost of production being given, the quantity of money would depend on the rapidity of its circulation." [6] After what has been already said, I hope that neither of these propositions stands in need of any further illustration.

Money, then, like commodities in general, having a value dependent on, and proportional to, its cost of production; the [II-31] theory of money is, by the admission of this principle, stript of a great part of the mystery which apparently surrounded it. We must not forget, however, that this doctrine only applies to the places in which the precious metals are actually produced; and that we have yet to enquire whether the law of the dependence of value on cost of production applies to the exchange of things produced at distant places. But however this may be, our propositions with respect to value will require no other alteration, where money is an imported commodity, than that of substituting for the cost of its production, the cost of obtaining it in the country. Every foreign commodity is bought by giving for it some domestic production; and the labour and capital which a foreign commodity costs to us, is the labour and capital expended in producing the quantity of our own goods which we give in exchange for it. What this quantity depends upon,—what determines the proportions of interchange between the productions of one country and those of another,—is indeed a question of somewhat greater complexity than those we have hitherto considered. But this at least is indisputable, that within the country itself the value of imported commodities is determined by the value, and consequently by the cost of production, of the equivalent given for them; and money, where it is an imported commodity, is subject to the same law.

[II-32]

CHAPTER X.

OF A DOUBLE STANDARD, AND SUBSIDIARY COINS. ↩

§ 1. Though the qualities necessary to fit any commodity for being used as money are rarely united in any considerable perfection, there are two commodities which possess them in an eminent, and nearly an equal degree; the two precious metals, as they are called; gold and silver. Some nations have accordingly attempted to compose their circulating medium of these two metals indiscriminately.

There is an obvious convenience in making use of the more costly metal for larger payments, and the cheaper one for smaller; and the only question relates to the mode in which this can best be done. The mode most frequently adopted has been to establish between the two metals a fixed proportion; to decide, for example, that a gold coin called a sovereign should be equivalent to twenty of the silver coins called shillings: both the one and the other being called, in the ordinary money of account of the country, by the same denomination, a pound: and it being left free to every one who has a pound to pay, either to pay it in the one metal or in the other.

At the time when the valuation of the two metals relatively to each other, say twenty shillings to the sovereign, or twenty-one shillings to the guinea, was first made, the proportion probably corresponded, as nearly as it could be made to do, with the ordinary relative values of the two metals grounded on their cost of production: and if those natural or cost values always continued to bear the same ratio to one another, the arrangement would be unobjectionable. This, however, is far from being the fact. Gold and silver, though the least variable in value of all commodities, are not invariable, [II-33] and do not always vary simultaneously. Silver, for example, was lowered in permanent value more than gold, by the discovery of the American mines; and those small variations of value which take place occasionally, do not affect both metals alike. Suppose such a variation to take place: the value of the two metals relatively to one another no longer agreeing with their rated proportion, one or other of them will now be rated below its bullion value, and there will be a profit to be made by melting it.

Suppose, for example, that gold rises in value relatively to silver, so that the quantity of gold in a sovereign is now worth more than the quantity of silver in twenty shillings. Two consequences will ensue. No debtor will any longer find it his interest to pay in gold. He will always pay in silver, because twenty shillings are a legal tender for a debt of one pound, and he can procure silver convertible into twenty shillings for less gold than that contained in a sovereign. The other consequence will be, that unless a sovereign can be sold for more than twenty shillings, all the sovereigns will be melted, since as bullion they will purchase a greater number of shillings than they exchange for as coin. The converse of all this would happen if silver, instead of gold, were the metal which had risen in comparative value. A sovereign would not now be worth so much as twenty shillings, and whoever had a pound to pay would prefer paying it by a sovereign; while the silver coins would be collected for the purpose of being melted, and sold as bullion for gold at their real value, that is, above the legal valuation. The money of the community, therefore, would never really consist of both metals, but of the one only which, at the particular time, best suited the interest of debtors; and the standard of the currency would be constantly liable to change from the one metal to the other, at a loss, on each change, of the expense of coinage on the metal which fell out of use.

It appears, therefore, that the value of money is liable to more frequent fluctuations when both metals are a legal tender [II-34] at a fixed valuation, than when the exclusive standard of the currency is either gold or silver. Instead of being only affected by variations in the cost of production of one metal, it is subject to derangement from those of two. The particular kind of variation to which a currency is rendered more liable by having two legal standards, is a fall of value, or what is commonly called a depreciation; since practically that one of the two metals will always be the standard, of which the real has fallen below the rated value. If the tendency of the metals be to rise in value, all payments will be made in the one which has risen least; and if to fall, then in that which has fallen most.