Fightback! Taxation and Expenditure Reform for Jobs and Growth (1991)

|

|

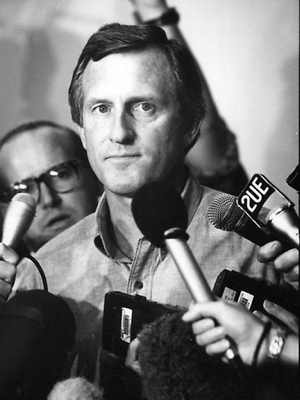

| John Robert Hewson (1946- ) |

Source

Fightback! Taxation and Expenditure Reform for Jobs and Growth. The Liberal and National Parties’ Plan to rebuild and reward Australia (21 November 1991).

Parliament of Australia website: text in facs. PDF and a poorly OCR’ed HTML from same.

According to the Wikipedia entry : Fightback! was a 650-page economic policy package document proposed by John Hewson, federal leader of the Liberal Party of Australia and Leader of the Opposition from 1990 to 1994. It represented the start of their new “dry”, economic liberal future policy direction, very different from the Keynesianism they previously practised. The package was part of their unsuccessful policy platform at the 1993 election.

Editor's Note: I have not corrected all the errors in the following documents. I have edited "The Introduction" and rebuilt the Table of Contents with links. The data tables were coded particularly poorly. See the facs. PDF version for details.

Table of Contents

- 1. INTRODUCTION ...........................................1

- 1.1 Why Tax Reform is Essential .................... ......... 1

- 1.2 Why Expenditure Reform is Essential ....................... 2

- 1.3 Objectives of Tax and Expenditure Reform ................... 3

- 1.4 Conclusion ............................................5

- 2. PERSONAL INCOME TAX ....................................7

- 2 .1 Key Decisions ......................................... 7

- 2.2 How Labor's High Tax Policy Has Failed ..................... 8

- 2 .3 Lower Income Tax Rates ............................... 14

- 2.4 Private Health Insurance Tax Credit ....................... 20

- 2.5 Medicare Levy Surcharge for High Income Earners ............ 21

- 2 .6 Superannuation Tax Rebate ............................. 21

- 2.7 Return "Bracket Creep" to Taxpayers ....................... 21

- 2 .8 Dependent Spouse Rebate ........................ , .... 21

- 2.9 Goods and Services Tax Credit ........................... 22

- 2 .10 Thresholds and Allowances .............................. 22

- 2 .11 Zone Rebates .................................. ... 22

- 2 .12 Tax Free Savings Scheme ............................... 22

- 2 .13 Prescribed Payments System ............................. 22

- 3. TAXES ON BUSINESS ......................................25

- 3.1 Key Decisions ........................................ 25

- 3.2 Labor's High Tax Policy on Business ....................... 26

- 3.3 The Liberal/National Commitment to Reduce BusinessCosts ................. ..................... 28

- 3.4 The Training Guarantee Levy .................... ....... 29

- 3.5 The Superannuation Guarantee Levy ....................... 30

- 3.6 Company Tax ........................................30

- 3 .7 Depreciation Allowances ................................31

- 3.8 The Research and Development Tax Deduction ............ . .. 32

- 3.9 The Coal Export Levy ..................................34

- 3 .10 Fringe Benefits Tax ....................................34

- 3.11 Tax Reviews .........................................34

- 3 .11.1 Large Projects .................................35 35

- 3 .11.2 Financial Transactions ........... ............ 35

- 3.12 Tax Administration ..................... ............. 35

- 4. CAPITAL GAINS TAX ... ........ ....................... 37

- 4.1 Key Decisions ................... ... ............... 37

- 4.2 Problems With Labor's Capital Gains Tax ................... 38

- 4.3 The Rate of Tax ...................................... 39

- 4.4 Exemption for Small Capital Gains ........................ 39

- 4.5 The Goodwill Exemption .................................40

- 4.6 Retirement Relief .....................................42

- 4.7 Rollover Relief ........................................43

- 4.8 Employee Share Participation ............................ 44

- 4.9 Budget Impact ........................................44

- Attachment I: Definition of "Like Kind Asset Exchange" ............. 45

- 5. INDIRECT TAXATION ..................................... 47

- 5.1 Key Decisions ........................................ 47

- 5.2 Problems with Indirect Taxation Under Labor ................ 47

- 5.2.1 Wholesale Sales Tax ............................ 47

- 5.2.2 Petroleum Excise ............................... 57

- 5.2.3 Customs Duty ................................ 61

- 5.2.4 Payroll Tax .................................. 62

- 5.3 The Goods and Services Tax ............................ 65

- 5.3.1 Why a Goods and Services Tax? .................... 67

- 5.3.2 Defining the Taxation Base ....................... 71

- 5.3.3 Rationale for Zero Rating Certain Activities .......... 74

- 5.3.4 Rationale for Exempting Certain Activities ........... 76

- 5.3.5 GST Rate Will Not Be Raised ..................... 80

- 5.4 Payroll Tax .................... .................... 80

- 5.5 Petrol Excise Abolition ................................ 81

- 5.5.1 Petrol Exise .................................. 81

- 5.5,2 National Road Funding Policy ..................... 81

- 5.6 Tobacco Excise ...................................... 83

- 5.7 Other Excise ........................................ 83

- 5.8 Customs Duty ....................................... 84

- 5.9 Adjustments to Excises, Payroll and Sales Tax ................ 84

- 6. TAX AVOIDANCE AND EVASION ............................. 95

- 6.1 Introduction .........................................95

- 6.2 The Black Economy ....................................96

- 6.3 Aligning Tax Rebates ...................................98

- 6.4 Eliminating Fringe Benefits Tax Rorts ......................98

- 6.5 Superannuation - No Longer a Tax Shelterfor the Wealthy ................. ............... 99

- 6.6 The R & D Incentive ....................................99

- 7. NATIONAL SAVINGS STRATEGY ............................ 101

- 7.1 Key Decisions ...................................... 101

- 7.2 Australia's Savings Problem .............................102

- 7.2.1 Savings and Investment Trends .. ................ 102

- 7.2.2 Balance of Payments/Foreign Debt Problems ......... 104

- 7.2.3 The Debt Hurdle .............................. 105

- 7.2.4 Fundamental Economic Relationship ............... 106

- 7.3 Labor's Response to the Saving Problem ................... 107

- 7.4 The Liberal/National Alternative ......................... 114

- 7.4.1 A Comprehensive National Savings Strategy ......... 114

- 7.4.2 A Newer Fairer, Comprehensive SuperannuationScheme ........................ 116

- 7.4.3 Long Term Savings ............................ 121

- 7.4.4 Tax Free Savings (TFS) ......................... 122

- 8. A CO-ORDINATED ANTI-INFLATION STRATEGY BUILT ON SOUND MONEY ........................... .... 127

- 8.1 Introduction ....................................... 127

- 8.2 Inflation as a Problem ................................ 128

- 8.3 Attacking Inflation .................................. 129

- 8.3.1 A Commitment to Price Stability .................. 129

- 8.3.2 Reserve Bank Independence ...................... 129

- 8.3.3 Fiscal and Monetary Policy ...................... 130

- 8.3.4 Industrial Relations Reform ...................... 131

- 8.3.5 Tariff Reform ............................... 132

- 8.3.6 Structural Reform ..................... ....... 132

- 8.3.7 Taxation Reform .............................. 132

- 8.4 Goods and Services Tax and Inflation ..................... 133

- 8.5 Prices Surveillance Authority ............................ 137

- 8.6 WST/GST Transition .................................. 138

- 8.7 Conclusion ......................................... 138

- 9. TAX ADMINISTRATION ...................................139

- 9.1 The Need for Income Tax Administration Reform ............ 139

- 9.2 Compliance Costs ................................... 140

- 9.3 Self-Assessment ..................................... 141

- 9.4 Tax File Number Arrangements .......... .............. 142

- 9.5 Internal Tax Office Ombudsman .................. ..... 142

- 9.6 Australian Tax Office Board of Directors ................... 142

- 9.7 Tax Administration and the Goods and Services Tax .......... 143

- 9.7.1 The Cost of the Wholesale Sales Tax System ......... 143

- 9.7.2 Goods and Services Tax and Business .............. 143

- 9.7.3 GST Procedures ....................... ..... 145

- 9.7.4 Government Administration of the GST ............ 147

- 9.8 GST Planning and Co-Ordination Office .................. 149

- 10. COMPENSATION FOR GOODS AND SERVICES TAX THETECHNICAL ASPECTS ............................... 151

- 10.1 Key Decisions ....... ............................... 151

- 10.1.1 Income Compensation .......................... 151

- 10.1.2 Wealth Compensation ......................... 151

- 10.2 Introduction .. ...................................... 151

- 10.3 The Starting Point: The Net Price Impact of the GST ......... 153

- 10.4 Determination of the Compensation Factors ................ 158

- 10.5 Designing the Compensation Package ..................... 159

- 10.5.1 Employed Non-Social Security Beneficiaries or Pensioners ...................... 159

- 10,5.2 Social Security Beneficiaries andPensioners ............................... 161

- 10.5.3 GST Credit for Retired Non-Pensioners Below 60 years ................... 166

- 10.5.4 Total GST Credits ............................. 167

- 10.6 The Overall Cost of Income Compensation ................. 167

- 10.7 Timing .......................................... 167

- 10.8 Wealth Compensation ............................. .. 168

- 10.8.1 Wealth Compensation Costing Objective ............ 170

- 10.8.2 Methodology ................................ 170

- 10.8.3 Cost Estimates ............................... 170

- 10.8.4 The Mechanics ........ ...................... 172

- Attachment 1: Links Between Consumption, Incomeand Wealth ....................................... 173

- Attachment 2: Income/Wealth Compensation, Illustrations of Over-Compensation ............... 175

- 11. ASSISTANCE TO FAMILIES ............................... 177

- 11.1 Introduction ................................... . ..... 177

- 11.2 A Proven Approach to Family Assistance ................... 177

- 11.3 Family Allowances ................................... 178

- 11.4 Family Allowance Supplement ........................... 180

- 11.5 Dependent Spouse Rebate .......... ................... 180

- 11.6 Child Care ........................... ............. 181

- 11.7 Redefinition of Income for Family Assistance ................ 182

- 11.8 Family Crisis Care ................................... 182

- 11.9 Employment ....................................... 183

- 11.10 Taxation ................. ........................ 183

- 11.11 Petrol ...I...., ............................... 183

- 11.12 First Home Owners Scheme ............................ 183

- 11.13 Health .. ..................................... 184

- 11.14 Education ......................................... 184

- 11.15 Superannuation and Savings .................. ......... 185

- 11.16 Superannuation For Housing ............................ 185

- 12. ASSISTANCE TO PENSIONERS AND RETIREES ............... 187

- 12.1 Key Decisions ...... ................................ 187

- 12.2 Compensating Aged and Service Pensioners for the Income Effect of the GST ......................... 189

- 12.3 GST Credit ........................................ 190

- 12.3.1 Low Income Earners ........................... 191

- 12.3.2 Pensioners and Beneficiaries ..................... 191

- 12.4 Compensating Age Pensioners and Retirees for the Wealth Effect of the GST on Savings .... ................ 196

- 12.4.1 Direct Wealth Compensation ..................... 196

- 12.5 Further Measures to Assist Pensioners .................... 198

- 12.5.1 Extension of Pharmaceutical Benefits Concession Card to Retirees ..................... 198

- 12.5.2 Health Care .................... ............ 198

- 12.5.3 Deferred Pension Plan .......................... 198

- 12.5.4 Simplified Reporting Arrangements ................ 199

- 12.5.5 Reforming The Assets Test ...................... . 199

- 13. ASSISTANCE TO OTHER BENEFICIARIES .................... 201

- 14. GENUINE ASSISTANCE FOR THE UNEMPLOYED .............. 209

- 14.1 Introduction ......................... ............. 209

- 14.2 Key Decisions ....................................... 210

- 14.3 Unemployment Benefits Under Labor ..................... 210

- 14.4 Training Programs Under Labor ......................... 212

- 14.5 A More Progressive Approach to Training Programs .......... 213

- 14.6 Administration of Income Support for the Unemployed ........ 214

- 14.7 The First Three Months .................... ......... 214

- 14.8 The Second Three Months .............................. 215

- 14.9 The Final Three Months ............................... 215

- 14.10 Failure to Satisfy Test . .............................. 215

- 14.11 At the Nine Months Mark .............................. 216

- 14.11.1 AUSTRAIN ......................... ....... 216

- 14.11.2 Work-For-Benefit .............................. 216

- 14.11.3 Special Benefit ............................... 217

- 14.12 DSS and CES ...................................... 218

- Attachment 1: Employment Outcomes .......................... 219

- Attachment 2: Case Study for the Unemployed ................... 220

- 15. ASSISTANCE TO FIRST HOME BUYERS ...................... 223

- 15.1 Key Decisions ....................................... 223

- 15.2 The GST Impact on Residential Housing ................... 223

- 15.3 Details of First Home Owners Scheme ..................... 224

- 15.4 Calculating the GST Impact on a New Home ................ 225

- 15.5 Calculating the GST Impact on an Established Home ......... 226

- 15.6 Access to Superannuation Funds by First Home Buyers ........ 226

- 16. EXPENDITURE SAVINGS ................................. 227

- EXPENDITURE DECISIONS ................................ 228

- 16.1 General Savings (Political) ............... ............. 234

- 16.2 Departmental Efficiency Saving ... ...................... 237

- 16.3 Aboriginal Affairs ...... ............................. 238

- 16.4 Administrative Services ............................... 241

- 16,5 Arts, Sport and Heritage ......... ..................... 242

- 16.6 Attorney-General's and Justice ..................245

- 16.7 Communications .................................... 247

- 16.8 Corporate Law Reform and Consumer Affairs ............... 248

- 16.9 Defence ..........................................248

- 16.10 Education .........................................250

- 16.11 Employment and Training .............................. 252

- 16.12 Energy and Resources .................................257

- 16.13 Environment ................... ..................... 258

- 16,14 Family Assistance ....................................259

- 16.15 Finance ...........................................260

- 16.16 Foreign Affairs ......................................261

- 16.17 Health ...........................................263

- 16.18 Housing ................ ......................... 265

- 16.19 Immigration and Ethnic Affairs .......................... 266

- 16.20 Industrial Relations ...................................267

- 16.21 Industry and Commerce ....... ....................... 268

- 16.22 Land Transport ......................................269

- 16.23 Primary Industry .....................................270

- 16.24 Prime Minister and Cabinet ............................. 271

- 16.25 Privatisation ........................................272

- 16.26 Science and Technology ................................274

- 16.27 Social Security .......................................275

- 16.28 Tourism and Aviation .................................291

- 16.29 Trade ............................................291

- 16.30 Treasury and Payments to Other Governments .............. 293

- 16.31 Veterans Affairs .....................................294

- 17.DISTRIBUTION OF THE NET BENEFITS TO THE HOUSEHOLDS .. 297

- 17.1 Key Points ..........................................297

- 17.2 Adding Up the Benefits ................................297

- 17.3 How the Reform Package Affects Community Groups ......... 299

- 17.4 Individual Examples of Net Benefits ...................... 303

- Cameo1 ...........................................304

- Cameo2 ...........................................304

- Cameo3 ...........................................305

- Cameo4 ...........................................306

- Cameo5 ...........................................306

- Cameo6 ...........................................307

- Cameo7 ...........................................308

- 18. TIMETABLE FOR REFORM ................................313

- 18.1 Overview ........................................... 313

- 18.2 Timetable for Reform .................................315

- 18.3 Basis of Estimates ....................................320

- 18.3.1 The Three Year Program ........................ 320

- 18.3.2 The 1990/91 Base Year ......................... 321

- 18.3.3 Funding the Program .......................... 322

- 18.4 Reliability of Figures ..................................326

- 18.4.1 Incentive Effects .............................. 326

- 18.4.2 Inflation Effects ............................... 328

- 18.5 Conclusion ..........................................329

- 19. RESTORING SUSTAINED EMPLOYMENT GROWTH ............ 333

- 19.1 Introduction ........................................ 333

- 19.2 Labor's Approach ..................................... 333

- 19.3 The Quality of the Recovery ............................ 335

- 19.4 What Sort of Economy by 1993/94? ....................... 336

- 19.5 The Task of Restoring Sustained Employment Growth ........ 339

1. INTRODUCTION

The overriding purpose of the Liberal/National program of reform is to achieve a generational change in policies and attitudes that will give individual Australians greater control over their own lives. We aim to achieve this goal by creating more incentives and opportunities for all Australians to work harder and be rewarded for it, to save and to invest.

The reform program of the Hewson Government will create nearly two million jobs and halve the unemployment rate by providing a dramatic stimulus to productivity and economic growth.

These objectives can only be achieved if national government sees its proper role as providing a framework of policy and equal laws within which individuals, families and businesses are allowed to fulfil their potential and plan with certainty and confidence.

We believe that policies aimed at building incentives, opportunities and rewards for individuals are the most effective way of overcoming the serious economic and social problems which Australia now faces.

Reform of the taxation system is a fundamentally important focus of our reform program. It is vital to reduce tax and simplify the tax system if the energies, talents and initiative of the Australian people are to be encouraged and fulfilled.

1.1 WHY TAX REFORM IS ESSENTIAL

The current tax system is unfair, complex, kills incentive, reduces our industry's ability to compete and the burden of tax is too high.

It is a fundamental responsibility of government to provide a tax system which rewards those who are prepared to make the extra effort, which allows them to save and profit by their effort, which enhances self-respect through making

personal independence possible, and which provides those in poverty and genuine need with every opportunity to improve their standard of living.

The tax system can have a significant effect on the way in which people invest their money. To the extent that it distorts or biases those decisions it wastes resources and undermines growth. A tax framework which allows people to make sensible investment decisions is crucial to prosperity.

The current tax system fails on every count.

[1]

Labor's tax system undermines the incentive to work harder and save more because of the crippling marginal tax rates imposed on low and average income earners.

It has failed to provide incentives for most Australians to save.

It has worked to the benefit of the rich at the expense of the great majority.

It rewards the tax cheats in the "black economy" and invites avoidance and evasion through various loopholes and administrative complexities, while those who have worked and saved for independence, particularly PAYE taxpayers, have been disadvantaged by inflation and high taxation.

It has created "poverty traps" for many Australians who are denied any real opportunity to work harder and be rewarded for it,

It has imposed major costs on the private business sector, which should be the driving force in job growth, through the ramshackle and costly system of sales tax, payroll taxes, excise taxes, customs duties, compulsory training and superannuation levies, a counter-productive application of the capital gains tax, and through many other cost burdens.

The result is that the rising tax burdens on business have discouraged exports, favoured imports, destroyed jobs and unnecessarily raised costs to consumers.

Under Labor, the burden of taxation has increased, particularly for low to middle income earners because of a failure to contain and reduce waste and duplication in government spending, and because of the encouragement given to dependence on government welfare.

Tax reduction and tax reform are an essential part of what is necessary to rebuild the foundations of Australian prosperity and to provide real opportunities for all Australians.

1.2 WHY EXPENDITURE REFORM IS ESSENTIAL

The size and cost of government in Australia are excessive. Under a Coalition Government both will be reduced. Together with the taxation reforms we will implement, our reductions in wasteful and unnecessary government expenditure will enable people to retain more of what they earn. This will, in turn, improve individual freedom of choice and reduce the unnecessary dependence of people on government.

In reducing the size and cost of government, we have clearly accepted our responsibility to assist those in genuine need. While eliminating abuse of the -velfare system and reducing waste and inefficiency, we will increase assistance those who genuinely need it.

[2]

Over many years, governments have increasingly and inappropriately involved themselves in the provision of goods and services that are more efficiently provided by the private sector. Public sector activities are too often shielded from competition. Individual firms in a competitive, private sector have no option but to minimise costs and maximise efficiency if they are to prosper. This means they must be innovative and responsive to changing demands.

The users of many services supplied by government would benefit considerably if these services were delivered by the private sector, The contracting out of these services will provide a better definition of the service provided and better targeting. It will also indicate the level of, and need for, community service obligations and will be more cost-efficient. Overseas and domestic experience indicates that about 20 per cent can be saved in the costs of delivering a service if it is contracted out to the private sector.

Many of the services currently provided by the public sector can be corporatised, privatised or contracted out with significant cost and efficiency savings to government and thus to the taxpayer.

A Coalition Government will place a high priority in implementing a full program to achieve that outcome.

1.3 OBJECTIVES OF TAX AND EXPENDITURE REFORM

Five guiding principles underlie the tax reform proposals outlined in this document.

First, the aim is to produce lower taxes and a simpler and fairer tax system which will boost the incentives to work, to save and to invest.

This objective requires a reduction in wasteful or unnecessary Federal Government spending. It also requires structural reform of the tax and government welfare systems so that individuals are given a clear choice and positive incentives when making decisions about whether they will work overtime, save another dollar, or invest that money in a business venture for the future.

Second, a tax system is required that will make the Australian economy more internationally competitive and productive. This can be achieved through abolishing inefficient and distorting taxes (such as the wholesale sales tax, payroll taxes and petroleum excise), through changes to the capital gains tax, through removing taxes on business inputs and exports, through encouraging productive investment, and through reducing tax avoidance and evasion.

Third, we aim to make the operation of the taxation system transparent and simple to the taxpayer.

[3]

No longer should the real burden of tax be increased through hidden ad hoc changes to wholesale or payroll tax rates or through automatically indexed increases in excise or in other Federal taxes which are hidden from the view of the taxpayer. No longer should effective marginal tax rates be increased by allowing increased wages to push average taxpayers into even higher tax brackets.

The tax system should be an important part of the accountability of government to those who elect it. It should not make such accountability even more difficult to achieve.

Fourth, we aim to establish a tax system that raises the revenue necessary for government programs in the most efficient and effective way. The current tax system, with its heavy reliance on personal income tax, the distortions it creates through its indirect tax arrangements and its heavy costs on business and exports, is neither efficient nor effective.

And fifth, we are aiming to establish a tax system that builds a stable and reliable base for public expenditure programs in both Commonwealth and State sectors of responsibility. In relation to the State sector, we are working to achieve that objective through moving to a new tax sharing arrangement and through the untied payroll tax abolition grant.

In addition to these objectives of tax reform, there are important objectives underpinning our reform of government expenditure.

In all areas of government, there is a requirement to target programs more effectively, to deliver programs and services more efficiently, and to reduce or abolish programs that are no longer cost-effective or appropriate.

In the circumstances of the worst recession for 60 years, fiscal restraint is essential and every area of government outlays and expenditure priorities needs to be scrutinised.

The next Liberal/National Government will ensure that taxpayers receive value for their tax dollars by:

better targeting government programs and assistance to those who most need them;

achieving greater efficiency in the way programs are managed and in the way services, benefits and assistance are delivered;

reducing or eliminating programs where there is duplication of other services or where provision of benefits or services by government is no longer appropriate; and

achieving greater cost recovery by charging for commercial services and encouraging private sector funding of some programs.

[4]

1.4 CONCLUSION

Australians pay too much tax and get too little value for the tax dollars they pay. A Liberal/National Government will reform the tax system across the board to make it fairer and simpler, thus restoring initiative, opportunities and jobs. We will also ensure that tax revenue is spent in a way that minimises unnecessary and wasteful government expenditure and is targeted to those who genuinely need it.

This document provides the details on how a Liberal/National Government will achieve these goals.

[5]

2. PERSONAL INCOME TAX

2.1 KEY DECISIONS

A Liberal/National Government will:

implement the largest personal tax cuts in Australian history:

- we will slash personal income tax by about 30 per cent - that is, by $13 billion;

- we will raise the tax free threshold from $5,400 to $7,000 with the result that at least another 320,000 low income earners will now pay no tax;

- we will out marginal tax rates across the board, especially targeted at middle income earners;

- 95 per cent of taxpayers will face a marginal rate of 30 cents or less: under Labor, over a half of all taxpayers face a rate of 38 cents or more, up to 47 cents;

- average Australians will be able to double their taxable income and still pay a marginal tax rate of 30 cents;

when our reforms are implemented, taxpayers will be able to earn up to $75,000 and pay a lower rate of marginal tax than they currently pay if they earn more than $20,700;

implement a new tax free savings scheme whereby interest income on new savings up to a limit of $1,000 a year (single) and $2,000 (married) will attract a rebate of 30 cents in the dollar;

increase the corporate tax rate to 42 cents to align it with the significantly reduced top marginal personal income tax rate, and thus eliminate tax avoidance through incorporation;

guarantee the return of revenue from tax bracket creep to taxpayers;

provide tax rebates of up to $100 to $400 for low to middle income earners who take out private health insurance;

provide an additional tax rebate for persons over 65;

Chapter 2 7

encourage higher income earners to take out private health insurance by

adding a surcharge to the Medicare levy for families with incomes above $50,000 and singles above $40,000 who do not have private health insurance;

increase the Dependent Spouse Rebate for eligible families with children to $1,679;

implement a major new initiative to ensure that low income earners are more than compensated for the impact of the Goods and Services Tax through a Goods and Services Tax Credit system;

adjust specific thresholds and allowances under the Income Tax Act for the impact of the Goods and Services Tax;

increase Zone Rebates by at least 25 per cent;

implement a range of other changes affecting personal tax such as a new superannuation tax rebate and the abolition of the lump sum tax (Chapter 7), a new tax free personal savings scheme (Chapter 7), a lower and revised capital gains tax (Chapter 4) and a reduced fringe benefits tax (Chapter 3).

2.2 HOW LABOR'S HIGH TAX POLICY HAS FAILED

There are four major flaws in the personal tax system in Australia.

(i) The overall burden of personal tax is excessive.

Australia has the fourth highest personal tax burden of the 24 OECD countries, and well above the average of the seven major industrial countries, and of course, significantly greater than in the newly industrialised countries of our region.

Moreover, despite three sizeable cuts in personal tax, the Hawke Government has still significantly increased the burden of taxation on household income. In fact, net PAYE tax has increased by nearly 30 per cent, in real terms, under the Hawke Government.

Moreover, average Australian families have been hit hard. For example, the average tax rate of a person on average (male) weekly total earnings with a dependant spouse and two children has increased, while for a family or a single person on three times average earnings, the average tax rate has declined.

8 Chapter 2

(ii) The tax rates significantly reduce the incentives to work.

Workers face high tax rates at low income levels and the situation has worsened dramatically under the Hawke Government. Workers on two thirds of average income face a marginal rate of 38 cents plus a 1.25 per cent Medicare levy.

Yet workers on average income faced a marginal tax rate of only 30 cents when the Hawke Government came to power. It is now 38 per cent, plus the Medicare levy and is fast approaching 46 per cent (plus the Medicare levy).

Indeed, if the Government's Budget forecast for wages growth in 1991/92 is applied to a person earning the equivalent of adult male average (total) earnings, that person would only be $29 per week short of a marginal tax rate of 46 per cent (plus Medicare levy).

Table 2.1 presents estimates of the number and proportion of individual taxpayers in each different tax bracket in 1989/90 together with the appropriate marginal tax rate.

TABLE 2.1

DISTRIBUTION OF TAXPAYERS

Income Tax Bracket Marginal Rate Proportion of Taxpayers in

Each Bracket

Cumulative Proportions

$ 0-$ 5400 0 0.6 0.6

$ 5401-$20700 20 48.5 49.1

$20701-$36000 38 34.3 83.4

$36001-$50000 46 11.6 95.0

$50001+ 47 5.0 100.0

Source: Income Tax Statistics 1989/90 Income Year

Note: The income tax brackets do not correspond exactly with the grades of taxable income provided in the statistics, so the allocation is approximate.

Most disturbingly, over 50 per cent of taxpayers face a marginal rate of 38 cents or more, of which 16 per cent face a marginal rate of 46 cents or more (plus the Medicare levy in both cases).

9

Chapter 2

Clearly, such high marginal rates on low to middle income earners are

unacceptable. There is no doubt they are a serious disincentive to work additional hours, to opt for an additional shift, to move towards (or indeed accept) a promotion, and so on.

The Centre of Policy Studies (1985) has reviewed Australian and US empirical evidence concerning the labour supply response to marginal tax rate reductions. It concluded that there is sufficient Australian evidence to confirm the pattern of US studies of generally low labour supply responses

for prime age males but more substantial responses for females, the young and the elderly. (Centre of Policy Studies in an EPAC Discussion Paper, 1985).

In 1988 EPAC found that:

"High marginal tax rates can have pervasive social and economic ramifications (e.g. for work incentives, wage demands and tax avoidance) which need to be avoided as far as possible."'

More generally, the Centre of Policy Studies stated in a paper prepared for the Business Council of Australia in September 1990 that:

"High marginal rates almost certainly cause significant national income and welfare losses through distortion to work versus leisure decisions and on incentives to evade and to avoid tax." 2

At the very time when the overriding requirement is to work our way out

of our economic difficulties, the personal income tax system is having a disastrous impact on work efforts.

(iii) The Government has increased its revenue by billions of dollars through stealth ⢠by hanging onto revenue generated from bracket creep".

Taxpayers have crept into higher income tax brackets as nominal incomes have increased due to the fact that tax brackets have not been indexed.

10 Chapter 2

TABLE 2.2

THE 1982183 TAX BRACKETS - ACTUAL AND IM)1?XED

Marginal Rate

Schedule For 1982/83 (a)

Average 1982/83 Tax Brackets

1982/83 Tax Brackets Indexed for Inflation to 1991/92 Dollars

not less than

not more than

not less than

not more than

0 1 4462 1 8607

30.67 4462 17894 8607 34517

35.33 17894 19500 34517 37615

46 19500 35788 37615 69035

60 35788 + 69035 +

(a) The marginal rates were changed during 1982/83. This scheme shows the average which applied in 1982/83.

The message from this table is clear. Because of the impact of inflation since 1982/83, tax brackets ought to have been approxinLai,ely doubled to avoid the arbitrary impact of bracket creep. When they were not increased, taxpayers were shunted into higher brackets and therefore into higher marginal rates.

Alternatively, if the tax brackets that had applied in 1982/83 had been indexed, average earners would face lower marginal tax rates than they do at present. Table 2.2 illustrates this effect.

The last two columns of Table 2.2 show the income brackets at which the 1982/83 tax rate schedule would have cut in if the brackets had been indexed for inflation and tax rates had not changed since then.

Quite clearly, a person on average weekly earnings would now face a marginal rate of 30.67 per cent if the brackets had been indexed, instead of 38 per cent, while a person on twice average income would face a marginal rate of tax of 46 per cent. Thus the marginal rate would be considerably

lower for the average income earner, a little lower for someone on twice average earnings, and considerably higher for someone earning three times average weekly earnings.

Chapter 2 11

According to the Business Council of Australia, most individuals on middle

incomes in 1990/91 pay a higher marginal tax rate than on the same real income in 1985/86. (BCA, July 1990)

Indeed, Access Economics (1990) found that:

"... in all years since 1982183 the total personal income tax burden ... has been higher than would have been the case under tax bracket indexation. The additional tax burden, cumulated over the period from 1983/84 to 1990/91 is over $22 billion (measured in 1989190

dollars)." 3

The burden of bracket creep has been borne by lower and middle income earners more than those on high incomes (Lombard 1991).

This result is confirmed in a recent paper by Warren (1991):

"... while the personal income tax became more progressive between 1975/76 and 1984/85, this progressivity has decreased in recent years. This is to be expected because of two factors - fi rs tly a failure to index the personal income tax threshold for the effect of inflation

and lowering of the top marginal tax rate from 60 per cent in 1984/85 to 49 per cent in 1988/89." '

Although the Government has attempted to paint its tax cuts (given to buy wage restraint) as of significant benefit to taxpayers, in reality the tax cuts have done nothing more than repay just some of the proceeds of bracket creep.

"Bracket creep" is yet another example of the Hawke Government's use of "taxation by stealth". It is an invisible taxation method whereby more and more taxpayers end up facing higher and higher marginal rates of tax, with a windfall revenue gain to the Government.

(iv) The present tax system discourages savings.

Not only does the present income tax system discourage additional work, it has a dramatic and equally damaging effect on private savings.

The present income tax system discourages private savings by taxing income earned from savings twice. In the case of a wage and salary earner, income is earned and taxed. If savings are made from after-tax income, the interest income earned will then be taxed. Thus income from savings incurs

double taxation.

The greater the dependence on income taxation, the greater the extent of double taxation and the greater the disincentive to save. This is, therefore, one of the most fundamental arguments for a move away from income to expenditure taxation.

12 Chapter 2

Even more importantly, the interaction of high marginal tax rates and

inflation provides a powerful disincentive to save by creating prohibitively high effective marginal tax rates. In effect, tax is being partly levied on the principal rather than just the income earned.

Based on analysis undertaken by EPAC in 1988, Table 2.3 sets out the effective marginal tax rates on interest income given the current tax schedule and assuming an inflation rate of five per cent and real interest rates of five per cent.

TABLE 2.3

EFFECTIVE MARGINAL RATES OF TAX ON INTEREST INCOME

Income Nominal Tax Rate

(a) (%)

Effective Tax Rate (b) (%)

$ 045400 0 0

$ 5401-$20700 20 39

$20701-$36000 38 74

$36001-$50000 46 90

Over $50000 47 92

(a) Effective from 1 January 1991 (b) Assuming real interest rate five per cent and inflation five per cent

Table 2.3 can be explained as follows: suppose Mr X earns average weekly total male earnings of around $33000. He faces a marginal tax rate of 38 per cent on any additional income. Suppose he puts $1000 in his bank account and, at the end of the year, has earned $102.50 in nominal interest income (assuming a real interest rate of five per cent and an inflation rate of five per cent). The tax paid on his nominal interest income is $38.95. With an inflation rate of five per cent, the purchasing power of Mr X's

original $1000 has fallen by $50. This leaves Mr X with a real interest income of $52.50 ($102.50-$50.00). The effective marginal tax rate is, therefore, 74 per cent ($38.95/52.50).

Similarly, if Ms Y earns $65000 and, under the same scenario of five per cent real interest rates and a five per cent inflation rate, on her $1000 bank balance Ms Y will earn $102.50, paying tax of $48.18 on that interest income. Given that her "real" interest income was only $52.50, her effective

marginal tax rate on interest income is 92 per cent.

Chapter 2 13

Clearly, for many taxpayers the disincentive to save is substantial with

effective marginal tax rates approaching 100 per cent, making saving a very unattractive option.

The interaction of high marginal tax rates and inflation is devastating for our savings effort. It is hardly surprising that our household saving ratio is at its lowest level for over 30 years.

In its 1988 paper referred to above, EPAC concluded that when income tax cuts are financed by spending cuts and the introduction of a broad based consumption tax:

"...to the extent that marginal income tax rates are reduced we would expect unambiguously positive implications for private saving."

It is imperative that private savings are increased if Australia is to invest to rebuild our industry and to stabilise our foreign debt. It is essential, therefore, for the marginal tax rates (especially for those earning lower and middle incomes) to be reduced and for inflation to be cut substantially - not

by recession but through productivity growth.

This tax/expenditure package addresses this issue in three ways - through our commitment to price stability (Chapter 8), through specific tax breaks on interest income (Chapter 7), and through lower marginal tax rates discussed below in this Chapter.

2.3 LOWER INCOME TAX RATES

A Liberal/National Government will implement a reform program that will include the largest personal tax cuts in Australian history. We will reduce net PAYE tax by $13 billion in two phases.

In the first phase from 1 October 1994 tax cuts are concentrated on middle income earners with the result that 95 per cent of taxpayers will face a marginal rate of 30 cents or less. The top personal rate is only reduced from 47 cents to 45 cents in that first phase. This has the effect that with the introduction of the Goods and

Services Tax middle income earners are compensated coincidentally, whereas high income earners will have to wait until the second phase of the tax cuts (from 1 January 1996) to get the full benefit of the tax cuts.

From 1 January 1996, we will introduce a new tax bracket from $50,000 to $75,000 with a marginal rate of 36 cents and we will align the top marginal personal rate with the company tax rate at 42 cents.

Taxpayers at or near average taxable income will be able to double their income without paying a marginal rate higher than 30 cents. (The current marginal rate for average taxpayers is 38 cents and is rapidly approaching 46 cents.)

14 Chapter 2

When our tax cuts are fully implemented, taxpayers will be able to earn $75,000

and still face a lower marginal rate of tax than applies now if they earn above $20,700.

These dramatic reductions in personal tax have three main purposes.

First, they will give added incentives to all taxpayers to work, save and invest.

Second, they are designed to ensure that after-tax income is increased at least by the CPS impact estimated to flow from the introduction of a Goods and Services Tax.

And third, the tax cuts are especially targeted at middle income earners who have been the main victims of Labor's high tax policies. These cuts, linked to our family assistance measures (see Chapter 11), will give these taxpayers the opportunities, incentives and rewards which they deserve but which, under the

Hawke Government, they have been denied.

The two phases for the introduction of the personal tax income tax reductions are shown in Table 2.4.

TABLE 2.4

Present Tax Scales

% Proposed Tax

Scales From. 1 October 1994

% Proposed Tax

Scales From 1 January 1996

$ 0-$ 5400 0 $ 0-$ 7000 0 $ 0-$ 7000 0

$ 5401-$20700 20 $ 7001-$20700 16.2 $ 7001-$20700 16.2

$20701-$36000 38 $20701-$50000 30 $20701-$50000 30

$36001-$50000 46 $50001 and over 45 $50001-$75000 36

$50001 and over 47 $75001 and over 42

The Liberal and National Parties are also committed to aligning the top marginal personal income tax rate, currently set at 47 per cent, with the corporate tax rate, currently set at 39 per cent.

The current top marginal personal tax rate applies to income above $50,000 and, as such, is a disincentive to people who want to work harder and be rewarded for it.

15

Chapter 2

It is also clear that many of the current avoidance and evasion problems (and the

associated legal complexity of the Income Tax Act) are a result of the high marginal personal income tax rates and the gap between it and the company tax rate. This differential discriminates between high income earners who rely primarily on wage and salary earnings (and who pay the top marginal rate) and

those who are able to shield their incomes in private companies (and pay tax at the 39 per cent rate).

In the four years to 1988/89, the number of taxpayers with taxable incomes exceeding $100,000 grew sevenfold (from 7,319 to 58,684), growing by 64.9 per cent in 1985/86, 51.4 per cent in 1986/87, 97.5 per cent in 1987/88, and 62.6 per cent in 1988/89. However, in 1989/90 - the year when the gap was

opened up between the company tax rate and the top personal marginal rate -numbers fell by three per cent. This suggests that tens of thousands of Australians took advantage of this loophole to pay less tax.

A Liberal/National Government will eliminate the current disincentives and anomalies caused by the top current marginal personal income tax rates in two phases.

In July 1993, the company tax rate will be raised to 42 per cent (see Chapter 3).

On 1 October 1994 the top marginal personal tax rate will be reduced from 47 per cent to 45 per cent and on 1 January 1996 will be reduced further to 42 per cent - the same rate applying to company tax (see the above table).

Tables 2.5 and 2.6 below show the proposed reductions in tax across a range of incomes during the two phases of implementation.

16 Chapter 2

TABLE 2.5

PHASE 1: TAX SCALES AS FROM 1 OCTOBER 1994

Income $

Tax Paid

Present Proposed

Scale(a) Scale(a) ColI Col II

$ $

Difference I - II $

Per Cent Reduction In Tax

Per Week Gain (a)

$

Gain In After Tax Income

M

7000 320 0 320 100.00 6.1 4.8

8000 620 162 358 68.9 6.9 4.8

9000 720 324 396 55.0 7.6 4.8

10000 920 486 434 47.2 8.3 4.8

15000 1920 1296 624 32.5 12.0 4.8

20000 2920 2106 814 27.9 15.6 4.8

25000 4694 3509 1185 25.2 22.7 5.8

30000 6594 5009 1585 24.0 30.4 6.8

35000 8494 6509 1985 23.4 38.1 7.5

40000 10714 8009 2704 25.2 51.9 9.2

45000 13014 9509 3504 26.9 67.2 11.0

50000 15314 11009 4304 28.1 82.6 12.4

55000 17664 13259 4405 24.9 84.5 11.8

60000 20014 15509 4505 22.5 86.4 11.3

65000 22364 17759 4605 20.6 88.3 10.8

70000 24714 20009 4705 19.0 90.2 10.4

75000 27064 22259 4805 17.8 92.1 10.0

80000 29414 24509 4905 16.7 94.1 9.7

85000 31764 26759 5005 15.8 96.0 9.4

90000 34114 29009 5105 15.0 97.9 9.1

95000 36464 31259 5205 14.3 99.8 8.9

100000 38814 33509 5305 13.7 101.7 8.7

(a) Annual figures rounded to nearest dollar, Weekly figures rounded to nearest ten cents.

Weekly conversion factor calculated by using the increase of 365 days divided by 7.

Chapter 2

17

TABLE 2.6

PHASE 2: TAX SCALES AS FROM 1 JANUARY 1996

Income $

Tax Paid

Present Proposed Scale(a) Scale(a) Col I Col II

$ $

DifTerence I - II $

Per Cent Reduction In Tax

Per Week Gain (a)

$

Gain In After Tax Income

(%)

7000 320 0 320 100.00 6.1 4.8

8000 520 162 358 68.9 6.9 4.8

9000 720 324 396 55.0 7.6 4.8

10000 920 486 434 47.2 8.3 4.8

15000 1920 1296 624 32.5 12.0 4.8

20000 2920 2106 814 27.9 15.6 4.8

25000 4694 3509 1185 25.2 22.7 5.8

30000 6594 5009 1585 24.0 30.4 6.8

I I 35000 8494 6509 1985 23.4 38.1 7.5

40000 10714 8009 2704 25.2 51.9 9.2

45000 13014 9509 3504 26.9 67.2 11.0

50000 15314 11009 4304 28.1 82.6 12.4

55000 17664 12809 4854 27.5 93.1 13.0

60000 20014 14609 5404 27.0 103.6 13.5

65000 22364 16409 5954 26.6 1.14.2 14.0

70000 24714 18209 6504 26.3 124.7 14,4

75000 27064 20009 7054 26.1 135.3 14.7

80000 29414 22109 7305 24.8 140.1 14.4

ii 85000 31764 24209 7555 23.8 144,9 14.2

90000 34114 26309 7805 22.9 149.7 14.0

95000 36464 28409 8055 22.1 154.5 13.8

100000 38814 30509 8306 21.4 159,3 13.6

(a) Annual figures rounded to nearest dollar. Weekly figures rounded to nearest ten cents. Weekly conversion factor calculated by using the increase of 365 days divided by 7.

These reductions constitute a dramatic change to the current marginal and average tax rates, as Charts 2.7 and 2.8 illustrate. It should also be recognised that the significantly lower marginal tax rates also flow through to the taxation of capital gains, savings and fringe benefits.

18 Chapter 2

AVERAGE TAX RATES

AVERAGE TAX RATE (7..) 0. 5 , -._ --__

0.41-

0.3

0.2

0.1

0 0

0.3

-04

0.3

0.2

0.1

0

120 20 40 60 80 100

INCOME PER YEAR ('000)

- J. ABOR --- LIB/NP 1994 LII3/NP 1996

CHART 2.7

MARGINAL TAX RATES

LABOR, LIB/NP 1994, LIB/NP 1996

MARGINAL TAX RATE

0.2'.i 00

0.1 i 0.1

0 5 10 15 20 25 30 35 40 45 50 55 fi0 65 70 75 80 85 90 95 100 INCOME PER YEAR ('000)

—"' LABOR MARGINAL RATE LiD/NP RATES IA9-a

LIB/VP RATES 1996

CHART 2.8

Chapter 2 19

2.4 PRIVATE HEALTH INSURANCE TAX CREDIT

As explained in the Health Policy in the Supplementary Paper No. 3, the current Medicare surcharge on taxable incomes introduced by the Hawke Government in 1983/84 will remain at its current level of 1.25 per cent.

A Liberal/National Government will provide substantial incentives through the tax system for people to take out private health insurance. In government, we will i mplement what is, in effect, a refundable tax credit system to provide ongoing assistance to income earners below $30,000 who take out private insurance.

The Health Insurance Tax Credit will be available not only to taxpayers but also to those who pay no tax but take out private health insurance.

Details of this Private Health Insurance Tax Credit are as follows:

TABLE 2.9

Income Group Tax Credit

below $12,000 $400 per family

$200 per single

$12,000 - $20,000 $300 per family

$150 per single

$20,000 - $30,000 $200 per family

$100 p er single

An additional tax credit of up to $400 per family and $200 per single will be paid to those persons aged 65 years or more on incomes of less than $30,000. This additional payment will enable those people over 65 with incomes below $12,000 (single) and $14,500 (family) to be effectively provided with the cost of private health cover entitling them, inter alia, to private hospital beds in public and private hospitals and to the doctor of their choice.

2.5 MEDICARE LEVY SURCHARGE FOR HIGH INCOME EARNERS

For the reasons detailed in our Health Policy Paper (see Supplementary Paper No 3), we will encourage higher income earners to take out private health insurance by requiring those with family incomes of greater than $50,000 per annum (singles $40,000 per annum) to either take out private health insurance

or pay a surcharge on the Medicare levy approximately equivalent to the costs of private health insurance.

20 Chapter 2

The amounts payable under this surcharge will be up to $800 per family per full

year and up to $400 per single per full year. These surcharges can be completely avoided by taking out private health insurance.

2.6 SUPERANNUATION TAX REBATE

Under a Liberal/National Government, contributions to a superannuation fund will be taxed at the employee's or selF employed's marginal tax rate but a 25 per cent tax rebate will be granted to all taxpayers on the first $6,000 of superannuation contributions. Lump sum taxes will also be abolished (see Chapter 7).

2.7 RETURNING "BRACKET CREEP" TO TAXPAYERS

A Liberal/National Government will calculate and publish in Budget papers the annual impact of tax bracket creep and commits itself to return that revenue to taxpayers. This commitment has been provided for in our reform package.

2.8 DEPENDENT SPOUSE REBATE

The Dependent Spouse Rebate (DSR) will be increased by $300 for eligible families.

Eligible families with dependent children will receive a DSR tax rebate of $1679 (now $1379).

For families without dependent children the DSR will be increased by six per cent (to compensate for the net impact of the Goods and Services Tax) to $1,204.

To better target it to those in need, the Dependent Spouse Rebate will be phased out from $75,000 for families with dependent children and from $50,000 for those without dependent children at the rate of one dollar for every four dollars of additional income.

2.9 GOODS AND SERVICES TAX CREDIT

To assist persons whose incomes are too low to be adequately compensated for the introduction of a Goods and Services Tax through reforms in the tax system and who are also outside the existing income support systems, we will introduce a Goods and Services Tax Credit system (refundable). Full details of the system are

provided in Chapters 10 and 12.

21

Chapter 2

2.10 THRESHOLDS AND ALLOWANCES

Specific thresholds and allowances applying under the Income Tax Act will be adjusted for the impact of the Goods and Services Tax including those applying to the Medicare levy, the Zone Rebate, the Sole Parent Rebate and various claims for dependants. The adjustments to be made to specific allowances are addressed

separately in Chapter 11.

2.11 ZONE REBATES

In addition to the change in the Zone Rebate Threshold, we will also make .changes to the Zone Allowance rebate. An additional sum of $34 million, or around 25 per cent, has been allocated to increase Zone Rebates.

On a pro rata basis, a 25 per cent increase in the basic Zone A Rebate would increase the existing flat $270 rebate by $67.50. Also on a pro rata basis, a 25 per cent increase in the Special Zone A Rebate would increase the existing flat

$938 rebate by $234.50. Zone B Rebates would increase in the same relative terms.

In Government we will also review the definition of the Zones.

2.12 TAX FREE SAVINGS SCHEME

The Tax Free Savings (TFS) scheme will have important personal tax implications. Under the scheme families with taxable incomes below $50,000 will be able to earn up to $2,000 in interest income from new savings tax free. Single people with taxable incomes below $50,000 will be able to earn up to $1,000 from new savings tax free. (For further details see Chapter 7).

2.13 PRESCRIBED PAYMENTS SYSTEM

A LiberaVNational Government will review the Prescribed Payments System to determine whether the present withholding rate is appropriate in the context of the new income tax rate scales.

22 Chapter 2

References

1. Office of the Economic Planning Advisory Council (1988) "Trends in Private Saving", Council Paper No. 36.

2. Centre of Policy Studies, Monash University, "Some Issues in the Consumption Tax Debate", Paper prepared for the Business Council of Australia, September 1990.

3. Access Economics, "Budget Monitor", April 1990.

4. Neil Warren, "Recent Trends in Australian Taxation and Their Impact on Tax Incidence", Paper No. 1991 /3, Centre for Applied Economic Research, University of NSW, 1991.

Chapter 2 23

3. TAXES ON BUSINESS

3.1 KEY DECISIONS

The business sector will benefit directly from the tax measures in the Liberal/National reform package. Taxes on business will be cut by at least $20 billion. Most importantly, we will:

⢠abolish the $9.4 billion wholesale sales tax;

⢠abolish the $5.8 billion payroll tax;

abolish the $6.6 billion excise on petroleum products (about 55 per cent of which falls on business);

⢠abolish effectively all $3.3 billion of customs duties;

⢠rebate Goods and Services Tax paid on most business inputs, including businesses competing with imports;

⢠reduce the tax on exports by $1.7 billion.

In addition, the Liberal and National Parties propose to implement a range of other measures to reduce cost disadvantages to the business sector:

our overall reform package dramatically lowers many business costs by 20 to 50 per cent;

the revised and lower capital gains tax system will permit greater access to rollover relief and make additional allowance for goodwill;

⢠the coal export duty will be abolished;

⢠the training guarantee levy, which is in effect an extra tax on employers, will be abolished;

the level of compulsory employer contributions to employee superannuation, in place at the time of the next election, will be retained but there will be no further compulsory increases. Further increases will be on the basis of

choice and incentive, rather than Labor's compulsion;

we will review the present depreciation arrangements to help Australian business to be able to match best international practice;

Chapter 3 25

company tax deductions for research and development costs will continue

from July 1993 at 125 per cent, but we will ensure strict measures to guard against abuse and we will promote new R&D links between industry and universities;

the fringe benefits tax will be reduced significantly and loop holes eliminated through the alignment of the corporate and top personal tax rate.

These tax changes are also to be seen against the background of the other elements of our reform agenda designed to reduce or eliminate major cost disadvantages to business (e.g. on the waterfront, in utilities, telecommunications, aviation, shipping, land transport, development approval processes, training and

others).

As with other sectors, the business sector will be expected to contribute to, as well as benefit from, the reform process under a Liberal/National Government. We are also committed to bringing the corporate tax rate into alignment with the top personal marginal tax rate.

3.2 LABOR'S HIGH TAX POLICY ON BUSINESS

Wholesale sales taxes, payroll taxes, petroleum excise, customs duties and other taxes shown in Table 3.1 add around $15 billion to business costs directly, and perhaps an additional 20 to 30 per cent indirectly through the cascading effect of some of these taxes.

There are additional problems, however, with the current system of business taxation.

It encourages debt over equity finance and discourages large investments with long lead times (such as the Very Fast Train project and the Alice Springs to Darwin rail link).

The capital gains tax discourages investment in new businesses and the expansion of existing ones.

⢠The rate of company tax is set considerably lower than the top marginal personal tax rate, thus encouraging incorporation to limit tax liability.

⢠The compulsory training and superannuation levies are counter-productive to lowering inflation and creating jobs.

2 6 Chapter 3

TABLE 3.1

INDIRECT TAX INCIDENCE ON INTERMEDIATE AND FINAL DEMAND

1990/91 15% Package

Total Domestic Total Domestic

$m $m $m $m

GST 1 0 0 50788 4837

0 0 20110 20110

WST I 3465 3099 0 0

F 5900' 5682 0 0

Petrol I 3208 2644 0 0

F 2602 2564 0 0

Tobacco I 29 20 36 25

F 1341 1344 1676 1667

Beer 1 1 1 1 1

F 878 878 878 878

Other excise I 31 27 31 27

F 474 474 474 474

Franchise 1 858 707 618 506

Petrol F 668 658 431 422

Tobacco 1 26 18 29 20

F 1166 1159 1322 1315

Beer I 0 0 0 0

F 480 480 473 472

Other I 8 7 8 7

Alcohol 117 117 115 115

Payroll Tax 1 5832 5114 0 0

Customs I 0 0 0 0

Duty I 1286 1119 1241 1080

F 1589 1479 1533 1427

TOTAL 29959 27581 34054 33383

INTERMEDIATE 14744 12756 7042 6503

FINAL DEMAND 15215 14825 27012 26880

Reduction in Tax on: Inputs $7702 million

Exports $1707 million

(a) Includes $1398 million collected from GST levied on residential construction materials. (b) Of which $1214 million is on investment final demand expenditure.

Chapter 3 27

3.3 THE LIBERAIJNATIONAL COMMITMENT TO REDUCE

BUSINESS COSTS

The private business sector, the main generator of sustainable job growth, will receive a significant boost from the wide-ranging program of structural economic change to be implemented by a Liberal/National Government.

Business currently labours under massive cost disadvantages relative to best international practice, paying 20 to 50 per cent too much for electricity, transport, waterfront clearance and other services. The central thrust of many of our reforms is to reduce and eliminate these cost disadvantages.

Business will also benefit directly from the abolition of, or reforms to, taxes which impose a significant relative cost disadvantage on Australian business generally, but most significantly on exporters and on those businesses whose products compete with imports.

Business costs will be reduced significantly by our proposed abolition, of the wholesale sales tax, payroll taxes, refined petroleum excises and customs duties (see Chapter 5). The Goods and Services Tax. will be fully rebatable for most business inputs including fuel. It is a tax on consumption; it is NOT a tax on

business.

Businesses will also receive greater incentives for investment through our proposed changes to the capital gains tax (see Chapter 4).

These reforms will dramatically reduce the costs imposed by government on private sector businesses, give Australian exporters and firms competing against imports a much sharper competitive edge, and work to the advantage of Australian consumers.

Business will also benefit from our commitment to price stability and from the increased economic activity generated by our reform program.

Our tighter fiscal policy and National Savings Strategy will mean significantly lower interest rates in nominal real terms and lower our exchange rate towards its long run competitive level.

It will benefit from the contracting out to the private sector of many government services, the reduced cost of government, the better opportunities for productive investment, and the encouragement we will give to workplace agreements.

In this economic climate, the private business sector's capacity for growth and for providing long-term jobs will increase significantly.

In addition to these reforms, a Liberal/National Government will introduce a range of other measures to reduce costs to business and thus to boost competitiveness, productivity and jobs.

28 Chapter 3

3.4 THE TRAINING GUARANTEE LEVY

The Liberal and National Parties are committed to upgrading vocational training and making it more responsive to the requirements of industry and the workforce.

Achieving that objective will require closer co-operation between the traditional sources of vocational training, the TAFE colleges and industry.

It also will require that the TAFE colleges be more closely integrated with secondary schools and universities within their own State as well as in other States.

These processes have already begun, but they need to be accelerated. Our industrial relations reform will assist through the impetus it gives to practical and relevant workplace training.

We will also take some specific funding decisions to further accelerate the program. We will, for example, provide an additional $75 million for TAFE in our first term (see "World Class Education and Training" in Supplementary Paper No 4).

The Federal Government's increasing resort to compulsion in the training area is counter-productive. It is discouraging the links that are developing at the initiative of the parties themselves.

The aim of the program has been to increase the overall level of training.

But legislation that compels employers with a payroll above a particular level to spend a progressively larger proportion of that payroll on training is inefficient and inequitable in the same way as payroll taxes and compulsory occupational superannuation.

The operation of the levy must be seen in the context of actual business reactions.

Large employers with training programs already in place are relatively unaffected. But other, smaller employers have been forced to divert funds from priorities which they had determined would best develop their firms. And some employers have simply avoided expanding their operations so that they will not incur the

direct and indirect costs imposed by the Government's training levy.

As the Business Council of Australia concluded:

"Skills formation should be market driven. Australia needs a more flexible labour market and the last thing we need is a costly bureaucratic apparatus which will create new kinds of inefficiencies for firms."1

Consistent with our commitment to reduce and eliminate unnecessary taxes which inhibit employment, a Liberal/National Government will abolish the training guarantee levy.

Chapter 3 29

Since the money currently raised by the levy (around $5-10 million) is dedicated

to training programs of questionable value, those payments will be discontinued with the result that the abolition of the levy will be budget neutral.

The above initiatives should be seen in context with our $3 billion Education and Training Program. .

3.5 THE SUPERANNUATION GUARANTEE LEVY

The superannuation guarantee levy is a significant additional on-cost to business.

It will add to inflation and unemployment.

The Liberal/National Party will oppose legislation for the introduction of this levy when it comes before the Parliament in 1992.

The level of compulsory employer contribution in place at the time of the next election will be retained, but we will also encourage voluntary, enterprise-level employment agreements which will seek to achieve a co-operative approach to retirement saving by employers and their employees tailored to the competitiveness of the enterprise and, hence, the long-term job security of the employees. Our superannuation tax rebate is designed to encourage further voluntary increases in superannuation contributions. For a full discussion of our superannuation arrangements see Chapter 7.

3.6 COMPANY TAX

It is expected that companies will utilise most of the gains provided by reform of taxation and other reductions in costs under a Liberal/National Government to make their own operations more efficient and more internationally competitive. Some of the gains will flow initially into restoring corporate profitability which will provide both the incentive and capacity for new investment and jobs.

Our reform package will cut taxes on business by at least $20 billion.

In view of these very substantial and wide-ranging benefits which our reform program will provide to private businesses, the Liberal and National Parties have reviewed the current rate of company tax.

In doing so, we have also taken into account the need to align the rate of corporate tax with the top rate of personal income tax in order to eliminate tax avoidance by means of incorporation.

30 Chapter 3

Accordingly, the company tax rate will be increased to 42 per cent from

1 July 1993. The revenue impact of this change will not occur until the 1994/95 year by which time most of our taxation, expenditure and microeconomic reforms will have been put in place. Taken together with the change in the personal tax rate outlined earlier, the new company tax rate will enable the company and top

marginal personal tax rates to be aligned by January 1996. In the longer term we are committed to reductions in the corporate tax rate in tandem with the top personal rate.

3.7 DEPRECIATION ALLOWANCES

Total investment in Australia is at the lowest level in over 30 years.

The current poor investment outlook is not simply a cyclical phenomenon. It is the result of deep seated problems in the Australian economy which have discouraged business from making major capital investment in Australia. These problems include an industrial relations system which fails to maximise productivity, a taxation system which discourages incentive, high real interest

rates (leading to an uncompetitive exchange rate), bureaucratic and special interest group obstacles to project development, and structural inefficiencies, particularly in shipping and on the waterfront, which impose significant cost disadvantages on Australian exporters.

The combined result of these impediments is that companies are investing less in Australia and some are making decisions to locate operations offshore which they would otherwise conduct in Australia.

Improving the investment climate lies at the heart of our reform agenda to rebuild Australia.

The business sector will have to finance the move out of areas in which it is not competitive with the rest of the world. It will have to boost efficiency in areas where it does, or could, have comparative advantage. And it will need to invest in the new activities which will advantage Australia in world markets over the

rest of the decade.

If these goals are to be achieved, Australia's tax system must give adequate incentive to business investment. If it fails to do so, Australia's prospective growth potential will be stifled.

The present business tax system results in relatively high net rates of tax on investment in new plant and equipment, thus reducing incentives and limiting the capacity of businesses to invest.

In this year's March Industry Statement, the Hawke Government announced its intention to introduce a depreciation system based on the effective life of assets. The administrative problems inherent in this approach have delayed its implementation.

Chapter 3 31

It is now apparent that the Government's specific proposals to adopt an

appropriate "effective life" basis for assessing depreciation have done little to boost investment incentives for Australian businesses.

The reality is that uncertainty and unpredictability about depreciation arrangements for business continue. Further changes to the Government's proposed system are therefore likely.

Against this background of uncertainty, the Liberal and National Parties will review whatever depreciation arrangements may exist at the time we come to government. The intention of this policy review will be to enable businesses to claim investments in plant and equipment as write-offs against their tax liabilities at

a rate that gives them greater incentive to invest in the latest technology and that enables them to match best international practice. Our purpose will be to enable businesses to make these investment decisions within practical and predictable administrative arrangements.

This review will include an examination of the need for a faster write off of certain types of assets.

3.8 THE RESEARCH AND DEVELOPMENT TAX DEDUCTION

If the private business sector is to compete effectively with the world, it is important that the tax system provides adequate incentive to undertake greater efforts in research and development (R & D).

While the rate of growth in R & D by the public and private sectors in Australia over the past decade has been ahead of the OECD average, this growth of spending has been off a substantially lower base. Australia still has a long way to go to match the pace on research and development set by our competitors.

Chart 3.2 shows that of nineteen OECD countries, only New Zealand, Ireland and Spain spend a smaller proportion of GDP on R & D than Australia does. On average, the commitment of Australian companies is only half the level of their OECD competitors and only about a quarter that of strongly performing economies like Switzerland, Japan and Germany.

32 Chapter 3

CHART 3.2

OECD FUNDING LEVELS FOR R & D AS A PERCENTAGE OF GDP

Switzerland Japan Germany

United States Sweden France Netherlands

United ICingdom Norway Finland Belgium Denmark

Austria Canada Italy

AUSTRALIA New Zealand Ireland Spain

2.5 2 1.5 1 0,5 ⢠0 0.5 1 1.5 2 2.5

-L%"

DIRECT GOVT ^3 OTHER FUNDS BUSINESS FUNDS

Source: Budget Statement L99L-9E

If Australia is to realise the objective of increasing our competitive capability and

matching best international practice, the emphasis given, in financial and structural terms, to R & D needs to increase markedly.

Australians are a talented and innovative people. The growth in the number of international patents applied for by Australians is the highest among OECD countries. This natural aptitude needs to be encouraged by committing greater resources to R & D.

The Liberal and National Parties' program of economic reform will remove many of the impediments which have hindered research an d development in Australia.

At present, a deduction of up to 150 per cent is available for R & D spending which will be reduced, according to the March 1991 Industry Statement, to 125 per cent from 1 July 1993.

A Liberal/National Government will follow this timetable and maintain the maximum deduction at 125 per cent for research and development expenditure.

We are determined, however, to see that these provisions are not abused by contrived arrangements. Accordingly, tough anti-avoidance provisions relating specifically to the R & D deductions will be included in the amending legislation.

Chapter 3 33

We are committed to providing an additional $228 million over a six year period

for research to train outstanding young graduates and to encourage clearer research links with industry. Five hundred new post-graduate research awards will be made available and $25 million per year will be allocated to a program to reward institutions which are successful in obtaining research contracts for

industry. (For further details see "World Class Education and Training" in Supplementary Paper No 4).

3.9 COAL EXPORT DUTY

The coal export duty was imposed in the mid- 1970s to siphon off high profits earned by coal exporters in the wake of the 1973 world oil price shock, This justification is no longer tenable, if it ever was, as coal prices have dropped significantly.

Following changes over the past 15 years, the coal export duty now applies only to high quality coking coal produced mainly for the steel industry by six Queensland mines all owned by BHP-Utah Coal Limited, an Australian-owned enterprise.

The coal export duty is inequitable in that it discriminates against some coal mines and not others. It is also a tax on exports and distorts investment decisions in the coal industry.

A Liberal/National government will abolish the coal export duty.

In 1990/91 the coal export duty raised $49 million.

3.10 FRINGE BENEFITS TAX

We will reduce the rate of the existing fringe benefits tax from 48.25 per cent to 46.25 per cent and later to 43.25 per cent in order to align it with the top marginal rate plus the medicare levy. We will review anomalies arising from the application of the fringe benefits tax, especially in the mining, pastoral and tourist

industries and in isolated areas.

3.11 TAX REVIEWS

Two major tax reviews will be undertaken by the Coalition in government.

A review of the tax treatment of large projects (e.g. the Very Fast Train and the Alice Springs to Darwin rail link).

A review of the taxation of certain financial transactions, most notably swaps options and other financial instruments and derivatives.

34 Chapter 3

3.11.1

Large Projects

The recent abandonment of the Very Fast Train project has been attributed in part to the view that current taxation concessions are inimical to investments in large scale projects of this kind.