Condy Raguet, The Principles of Free Trade (1835, 1840)

|

|

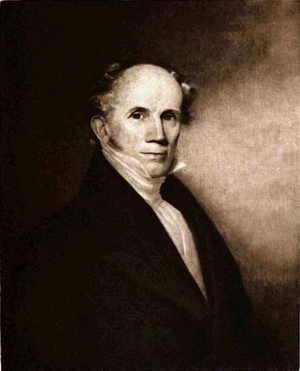

| Condy Raguet (1784-1842) |

Source

Condy Raguet, The Principles of Free Trade, Illustrated in a Series of Short and Familiar Essays originally published in the Banner of the Constitution. Second Edition (Philadelphia: Printed for the Author, 1840). 1st ed. 1835.

See also the facs. PDF.

Table of Contents

- ADVERTISEMENT TO THE FIRST EDITION.

- ADVERTISEMENT TO THE SECOND EDITION.

- ESSAYS on the PRINCIPLES OF FREE TRADE.

- ESSAY No. I.

- ESSAY No. II.

- ESSAY No. III.

- ESSAY No. IV.

- ESSAY No. V.

- ESSAY No. VI.

- ESSAY No. VII.

- ESSAY No. VIII.

- ESSAY No. IX.

- ESSAY No. X.

- ESSAY No. XI.

- ESSAY No. XII.

- ESSAY No. XIII.

- ESSAY No. XIV.

- ESSAY No. XV.

- ESSAY No. XVI.

- ESSAY No. XVII.

- ESSAY No. XVIII.

- ESSAY No. XIX.

- ESSAY No. XX.

- ESSAY No. XXI.

- ESSAY No. XXII.

- ESSAY No. XXIII.

- ESSAY No. XXIV.

- ESSAY No. XXV.

- ESSAY No. XXVI.

- ESSAY No. XXVII.

- ESSAY No. XXVIII.

- ESSAY No. XXIX.

- ESSAY No. XXX.

- ESSAY No. XXXI.

- ESSAY No. XXXII.

- ESSAY No. XXXIII.

- ESSAY No. XXXIV.

- ESSAY No. XXXV.

- ESSAY No. XXXVI.

- ESSAY No. XXXVII.

- ESSAY No. XXXVIII.

- ESSAY No. XXXIX.

- ESSAY No. XL.

- ESSAY No. XLI.

- ESSAY No. XLII.

- ESSAY No. XLIII.

- ESSAY No. XLIV.

- ESSAY No. XLV.

- ESSAY No. XLVI.

- ESSAY No. XLVII.

- ESSAY No. XLVIII.

- ESSAY No. XLIX.

- ESSAY No. L.

- ESSAY No. LI.

- ESSAY No. LII.

- ESSAY No. LIII.

- ESSAY No. LIV.

- ESSAY No. LV.

- ESSAY No. LVI.

- ESSAY No. LVII.

- ESSAY No. LVIII.

- ESSAY No. LIX.

- ESSAY No. LX.

- ESSAY No. LXI.

- ESSAY No. LXII.

- ESSAY No. LXIII.

- ESSAY No. LXIV.

- ESSAY No. LXV.

- ESSAY No. LXVI.

- ESSAY No. LXVII.

- ESSAY No. LXVIII.

- ESSAY No. LXIX.

- ESSAY No. LXX.

- ESSAY No. LXXI.

- ESSAY No. LXXII.

- ESSAY No. LXXIII.

- ESSAY No. LXXIV.

- ESSAY No. LXXV.

- ESSAY No. LXXVI.

- ESSAY No. LXXVII.

- ESSAY No. LXXVIII.

- ESSAY No. LXXIX.

- ESSAY No. LXXX.

- ESSAY No. LXXXI.

- ESSAY No. LXXXII.

- ESSAY No. LXXXIII.

- ESSAY No. LXXXIV.

- ESSAY No. LXXXV.

- ESSAY No. LXXXVI.

- ESSAY No. LXXXVII.

- ESSAY No. LXXXVIII.

- ESSAY No. LXXXIX.

- ESSAY No. XC.

- ESSAY No. XCI.

- ESSAY No. XCII.

- ESSAY No. XCIII.

- ESSAY No. XCIV.

- ESSAY No. XCV.

- ESSAY No. XCVI.

- ESSAY No. XCVII.

- ESSAY No. XCVIII.

- ESSAY No. XCIX.

- ESSAY No. C.

- ESSAY No. CI.

- ESSAY No. CII.

- ESSAY No. CIII.

- ESSAY No. CIV.

- ESSAY No. CV.

- ESSAY No. CVI.

- ESSAY No. CVII.

- ESSAY No. CVIII.

- ESSAY No. CIX.

- ESSAY No. CX.

- ESSAY No. CXI.

- ESSAY No. CXII.

- ESSAY No. CXIII.

- ESSAY No. CXIV.

- ESSAY No. CXV.

- ESSAY No. CXVI.

- ESSAY No. CXVII.

- ESSAY No. CXVIII.

- ESSAY No. CXIX.

- ESSAY No. CXX.

- ESSAY No. CXXI.

- ESSAY No. CXXII.

- ESSAY No. CXXIII.

- ESSAY No. CXXIV.

- ESSAY No. CXXV.

- ESSAY No. CXXVI.

- ESSAY No. CXXVII.

- ESSAY No. CXXVIII.

- ESSAY No. CXXIX.

- ESSAY No. CXXX.

- ESSAY No. CXXXI.

- ESSAY No. CXXXII.

- THE COMPROMISE ACT.

- Endnotes

- APPENDIX, A. Minutes of the Meeting referred to, at page 866, which called the Free Trade Convention.

- APPENDIX, B. Names of the Members of the Free Trade Convention,

- APPENDIX, C. Imports and Exports of the United States, from the 1st of October, 1789, to the 30the of September, 1838, taken from documents accompanying the Secretary of the Treasury’s annual Report to Congress, of the 3d of December, 1839.

To Henry Lee, Esquire, of Massachusetts, Colonel Clement C. Biddle, of Pennsylvania, and His Excellency Robert Y. Hayne, late Governor of South Carolina.

Gentlemen:

The conspicuous position held by you in the Northern, Middle and Southern sections of the United States, respectively, among the advocates of Free Trade, during the contest which happily terminated with the adoption of the compromise bill of March 2d, 1833, added to your claims upon the gratitude of the author of these essays for the intellectual aid which you extended to him during the prosecution of his work, have designated you as the particular friends to whom its dedication would be appropriate. To Mr. Lee is the country indebted for that most powerful and conclusive exposition of the practical operation of the Tariff upon the interests of Agriculture, Commerce and Manufactures, “The Boston Report,” which was first published in November, 1827, and to which may be ascribed the first impulse of re-action against the Restrictive System. To Colonel Biddle is it indebted for his instrumentality in disseminating sound views of public policy, through his notes appended to the six American editions of Say’s Political Economy, which have appeared under his editorial superintendence. To Governor Hayne is it indebted, whilst a member of the Senate of the United States, for a series of the most clear and scientific illustrations of the Principles of Free Trade, which have ever been presented to the American community, through the medium of public speeches. And to each of you, gentlemen, is the author indebted for much moral support through correspondence and personal intercourse, in the painful and trying situation in which he was placed for four years, whilst advocating an unpopular, and, at one time, what appeared to be a hopeless cause; and he begs you to accept of the assurance of his sincere acknowledgments, and of his best wishes for your individual health and happiness.

THE AUTHOR.

Philadelphia, August, 1835.

ADVERTISEMENT TO THE FIRST EDITION.

In offering to the public the present volume, the author trusts that a brief sketch of the circumstances under which its contents were originally written and published, will be acceptable to the reader.

During the war which was declared against Great Britain in 1812, and which was terminated in the commencement of 1815, the wants of the government led to a doubling of the duties which had been previously imposed upon foreign commodities. This increase of duties, accompanied as it was by diminished supplies from abroad, and by an increase of the expenses of import in the charges of insurance and freight, naturally augmented the prices of foreign products, and brought into premature existence several branches of domestic manufacture, which could only be sustained by a continuance of war prices. Accordingly, when an adjustment of the Tariff, adapted to a state of peace was about to be made, the manufacturers of cottons and woollens, whose interests were dependent upon a continuance of the double duties, earnestly solicited Congress, not for their permanent retention, but for such a gradual system of reduction as would enable them to avoid the ruinous effects of a sudden repeal. This reasonable request was listened to, and granted; and accordingly, by the act of April 27, 1816, the duties on certain descriptions of cotton and woollen goods were fixed at twenty-five per cent. ad valorem, until the 30th of June, 1819, when they were to be reduced to twenty per cent. Prior, however, to the arrival of this latter period, the manufacturers applied for a postponement of the time at which the reduction should take effect, and so strong an appeal was made by them to Congress, that, on the 20th of April, 1818, a law was passed, fixing the 30th of June, 1826, as the period of reduction. On the same day, two other acts were passed, one, entitled “An act to increase the duties on certain manufactured articles imported into the United States,” comprising manufactured copper, silver-plated saddlery, coach and harness furniture, cut-glass ware, tacks, brads and sprigs, and Russia sheetings; and the other, “An act to increase the duties on iron in bars and bolts, iron in pigs, castings, nails, and allum.”

The first of these acts destroyed the temporary character of the protection afforded by the act of 1816, to cottons and woollens, and the others virtually introduced the right of permanent protection, in reference to the articles therein enumerated, and thus laid the foundation of the restrictive policy, which was adopted as general by the acts of 22d of May, 1824, and May 19, 1828, known by the appellation of the “American System.” By those two laws duties were laid, with the manifest object of protection, upon almost every foreign commodity known to come into competition with the branches of domestic industry then in operation, and so unanimous was the voice of the Northern, Middle, and some of the Western states, in favour of the system, that it was generally deemed, in those sections, to be “the settled policy of the country.”

Amongst the few individuals residing north of the Potomac, who believed that the restrictive policy was adverse to the true interests of the country, and might be at least prevented from being pushed to absolute prohibition by proper efforts, was the writer of these essays, who, with the design of contributing his humble labours to the advancement of what he conceived to be so good a cause, commenced the publication, on the 1st of January, 1829, of a weekly paper, in octavo form, under the title of the “Free Trade Advocate.” After the completion of two volumes of that work, it was, on the 1st of December of that year, enlarged to the quarto form, under the name of the “Banner of the Constitution,” of which the third and last annual volume was completed in December, 1832.

The essays contained in this work comprise a selection from those which originally appeared as editorial in the publication just mentioned. The date of the appearance of each has been retained, for the reason that, as the Tariff from time to time during the three years embraced by the work underwent partial modifications, a history of its gradual reduction is thereby presented. These essays, however, do not reach the period of the final termination of the Free Trade conflict. On the 14th of July, 1832, an act was passed, containing a general modification of the duties, but the concessions therein contained, were not sufficient to satisfy the people of South Carolina, who had been the most conspicuous for their opposition to the restrictive policy. That state, accordingly, on the 24th of November, 1832, passed in convention an ordinance, declaring unconstitutional, and consequently null and void, and not operative in South Carolina after the 1st of February, 1833, the Tariff laws of the United States. The events which followed this measure are too well known to require a recapitulation here. Suffice it to say, that the most important of them was the passage, on the 2d of March, 1833, of a bill, entitled “An act to modify the act of the fourteenth of July, one thousand eight hundred and thirty-two, and all other acts imposing duties on imports.”

By this act, known as the Compromise Bill, it was provided that all existing duties exceeding twenty per cent. should be gradually reduced to that amount by the 30th day of June, 1842, which, having been satisfactory to S. Carolina, her ordinance was revoked, and thus was terminated a conflict which, at one moment, endangered the peace of the Union, and which it is to be hoped will never again be revived. There is good ground for believing, that the effects of the gradual reduction of the duties will be overcome by the manufacturers in most or all of the branches affected by it, by increased skill, economy, and improved machinery, so that the losses anticipated by them will not be realized. Such a consummation is devoutly to be wished. But should it unfortunately happen, that those amongst them who, for want of capital to procure the most improved machinery, or from possessing barren iron mines, or unfertile sugar lands, cannot stand the competition of the foreign market, should, at a future day, seek to revive the restrictive policy, they must be met as heretofore, by arguments addressed to the understandings of the people. A collection of such arguments, it is confidently trusted, will be found in this volume, which, although containing some matter applicable to a particular time and particular places, will be found to embrace the investigation of almost every question that is likely to be presented in connection with protective duties, for many years to come.

For the information of those who may wish to have access at a future time to a complete history of the Free Trade contest, the author takes the liberty of stating, that, in the two publications above-mentioned, and in the “Examiner,” a semimonthly work in octavo, published by him, of which the second volume was completed in July, 1835, will be found almost every important document and state paper, and an account of almost every movement growing out of the restrictive system which made its appearance, or occurred, subsequent to the year 1828. A copy of each of those works has been presented by the editor to the Library of Congress, the Library of the Pennsylvania Legislature at Harrisburgh, the Philadelphia Library, and the Library of the American Philosophical Society, where they may be seen.

Philadelphia, August, 1835.

ADVERTISEMENT

TO THE SECOND EDITION.v

The first edition of this work, published in 1835, having been exhausted, and the question of a protective tariff having been within the last eight months revived, with every appearance of an excitement of no ordinary extent, the present moment has been embraced by the Author as the best adapted in his opinion, for the favourable reception of a second edition. In the text of the book, no alterations except a few verbal ones have been made, inasmuch as upon a careful perusal, no errors of principle or of fact have been discovered, and the essays therefore appear, as originally written.

To this edition are added in the form of an appendix, the minutes of the original meeting, which called the Free Trade Convention, held in Philadelphia in the year 1831, together with the names of the two hundred respectable gentlemen from seventeen States of the Union, who composed that Convention. To these documents is added a Table of Imports and Exports of the United States, from 1789 to 1839, from which it will appear how greatly the foreign commerce of the country has been influenced by legislation, thus exhibiting a practical illustration of the truth of the principles inculcated in this volume.

It will be perceived by the title-page, that this edition is printed for the Author. The principles of free trade, although much more extensively acknowledged at the North, than they were ten years ago, are not sufficiently popular to induce booksellers to embark in a work of this character; and no middle course existed, between his undertaking it himself, and permitting the book to remain out of print.

Philadelphia, June, 1840.

ESSAYS on the PRINCIPLES OF FREE TRADE.

ESSAY No. I.

december 5, 1829.

Introductory remarks. General propositions connected with Free Trade, to be established by these essays.

THE last number of the “Free Trade Advocate,” a journal commenced in January of the present year, and continued weekly at Philadelphia, was published in that city on Saturday last, the 28th of November, and, agreeably to the arrangement sometime since announced, we now offer to the patronage of the public, the first number of the “Banner of the Constitution,” which will persevere in the support of the same principles, as those which were maintained by its predecessor.

To those who were not subscribers to the Free Trade Advocate, it may be proper upon this occasion to state, that that journal was established chiefly with the design of disseminating sound views of political economy in relation to the restrictive system, banking, currency, exchange, the balance of trade, the exportation of coin, the relative value of gold and silver, and the various other branches of the science, which are essential to be understood, in order to secure correct legislation. It was conceived by its editor, acting in conjunction with a number of zealous and enlightened friends of both the great political parties, that a proper understanding of these topics was so intimately connected with the prosperity of the people, and the perpetuity of this confederation of Republics, that an effort to draw the public attention towards a temperate and argumentative discussion, would be attended with at least the salutary effect of inducing many to examine for themselves, who had before formed their political opinions upon the judgment of others, without that mature investigation, by which alone the truths of any science can be established. How far our efforts have succeeded, we leave to the judgment of those who have witnessed the progress of our work, and if their decision be adverse to any claims on our part, on the score of successful exertion, they will at least not deny us the merit of having displayed an untiring zeal and devotion to the cause.

That the Free Trade party has gained an accession of strength, since the passage of the last tariff law, can scarcely be doubted. The admission of the fact is every where to be seen, in the alarm evinced by the advocates of restriction, lest during the approaching session of Congress, they should be placed, for the first time since the formation of the government, upon the defensive. It was displayed in a recent proposition submitted to the Legislature of New-Jersey, to instruct the representatives of that state in Congress, to oppose any change of the tariff. It was displayed in several speeches delivered at the Eastward on the 4th of July last, in which denunciations against the South, and vindictiveness against all who were influenced by the patriotic and benevolent wish, of seeing the labouring classes exempt from unjust and unequal burthens, were too conspicuous to have flowed from the mere feelings of triumph over a conquered opponent, and it continues to be displayed, in the unceasing efforts of certain journalists, to identify the anti-tariff party with the actual administration party, when, it is well known that, in many of our cities, some of the most strenuous supporters of the free trade policy, are not the friends of the administration.

Be this, however, as it may, it is manifest, that, let the ground be much or little, which has been gained by the advocates of untrammelled industry, that ground ought not to be lost through any relaxation of effort. The moment is propitious for pushing on the conquest, and whilst the champions who are placed within the walls of the capitol, are waging war in the front of the battle, let ours be the humbler task of skirmishing with the outposts. Nothing is wanted to overthrow the whole delusion which has been imposed upon the American people as a wise and judicious course of policy, but a dispassionate and unprejudiced examination of its real character, when divested of the false theories upon which it is built. Such an examination would shew—

That individuals are better judges of the most advantageous mode of employing their labour and capital, than governments—

That wealth cannot be created by the mere enactment of laws—

That commerce is an exchange of equivalents not merely beneficial to one of the parties which carries it on, but to both, by enabling each to exchange with the other, those products which it can furnish upon the most favourable terms—

That commerce must be reciprocal, and consequently, that when one nation restricts its trade with another, and says, “I will not buy,” she declares in the same words, “I will not sell.”

That as far as foreign nations refuse to take our productions, they ipso facto, and without requiring any laws on our part to enforce a retaliation, absolutely deprive us of the power to take their productions—

That it is an error, to suppose that free trade is only advantageous when adopted by all nations, and that the interests of a country are to be promoted by counter restrictions—

That commerce being an exchange of domestic products for foreign products, gives employment to domestic industry, inasmuch as foreign products can only be paid for with domestic products—

That all high duties exclude a portion, or the whole, of the articles upon which they are laid, by raising their price to the consumer, or, what is the same thing, by preventing the price from falling as low as it would otherwise fall, were it not for the duty, as is the case now, with all articles made of wool, cotton, iron, and many other things—

That this enhanced price is a real tax upon the consumer, which goes into the pocket of the favoured monopolist, not always, indeed, increasing his wealth, but preventing his loss from being as great as it would be, did the high duty not exist—

That the great fall which has taken place since the year 1816, in many articles of manufacture, has resulted chiefly from the great improvements in labour-saving machinery which have progressed not only in this country but in Europe, and which in England have advanced so rapidly, that we are informed, in late papers, that an article for the manufacture of which, 2s. 6d. used formerly to be paid, can now be had, materials and all, for 5d.—

That the complaint of the manufacturers that the duties are not high enough, is positive proof that foreign fabrics can be imported cheaper than they can be made at home, and, consequently, that there is a want of consistency in the conduct of those who assert that the tariff system brings down prices, whilst, at the same time, they demand more duties, and thus appear to court their own ruin—

That all artificial modes of raising prices, or, of preventing them from falling, are oppressions upon the poor and labouring classes, inasmuch as they are compelled to pay for the necessaries of life a higher price than they would otherwise have to pay, whilst the demand for their labour is diminished, from the circumstance that their employers, being themselves also obliged to give more for the articles of which they stand in need, have less means of giving employment to others than they would otherwise possess—

That all restrictive laws retard the gradual increase of capital, by rendering the producing faculties of the community less productive, and thus prevent that rapid accumulation of wealth, in which alone is to be found the means of affording employment to an increasing population—

That restrictive laws, by compelling people to abandon pursuits in which they find it their interest to labour, and to follow others, which are only made profitable to them by laying contributions upon all the rest of the community, operate precisely like laws which should compel A, without an equivalent, to contribute to the support of B, who has not even the merit of being entitled to such support, as a public pauper—

That restrictive laws operate upon the body politic as cords and bandages do upon the body natural, and equally diminish the power of production—

That restrictive laws operate precisely in the same manner as a law would operate, which should enact that a man with two hands should only labour with one—that a farmer who could work with a plough, should dig with a spade—that the owner of a cotton factory who has mules and spindles, should spin with the distaff—that a wood-cutter should chop trees with a dull axe instead of a sharp one—or, that a taylor should sew with a blunt needle instead of a sharp-pointed one—and, finally,

That the term “American System,” is a misnomer for what is nothing but the antiquated “British System,” and that its employment, for political party purposes, is a fraud upon the honest and patriotic feeling of the nation, devised for the purpose of appealing to the prejudices of the people upon a subject, upon which their understandings alone should be addressed.

These, and many other truths of similar import, we shall undertake to establish in this paper, to the satisfaction, we trust, of any individual who holds himself subject to the rule, that conclusions, logically drawn from premises, are not liable to be rejected or admitted at the pleasure of the reader, but must be admitted as data for subsequent arguments.

In the discussion of questions of political economy, it is manifest that much abstract reasoning, as in other sciences, is necessary for a complete understanding of them. Such reasoning, however, is only adapted to the studies of comparitively few, such, for example, as those who are selected for their supposed wisdom in the science of government, to make laws for the nation. The great mass of readers have neither a taste nor an inclination for severe investigation, and, on this account, whilst we must not lose sight of the duty of offering up a regular repast for those who delight in strong food, we shall study, as much as possible, the palate of those who can only digest a modorate and diluted portion of scientific truth.

ESSAY No. II.

january 9, 1830.

Remarks on the Report of the Committee of Manufactures, made to the House of Representatives on the 5th of January, 1830. Impossibility of protecting one branch of industry without injuring others. Observations on the phrase “The encouragement of manufactures,” employed in the preamble to the Revenue Act of 1789. Smuggling. Downfall of the American System foretold.

IN our last paper we gave the Report of the Committee on Manufactures, made to the House of Representatives on the 5th inst. on the subject of the Tariff, in which it was declared to be the opinion of the committee, that “it is inexpedient, at the present time, to make any change in the existing laws intended for the aid and protection of domestic industry.” This opinion may be regarded as evidence of the sense of a majority of the committee, who are favourable to protective laws, and is important in one point of view. It establishes the fact, that the American System has been brought to a halt, and we consider that the friends of agricultural and commercial freedom, have cause to congratulate themselves upon this auspicious symptom. If high duties are calculated to augment the wealth of the nation, and promote the prosperity of the people, why hesitate to push onward, when the cry of all the woollen manufacturers is, We are not sufficiently protected? If a doubling of the duties on low-priced woollens, be essential to the salvation of the manufacturers, as has been over and over again proclaimed by their most distinguished champions, why not abolish the one dollar minimum, and thus accomplish that which has been the burthen of the writings and speeches of editors and orators for a year past? But no: The report in question recommends an abstaining from all movements, and as this is the first instance since 1816, of a hesitancy, on the part of the advocates of restriction, to push still further their favourite policy, it may be regarded as evidence of doubt as to the efficiency of the American System, or as to their power to extend its desolating influence.

With these preliminary remarks, we shall take the liberty of commenting on such parts of the report as strike us as being particularly open to criticism.

The committee say, in reference to the applications for protection from different interests—“To do justice to all, and injury to none, was a delicate and difficult undertaking.” In this position, we differ from the committee. It was one of the easiest and most simple tasks imaginable. But it could be accomplished only by one mode, and that mode was to abstain from granting the request of either. If there be any doubt on this subject, we think it can be removed by a slight attention to a very simple illustration. A hatter says to Congress, “I wish a monopoly—I want a law which shall prohibit all other persons from selling hats.” Says the shoemaker, “I have no objections that the hatter shall charge every body double price for his hats, as I only wear one in a year, provided that Congress will prohibit all persons but me from selling shoes.” Says the tailor, “I will agree that the hatter and shoemaker may both tax the whole nation for their hats and shoes, provided that an equal protection be extended to me, by prohibiting every body from making clothes but me.” Congress listens to their pretensions, and grants them the desired monopolies. Now, how does the matter stand? The hatter pays the shoemaker and the tailor a tax, upon what he consumes of their fabrics, but, as a remuneration for this, he compels all the rest of his customers to pay a tax to him. The shoemaker and the tailor do the same thing. Now if this sort of protection, or monopoly, were extended through the whole circle of employments,—if each individual were bound to pay to others as much as others paid to him, then the protection would be equal. What a man paid out of one pocket, would be paid back into the other, and each one, at the end of the year, would stand in the same relative position, with this difference, however, that each would have had fewer of the comforts and necessaries of life, than if competition had been left free. But for protection to be equal, all employments must have monopolies, and as all cannot have them, it follows, that “justice to all and injury to none,” can never be the result of protective laws. Laissez-nous faire, is the only sound doctrine in such cases, and to suppose that laws, which authorize a dozen trades to levy contributions upon six hundred, are equal or just in their operation, is just as rational as to suppose that it would be advantageous for a community that every fiftieth man should be allowed to rob all the rest; for it can readily be seen, that there could be no equal justice in the case, unless each individual was allowed to rob all the others. Now if the question were fairly put, shall each man in the land be allowed to plunder all the others, or shall each be protected in the enjoyment of his property, which of the two propositions would be most likely to be adopted? The answer to this can be but in favour of the latter, and this is the answer which Congress ought to have given to the applicants for protection.

But was “the tariff of 1828, adopted as the best measure, under all circumstances, that could be devised to accomplish the desired object?” We think not. In some particulars it defeated the objects for which it was ostensibly enacted. It imposed high duties upon manufactures, and, at the same time, high duties upon the foreign materials, without which they could not be made. It thus destroyed the interest it was designed to uphold. It may perhaps have been the only measure, which, “under all circumstances,” could have been extorted from a majority of Congress. But it contained as much bitter as sweet, as much poison as honey; and this sad and solemn truth is now known to many, who, so far from regarding it as a measure advantageous to the manufacturing interest, have stigmatized it as “the bill of abominations.” So fully are we of the opinion, that this epithet is an appropriate one, that we do not believe there is in the whole law a single provision, which, by itself, would have had a majority of Congress in its favour. And shall such a monster, without a single feature allowed to be symmetrical by a majority of those who were present at its birth, be held up as an idol, which it would be sacrilege to touch?

But “it is now the law of the land.” This, unfortunately, is but too true, but we hope it will not long remain so. Indeed we think it cannot so continue for two years longer, if the calamities experienced in the manufacturing districts be as extensive as represented. Smuggling is now making rapid strides towards a fixed residence among us, and we shall be greatly mistaken, if another season does not witness New England herself coming to her senses, and calling out for the statu quo ante.

The committee think, “that any effort to change existing provisions, at the present time, would be wholly unsuccessful.” That is indeed quite probable. All attempts to repeal portions of the law, which have been found hurtful to particular interests, would meet with the undivided opposition of the members from the anti-tariff states. Whenever a sense of justice shall operate upon the North, and induce its representatives to propose a modification, which “shall do justice to all,” they will find a host ready to join with them in releasing the country from her shackles. And yet, notwithstanding the conviction of the committee, that any effort at modification would be unsuccessful, we are fully persuaded, that there is not in the law, a single duty, which, if presented by itself, would not find a majority in favour of its repeal.

“Great apprehension has been entertained that the protecting policy would, eventually, be abandoned.” And with good reason. The more its true character is known, the more must the people be convinced, that its tendency is to subvert the best interests of the country. Knowing this fact, are not apprehensions very natural, with those whose fortunes are placed at the disposal of the popular breath? And is it not a happy thing for the country, that the instability of the system, operates in restraining others from committing theirs to the same uncertain tenure? What sure guarantee can exist, in a representative government, for the continuance of a system, ascertained by a majority, for the time being, to be injurious to the interests of the nation? There can be none, and consequently there never can be a character of stability imprinted on that policy, which is believed, by a vast portion of the most intelligent people, to be hostile to the public prosperity; and, as we believe that the existing tariff law is opposed to sound policy, we shall ever use our feeble endeavours to repudiate the doctrine, so confidently laid down by the committee, that “nothing should be attempted that can, at home or abroad, be considered as giving the least countenance to the opinion or belief, that a hostile change will ever be effected.” We believe that such a change will be effected, and we further believe, that the proposition to effect it, will proceed from a portion of the very individuals who have, to their sorrow, fastened the system upon themselves and the country.

In a report proceeding from a committee containing a majority of advocates of protective laws, we are not surprised to find the fallacies of the restrictive system relied upon as arguments. We have here the old doctrine of foreigners selling us their goods for next to nothing, presented to us as a national evil. The Committee are of opinion, that if it was thought by foreign nations that we were not bound neck and heels by the cords of the restrictive system, they would force their fabrics upon us, “let the losses and sacrifices be ever so great.” This is all delusion. Foreign nations have no goods to dispose of in so silly a manner. And as to individual manufacturers, very few of them could afford to play at so losing a game for any length of time. We should like to know whether it is probable that the manufacturers of New England would be guilty of the folly of giving their goods for half price to the inhabitants of South Carolina and Virginia, in order to break down the cotton manufactures which some few individuals have been there recently establishing. If so, we should like to know how they would combine, and how long and how much they would be willing to contribute to this prostrating fund? The idea of such deliberate folly, as shipping goods to a known certain loss, is a fiction of the American System, and it has been so often repeated, that many persons take it as a fact which ought not to be doubted.

But the committee say, “It should be kept in mind, that the determination to protect the industry of this country, as far and as fast as circumstances would allow, has existed ever since the formation of our government.” We admit the position, so far as it refers to the acts of the government prior to the commencement of the restrictive policy; but we deny it, as relates to a subsequent period. During the former epoch, agriculture, commerce and manufactures, which conjointly constitute the industry of the country, were left in a state of freedom. The agriculturist, the merchant and the manufacturer, were at liberty to direct their capital and labour to any pursuit, which to them might appear to be most advantageous. Duties were imposed for the legitimate purposes of revenue alone, and were upon a scale so moderate, that no artificial excitement existed, to force into being any branches of industry but those, and they were not a few, which the natural course of things demanded. In this manner, the industry of the country was protected. During the latter period, on the other hand, “the industry of the country” has not been protected. The industry of manufacturers and of wool growers, and iron masters, has alone received the protection of the government. To call these few interests, which, to all the interests of the nation, bear an insignificant proportion, “the industry of the country,” is a sheer misnomer. As well might the hatter, the shoe-maker and the tailor we have referred to above, pretend, that “the industry of the country” was protected by their monopolies. We know very well, that the committee had their eye upon the preamble to the first act of Congress, which assigns “the encouragement of manufactures” as one of the motives of imposing a duty upon cotton and woollen fabrics of five per cent. But who cannot perceive, that the introduction of that phrase into the preamble was a mere expedient to render palateable to the people, even so small a duty, and one too imperiously called for by the exigencies of the government. Can any man seriously believe, who reflects that, at the present day, when, by the aid of machinery the inequalities of the wages of labour in different countries is so materially diminished, and who adverts to the fact that, from fifty to two hundred and twenty five per cent. duty is required to enable the manufacturers of this country to compete with those of Great Britain—can any man, we say, seriously believe that, in the year 1789, a duty of five per cent. could have been in any degree imposed for the purpose of encouraging the growth of manufactures? The idea is preposterous, and this will be manifest to all who reflect for a moment upon the fact, that, at the period designated, agriculture was so clearly the natural and most profitable channel for capital and labour to flow in, that higher duties would then have been required to divert them from that employment, than are required at the present day. Let the idea then be for ever discarded, as unworthy of reliance, that the act of 1789 was, in the most remote degree, designed for the protection of manufactures. It could not possibly so have been, if the application of means to an end was a branch of knowledge possessed by those who framed it, and it is evident, that the absurdity of so misplaced a reason was soon discovered, for it was omitted in the next act on the same subject, and has never since been restored.

In regard to frauds on the revenue, there may be, and there no doubt are, strong reasons for believing that many have been practised. Such frauds are as inseparable from high duties, as an effect is inseparable from its cause, and it is by means of these very frauds, that limits are placed upon the power of governors and legislators, which restrain them in their tendency to encroach upon the rights of individuals. We have no doubt that smuggling is fast usurping the seat of lawful commerce, and we are equally sure, that after it shall, by a continuance of the protection which is now so generously extended to it by law, (smuggling being the branch of industry most highly protected,) become fully established, it can never afterwards be eradicated from the country. The man whose moral feeling requires two hundred per cent. to tempt him to dishonesty, will, after the first plunge, be willing to continue in crime for twenty per cent. And yet this important fact, so fully established by the experience of all Europe and South America, is regarded by the manufacturers of this country, as a bug-bear conjured up by their opponents for the purpose of exciting their fears. The time, however, will come, when they will realize the truth of the solemn warnings which have been reiterated on this point, and will regret that the morals of the people, the only safe barrier against frauds upon the revenue, had been tempted beyond what they were able to bear.

In the last paragraph of their report, the committee has thought it expedient to throw out a suggestion, probably with the view of quieting those who have been clamorous for more of the “American System.” They say, “The alleged evasions of our revenue and protecting laws require an immediate and thorough investigation. If they are found to exist, the most effectual means should be employed to prevent them in future. When this is done, it is probable all may be satisfied that higher protecting duties should not be required. Until this is done, it is impossible to determine how efficient those duties may be made to operate. The committee have already proceeded to the consideration of this subject.” From this, we would infer, in case the existing frauds should be found to be of limited extent, and in case it should appear, that the glut of the market and the consequent fall of prices, has not resulted from evasions of the laws, as much as from other causes, that then it may become necessary to take another turn at the windlass. In other words, the hope is indirectly held out, that, at a future day, it may be found expedient again to take up the line of march, and push on with restrictions. We think, however, that no such onward movement will be again urged upon Congress, with any reasonable prospect of success. The Western states, which have now found that they experience no benefit from the American System, but, on the contrary, a positive injury in the tendency it has to discourage emigration to the West, will naturally look well to this point, and regard it as adverse to that growth of population which they expect will one day transfer the political power heretofore wielded by the Atlantic states, to the regions west of the Alleghany. Judging indeed, from what we see, we cannot avoid the belief, that the day is not distant, when a multiplicity of questions, involving interests of the most important nature, will be brought to bear upon each other, and in the conflict which is to ensue, we shall behold the American System crumble into atoms. For this prophetic annunciation, we shall perhaps be styled visionary. Be it so. We have no hesitation in encountering the risk of so being thought, by those who shall live five years hence, and whom we consider to be the only competent tribunal to pass judgment in such a matter.*

ESSAY No. III.

january 13, 1830.

Rail roads and Canals. Impolicy of constructing them prematurely. Principles on which expenditures should be regulated. Pennsylvania will be obliged to resort to direct taxation to sustain her internal improvement.

THE mania for rail-roads and canals, which has latterly seized upon the public mind in all parts of the United States, as the banking mania did in 1814, cannot but be attended with the most deleterious effects. In this country, it seems, nothing is done upon system, and the great mass of the nation actually believe that, the more we have of a good thing, the better. Now, although this be true, of the moral virtues, yet it is not true of roads and canals. One rail-road, or one canal, may be beneficial to the community, whilst a dozen may ruin it. This position, we are aware, will be regarded by many, as paradoxical, and therefore needs explanation.

An artificial road or canal, is never created by magic. It can only result from the expenditure of capital, and the extent therefore to which roads and canals can be made, without encroaching upon the fund required to keep in constant employment the various branches of industry which unitedly produce the wealth of the nation, must be a limited extent. If, therefore, the existing wealth of a state be such as to bear an abtraction of ten millions of dollars, for example, without touching upon the agricultural, commercial and manufacturing capital, which can be profitably employed by the farmers, the merchants, and the manufacturers in their respective pursuits, such abstraction may be made with great advantage to the public towards the construction of a road or canal, the location of which is such, that the diminution of the expense in the transportation of the merchandize and produce which pass along its surface, will be annually equal to the revenue which could be derived from the employment of the same capital in other pursuits. But if such capital cannot be spared without depriving existing occupations of the fund requisite to enable them to carry on their business to the extent to which it could be profitably conducted, it may happen, that more injury shall be sustained by the society from this source, than can be compensated by the road or canal.

A proper understanding of this principle, is essential for all sound legislation, but its particular application must be left to the judgment of those individuals whose capitals are to be devoted to the work. They, and they alone, are the best judges of the most profitable direction of their capitals, and if they err in their calculations, they have nobody to blame but themselves. Although it be true, that individual speculations of this sort have often failed, yet we apprehend that this has been principally owing to the facilities afforded by the state governments, in the granting of charters to companies, without a guarantee that the requisite amount of capital stock to complete the undertaking, could be raised by the parties applying for incorporation. In some instances the work has been commenced before a third of the sum required to accomplish it has been subscribed, and the consequence has been that a delay in its execution has annihilated for years all income from the expenditure, which is, pro tanto, a sinking of capital—or, that it has been abandoned, subject to a total loss of the outlay—or, that the original subscribers have advanced additional sums, not upon the principle of a profitable investment, but upon the principle of sending good money after bad, in the vain hopes of its overtaking and bringing it back.

In cases where the state itself undertakes the work, as in New York and Pennsylvania, the same reasoning, precisely, is applicable; but owing to the greater number of individuals who contribute to all public works, in the form of taxes, direct or indirect, and to the power which a government possesses of compelling posterity to pay for its follies, the evil is not so manifest, and indeed, if it were, there are politicians enough to be found, who, for the present improvement of their particular county, would not hesitate to saddle their great-grandchildren with the expense of making it.

The time must arrive, as it did with the banking mania, when the people will feel the effects of an improvident expenditure of capital in roads and canals. Many of them have not been called for by the actual state of population and wealth. Nor can they ever be productive to their proprietors, to an extent equal to the interest of the money expended, until after the lapse of many years. And we need hardly here say, that an expenditure of capital in the construction of a road or canal before it is wanted, is just as injudicious as it would be for a farmer to appropriate a part of his active agricultural capital to the construction of a wagon, many years before he would have any thing to transport to market.

The state of Pennsylvania is now beginning to feel the effects of improvident undertakings. She authorized too many improvements at a time, and, instead of completing one object before she commenced another, she involved herself in liabilities, from which nothing, we think, can extricate her but a direct tax.*

ESSAY No. IV.

january 13, 1830.

Ironical petition of oystermen and others, designed to shew the absurdity of laws restricting industry.

PETITION.

To the Honourable the Senate and House of Representatives of the United States:

The petition of the subscribers most respectfully represents, THAT your petitioners are inhabitants of the district of country which borders upon the river Delaware, and have been long engaged in the business of catching rock-fish and perch, in raking oysters, and in shooting wild ducks for the Philadelphia market—that in the pursuit of their respective occupations, your petitioners have set in motion a great quantity of American industry, such as that employed in fishing, and shooting, in boat-building, in navigating, and in selling fish and game in the market, and in transporting oysters in carts or wheelbarrows to the numerous oyster cellars of the city—that your petitioners are great admirers of the “American System,” inasmuch as it teaches the glorious truth, that home industry ought to be protected against foreign rivalship, and that it is unpatriotic for a people to send abroad for things which can be produced by themselves at home—that, holding these truths to be self evident, your petitioners have seen, with extreme regret, the completion of the Delaware and Chesapeake canal, which, owing to the superior abundance of fish, oysters, and wild ducks, on the waters of the Chesapeake, enables the fishermen, the oystermen, and the duck shooters, of Maryland, a foreign State, to undersell your petitioners in the home market—that this introduction of foreign fish, oysters and wild ducks, creates an unfavourable balance of trade against Philadelphia, by which a large amount of specie will be drained from her, which was not the case when your petitioners had the command of the home market, for they, in exchange for their fish, oysters and wild ducks, were in the habit of taking dry goods, groceries and liquors—that the notion entertained by many people, that it is good policy to buy cheap instead of dear, is one of the fallacies of the Free Trade System, and is very clearly so to your petitioners, who think that it would be manifestly for the benefit of the citizens of Philadelphia to buy their fish, oysters and wild ducks, at double price, rather than encourage the industry of foreigners, for it is humbly conceived that Maryland is as much a foreign state to Pennsylvania, as Great Britain is to the United States—that, in fine, your petitioners cannot pursue their several vocations without some Congressional aid:—

They therefore pray that your Honourable bodies, by virtue of that power granted by the Constitution, which authorizes any and every act which may be calculated to promote “the general welfare,” will impose a tax upon all fish, oysters and wild ducks, which may pass through the canal aforesaid, or entirely prohibit their importation into Philadelphia. And your petitioners, for thus putting money into their pockets, taken out of those of the consumers, will, as in duty bound, ever pray.

ESSAY No. V.

january 16, 1830.

Incompatibility of the interests of the wool growers, with those of the wool manufacturers.

IN the New-York Morning Herald a series of essays has been published, “On the policy of manufacturing in this country,” which have proceeded as far as No. 11. Those which we have seen, have contended most strenuously for the protecting system, but have advanced nothing by way of argument, different from the ordinary language of the great body of American System writers. The author, however, is evidently a sensible man, and practically acquainted with the details of manufacturing, and he has, in some of his essays, stated a number of facts which are well worth preserving.

In his eleventh essay he has pointed out the absolute incompatability of the interests of the wool growers and the wool manufacturers. He has shewn that, whilst the interests of the farmer are to be promoted by the high price of wool, the interests of the latter require that the raw material of their fabric should be at a low price; and he has ascribed the great imperfection of the present tariff law and its oppressive influence upon the manufacturers, to the erroneous information given by themselves to the committee of Congress, prior to its passage. We have copied in our paper of to-day this whole essay. It may be regarded as testimony of an important nature, coming from a party which can have no interest in making such an admission. The real fact is, that, not only in relation to the woollens, but also to the iron manufacture, an attempt has been made to reconcile discordant interests. If high duties are imposed upon raw materials to encourage the domestic production, just in proportion to those duties must be the discouragement of the manufacturers, and these duties may even be so high, that the foreign fabric can be imported, ready made, cheaper than the raw material. This we know to be the case in regard to some manufactures of iron. But why did the woollen manufacturers consent to the high duties on wool? Simply because they could in no other way secure a majority in Congress in favour of their protection. The farmers of the middle and Western states knew too well that high duties upon manufactures were a tax upon consumers, and they would not therefore willingly consent to this tax, unless a compromise could be effected, by which they should receive a part or the whole of it back again, in the form of a high price for wool. The compromise, however, failed of its object. To insure a monopoly, it is essential that a limited quantity only, of the commodity protected, can be produced. The gold diggers of North Carolina might enjoy the benefit of a monopoly, if Congress could impose a prohibitory duty upon gold, because that metal is only to be found in small quantities. But to attempt to create a monopoly for the growing of wool, when every man in the land can keep sheep, would not be less absurd, than an attempt to create a monopoly for the raising of wheat. This important truth appears to have been lost sight of by our legislature, as well as by our farmers, and the effects of their impolicy have been felt far and wide. Of all the capitals which are employed in production, a capital invested in living animals is the most likely to bring ruin on its proprietor, when the business is overdone. Steam engines may be stopped—machinery may be suspended, and factories may be closed when there is no demand for cloth—and all that the proprietor loses, is the rent of his buildings, and his water power, the interest on his capital, and the deterioration of his machinery, from its standing idle. In the case of sheep, the matter is different. They must be fed, or killed off. In either case, they may occasion a total loss; and as in the case of their being slaughtered, they will sell for no more than the price of the cheapest meat, which, including skin, fleece and all, in many places, does not exceed one dollar a head, all the surplus paid for a flock, is a capital annihilated for the owner. A vast extent of losses of this kind has already been experienced in New-England and elsewhere, and the probability is, that, before the business is over, some millions of dollars will have been lost to the farmers by this process.

But the question is, will the farmers consent to forego all the benefits of the American System, in favour of the manufacturers? Will they agree to pay the whole tax of supporting, not merely the wool manufacturers, but those of cotton and iron and glass, and all the rest who are favoured by the protecting laws, if they are to see no way by which they are to be remunerated in part, for such an enormous burthen? We think not, and we therefore consider it likely that the wool manufacturers will be held to the terms of the original compact. Finding then that no remedy is presented in this quarter, they may appeal for a total prohibition, which would be accomplished by striking out the one dollar minimum from the existing law. Such a measure would seal their doom. Smuggling would then take the entire place of lawful importations, and the market price of woollen fabrics, instead of being controlled, as it now is, by the rate of lawful importations, would settle down to the rates of smuggling.

ESSAY No. VI.

january 20, 1830.

Progress of Free Trade principles in the United States. North American Review. Boston Report. Southern Review. South Carolina Exposition. Dew’s Lectures on the Restrictive System. Doctor Cooper. Professor Mc Vickar.

IT is a source of great satisfaction to the advocates of a liberal intercourse with foreign nations, to observe the progress which the science of political economy is making in this country. Within the last two years the restrictive system has been more closely examined, as to its essential character, than at any former period, and materials have been collected, which are now at the service of any one who is disposed to understand the subject to the bottom, that will render hereafter the investigation of its doctrines comparatively easy. The old mercantile theory of Great Britain, brought over to the United States, and palmed upon the American people as a new discovery, had made great strides towards a general reception in the Northern and middle states. The immediate, direct and positive interest which those embarked in the cotton and woollen manufacture possessed in the establishment of a policy which should exclude foreign competition, had a most powerful operation. Writers and editors were also found, who, having no capacity to think upon abstract subjects, were easily induced to lend their aid in the dissemination of principles which were as adverse to the true interests of the community, as they were to the dictates of common sense; and, for a series of years preceding the passage of the last tariff law, the press overflowed with productions in praise of the American System, of which the inevitable tendency is, to depress agriculture and commerce, and promote the interests of comparatively few individuals. In vain was the voice of wisdom and warning resounded through the halls of Congress, by the numerous statesmen who have borne public testimony against the restrictive policy. In vain was the language of cogent and irrefutable reasoning poured out through the columns of the North American Review, presenting the subject in such various and intelligible aspects, that none could doubt who would read.* All, all was in vain. A delusion seized upon the public mind, and, like an epidemic disease, spread such havoc throughout the community, that the few who remained uncontaminated, were silenced by superiority of numbers, or thought it useless to attempt to oppose the torrent.

To the author of the “Boston Report” belongs the distinction of having first laid before the public, in the form of a volume, ample materials for arresting the progress of the delusion. In November 1827, a document, comprising near two hundred pages of the soundest reasoning, supported by the most satisfactory proofs, made its appearance as a “Report of a Committee of the citizens of Boston and vicinity, opposed to a further increase of duties on importations.”† To this work succeeded an able article on the tariff, in the Southern Review, and the “Exposition of South Carolina,” against the injustice and impolicy of the protective system, than which a more powerful appeal to the patriotism and common sense of the public has not often been seen.* That these works effected the commencement of a counter current in the public mind, is manifest to all who have felt interest enough in the question to watch its progress. We pronounce it, and we do so upon the evidence both of foes and friends, that the public faith in the American System has been shaken by the efforts of the last two years to enlighten the public mind, and we predict that the time is not very distant, when thousands, who have now scales on their eyes, will look back with amazement at the fallacies and delusion of which they have suffered themselves to be the dupes.

But the publications above referred to are not the sole evidence of the advance of the important truths to which they relate. The college of William and Mary, in Virginia, has lately, through one of her professors, Thomas R. Dew, Esq., as we have already mentioned, put forth a volume which does great credit to that institution, as well as to the gentleman named. His course of “Lectures on the Restrictive System, delivered to the senior political class” of that college, and published at Richmond in October last, may be regarded as a work of the highest merit. It comprises ten lectures, occupying near two hundred pages octavo, and enters so minutely and so intelligibly into an examination of the several fallacies of the restrictive system, that the writer has not left a single point untouched, and, as far as our humble judgment extends, we think he has not left a single point which has not been entirely refuted. As far as our recollection serves, we believe that this is the first course of lectures against the restrictive system pronounced in a seminary of learning in the United States, which has been published; although we are not ignorant of the fact, that Dr. Cooper, President of the South Carolina College, and professor McVicar, of Columbia College, New York, have both enriched the science of political economy by sound and erudite publications. Professor Dew’s lectures we warmly recommend to our readers, and if the trustees of our universities and colleges were generally to adopt a course of lectures upon political philosophy, as a branch of liberal education, the youth who are now at school, but who are hereafter to make laws for the country, would enter the public service with the acquirements requisite for statesmen, and not with the smattering of knowledge in politics that qualifies them solely for the functions of statistical collectors.

ESSAY No. VII.

january 23, 1830.

To benefit manufacturers, raw materials should be admitted free, or, at low duties. Incompatibility of the interests of the owners of iron mines, with those of blacksmiths, and other artificers in iron.

IN order to understand the true operation of the “American System” upon the different branches of industry, it is necessary to examine each by itself. The cunning and artifice by which the manufacturers, who are protected by enormous duties, have managed to impress the public with the idea that their cause is the common cause of all the manufacturers in the country, have been too successful, and the consequence has been, that many of those whose industry has always prospered under the most moderate rates of duty, have been persuaded that their interests would be promoted by granting to others a greater extent of protection than they themselves enjoyed. But this is not all: In some instances the boasted protection to the operative manufacturer, which has invested this “American System” with a great share of its popularity, has proved to be a sheer fraud. This has been especially the case with the manufacturers of iron, as has been most ably and most conclusively shewn by the blacksmith, whose communication was published in this paper on the 9th and 13th inst., and which would have done credit to any statesman in our legislative councils.*

To promote the interests of manufacturers, the raw material upon which they employ their labour should be always furnished at the lowest possible rate. This matter is so well understood in Great Britain, that wool is there admitted at one half penny per pound, if it cost less than one shilling, and one penny per pound if it cost above; cotton at a duty of six per cent., raw silk at one penny per pound, bar iron at six dollars sixty-seven cents per ton, pig iron at two dollars twenty-two cents per ton, hemp at twenty dollars seventy-five cents per ton, and flax at one penny per hundred weight. The British government understands too well the incompatibility which exists between the high prices of raw materials and the low prices of manufactured goods, to listen to the petition of the wool growers in favour of high duties on wool, and it knows that any attempts to enable the wool growing and the wool manufacturing interests to combine, would be fatal to both. The consequence therefore of their policy is, that raw materials can be purchased by the manufacturers of England, at a price so little above the prices which they bear at the places of their growth, that the fact in regard to many articles, of growing the raw material, has ceased to be an advantage worth speaking of.* The result therefore is, that Great Britain can manufacture cheaper than those countries which tax the raw materials, independent of the advantages she enjoys from abundance of capital and cheapness of labour.

Now what are the facts in reference to the United States? Why, for the sake of benefiting the producers of the raw materials, we have imposed so heavy a duty upon their importation, that the manufacturers have, in some cases, found that it more than counterbalances all the advantages they enjoy from the high duties imposed upon the manufactured articles. This is especially the case in the manufacture of iron. The duty upon bar iron is thirty-seven dollars per ton, which is less than the price that the English manufacturer has to pay for it, and as the duty upon many iron manufactures is but twenty-five per cent., the consequence is, that they can be imported and sold in the market at a less price per ton than the raw material can be imported for. This absurd result was very minutely and perspicuously explained in a petition from the iron manufacturers of Philadelphia, presented to the Congress of the United States prior to the passage of the last tariff law, and which was published at page 325 of the first volume of the Free Trade Advocate. Let such a duty therefore cease to be called a duty for the protection of the manufacturers of iron; it is a duty for their destruction; and can possibly benefit nobody but the owners of the land upon which the iron mines are located, who, by being authorized to levy a tax upon the consumers of bar iron, are enabled to pocket the amount, which would otherwise have gone into the pockets of the workmen, who have been deprived of the power of employing their industry in the fabrication of the raw material. That this is so, we refer to the petition above mentioned. It says: “We are completely shut out of our own market, by laws, we are told, that were made for our protection. Such articles as cost one penny and one penny and a half per pound to manufacture, which include all those articles which could be manufactured here to the best advantage, are now imported, and can be sold profitably at one hundred and seven dollars and twenty cents per ton, or two dollars and eighty cents less than the cost of the same quality of iron in most of our seaports.” A very important item, perhaps not thought of at the time by the petitioners, is the iron for rail roads, which, although in bars, is admitted under the denomination of manufactured iron, and is charged with but twenty-five per cent. This article can be imported at sixty dollars per ton, whilst the raw material of which it is made cannot be imported for less than eighty dollars.

What has taken place in regard to iron, has also taken place in reference to wool. The duty on that quality which cannot be raised in this country to advantage, is so high that the manufacturers say, that the duties on woollen fabrics, although ranging from forty-five to two hundred and twenty-five per cent., are not sufficient to protect them, and they consequently call out for more of the “American System.” Indeed, some of them say, that nothing short of prohibition will save them from ruin. We cannot however sympathise with this class of manufacturers, as we do with the manufacturers of iron. The “American System” was of their own seeking, whilst it was opposed by the others, as will appear from a reference to the cited petition, wherein it was expressly declared, that the petitioners were satisfied with the existing duties on manufactures of iron.

That the force of our remarks may be more apparent, we will quote the duties now payable in the United States upon the raw materials referred to. They are as follows:—

Wool, four cents per pound, and forty-five per cent., ad valorem besides.

Bar iron, thirty-seven dollars per ton.

Pig iron, twelve dollars and fifty cents per ton.

Hemp, fifty dollars per ton.

Flax, forty dollars per ton.

Upon cotton, the duty is three cents per pound, which, if any were imported, would be about thirty per cent., but this not being the case, it is a mere nominal duty.

ESSAY No. VIII.

january 30, 1830.

Ironical petition of the owners of gold mines for protection.

PETITION.

To the Honourable the Senate and House of Representatives.

THE petition of the subscribers respectfully represents: That your petitioners are of that class of political economists who believe that the wealth of a country consists in gold and silver, and having heard that gold mines had been recently discovered in the states of Virginia, North Carolina, South Carolina, and Georgia, they had been induced to abandon their agricultural, commercial and manufacturing pursuits, with the patriotic design of enriching the nation, by adding to the mass of the precious metals; which, unfortunately, owing to the balance of trade being against the country, are constantly exported. That your petitioners had not been long engaged in their new occupation, before they discovered that “all is not gold that glistens;” for, although a few individuals, who had the good fortune to strike upon fertile spots, have been successful in their enterprises, yet by far the greatest portion of those who were tempted to embark their capitals and industry in the mining business, have found, to their cost, that hunting for gold is not a more profitable business than ploughing for corn: Indeed it is thought by some, that, taking into consideration the loss of labour in unfruitful attempts to find the precious article, the discovery of these mines has thus far been rather a disadvantage than a benefit to the public.

It is easy, however, to account for the failure of these laudable experiments. Gold and silver are, as is well known to your honourable bodies, commodities produced by human labour, and it is wholly owing to the importation, free of duty, of foreign gold, which can be produced cheaper in Spanish and Portuguese America than in this country, that the home producers find their business unprofitable. Believing, as we do, that the American System is a grand panacea, in comparison with which Mr. Swaim’s is mere quackery, and that its application to the protection of gold-finders is as appropriate as to the manufacturers of cotton, wool, and iron, and especially of the last named, which is a kindred commodity, your petitioners respectfully solicit the attention of Congress to the reasoning which they use in favour of their claims.

One of the great objects of all governments is, to afford employment to the labouring classes, for labour being the only source of wealth, it follows that the more there is of it employed, the greater will be the mass of wealth created. Who cannot see, even if the great Chesapeake and Ohio canal should never be finished, that it will have been of incalculable benefit to the community, by giving employment to so many thousand labourers? Just so would it be with the gold mines of the Southern states. If properly protected by law, by the imposition of a duty of from forty-five to two hundred and twenty-five per cent. ad valorem upon foreign gold, they would set in motion an infinite quantity of American Industry, and would place the nation in the desirable situation of not being dependent upon foreign nations for gold.

The argument, it appears to your petitioners, is equally strong in their favour, as it was when urged in favour of the iron masters, and we can see no reason why a protection granted to them, should be withheld from us.

Your petitioners, therefore, relying upon the wisdom and justice of your honourable bodies, and believing that you possess the power by the constitution, to do any thing which is calculated to promote “the general welfare,” they earnestly beg that their petition may be granted. And, as in duty bound, they will ever pray.*

ESSAY No. IX.

january 30, 1830.

Comments on the bill reported on the 27th of January, to the House of Representatives, by the Committee of Manufactures. Impracticability of a just appraisement of manufactured goods by the officers of the customs.

THE bill reported by the Committee of Manufactures on the 27th instant in the House of Representatives, and which will be found at full length in our paper of this day, under its appropriate title, may be looked upon as the last struggle of the American System for a sickly existence. The manufacturers of wool, after having by the instrumentality of minimums and provisos, secured a protection of from fifty to two hundred and twenty-five per cent. upon their fabrics, under the modest nominal duty of forty-five per cent., and having found that this enormous tax upon the people was not enough to replace the losses incident to their trade, and that no chance existed for the enforcement of a new levy, have now resorted to a scheme, of which the tendency is to throw such difficulties in the way of importations, as will most materially diminish them, if not entirely destroy them. This scheme is in itself so novel in our country, and so fraught with mischief and injustice, that a brief analysis of its features will, we trust, be acceptable to those who are not conversant with commercial details.

By this bill it is required, that all woolen goods imported, shall be taken to the custom-house, and be there examined by appraisers, who shall inspect each piece and determine, without the aid of invoices or of oral evidence, “according to the best of their knowledge and belief, the actual value of each square yard of the same, at the place whence imported.” Now we do pronounce it to be wholly impossible for any man or set of men, to possess such a knowledge of the quality and prices of foreign woollen manufactures, particularily at a time of great fluctuations in the foreign markets, as would enable them to decide upon the cost with that certainty which should exist, when penalties of so exorbitant and tyrannical and unjust a character are proposed to be inflicted. Can it be believed, that a committee of the Congress of the United States should seriously propose to set up the judgment of any two or three individuals, in matters of a nature not susceptible of positive exactness, against the solemn oaths of the most respectable merchants of the country, upon whose integrity the nation has thus far relied for the means of supporting the government and of paying off its debts? Can it be believed, that such a committee would propose to invest such a tribunal, denied the use of the only evidence that could render their judgments worth respecting, with the power of doubling the duties upon whole invoices of merchandise, of confiscating entire packages, and of sentencing the unhappy victims of such cruel and arbitrary decrees to a forfeiture besides of double the amount? And yet this is the substance of the bill. By the third section it is enacted, that the appraisers shall determine the minimum valuation or class to which the goods belong, and consequently, they may decide that a piece of cloth, invoiced at forty-nine cents per square yard, cost fifty-one cents, or that one invoiced at ninety-nine cents, cost one hundred and one cents; the effect of which would be to throw them into a higher class, and thus subject them to twice the duty which they ought to pay. Such sporting with the property of a community might be suitable for countries where commercial honesty and oaths are held in no esteem, but for a land, distinguished above all others for its mercantile integrity and honour, it is as ill-judged and revolting a proposition as was ever before suggested.

Again, if these appraisers, upon the strength of their own judgment, should decide that the value of the goods at the place where they were purchased, is twenty per cent. more than the price at which they are invoiced, absolute forfeiture of the goods shall take place, and beside this, “all legal duties shall be paid, the same as if no forfeiture had taken place.” Now we candidly put the question to any reasonable man: Is it possible for any persons, however skillful in the value of woollen cloths, to decide with the precision which ought to exist where the property of a citizen is at stake, whether an article manufactured in Great Britain, France, or Germany, did in reality cost forty-nine or fifty-one cents, ninty-nine or one hundred and one cents? How could they decide with such unerring precision, whether an article in those countries where sales of bankrupts’ estates upon fluctuating markets are of constant occurrence, cost forty-five or fifty-five cents, ninety or one hundred and ten cents? And yet upon such fallibility of judgment does this bill stake the whole capital of our importers of woollen cloths. The measure is monstrous. It is calculated to deter our citizens from promoting the interests of the country by purchasing their foreign supplies cheap, through fear that by being successful in their speculations, they may be ruined. Look at the case of fluctuations in price at home: The very ground upon which the manufacturers rest their pretensions for this arbitrary measure, is conclusive as to the very fluctuation in prices which is denied to exist by this bill. It is because woollen goods have fallen, that the manufacturers require further restrictions upon importations; and yet upon a falling market abroad, they desire to urge the judgment of appraisers as better evidence of the actual cost of a commodity, than the invoice, supported by the oath of the very man who made the purchase. The whole tenor of this bill is proof of the desperate measures which the manufacturers would gladly resort to, to preserve their monopoly of the home market, and that to accomplish that, neither justice nor respect to private property would be regarded.