Text

But it is essential to make the following clear here and now: the economic regime of Great Britain is far from being based on the principle of freedom; wealth there is by no means distributed in a natural way; and finally it is far from being the case that, as Mr. Lamartine so nicely put it, thanks to free enterprise every activity obtains results such as no arbitrary system could offer. In fact, there is no country in the world, save those still cursed with slavery, where Adam Smith’s theory – the doctrine of laissez-faire, of non-interference - is less put into practice than in England, and where the exploitation of man by man has been more systematically developed.

And it should not be imagined, as some might argue, that it is precisely free competition that eventually brought about the subjection of labor to capital, of the working class to the idle. No, that unjust domination cannot be considered to result from, nor even to be a misapplication of, a principle that never guided British industry. In order to determine the origin of that domination, one would have to go back to an era that was most certainly not a period of freedom: to the conquest of England by the Normans.

But without retracing the history of the two races that tread the soil of Britain and who fought each other in so many bloody battles over civil, political and religious matters, it is appropriate here to recall their respective positions from the economic point of view.

The English aristocracy, as you know, owns all the land in the country. Moreover, they hold the legislative power. The question is simply: have they used that power in the interests of the community or in their own interests?

In Parliament, Mr. Cobden addressed the aristocracy itself in these words, “If our financial system, our statute book, could reach the moon, alone and without any historical commentary, it would take nothing more to show its inhabitants that it was the work of an assembly of landlords.”

When an aristocratic breed has both the right to make laws and the strength to enforce them, it is unfortunately only too true that they will legislate to their own advantage. That is a painful truth, which will, I know, sadden those kindly souls who rely, to remedy unjust practices, not on the reaction of those who suffer such practices, but on the free and brotherly initiative of those who exploit them. I wish someone could point out to me an example in history of such abnegation. But there has never been any example of it, be it among the upper castes in India, or among the Spartans, Athenians and Romans who are forever being held up to our admiration, or among the feudal lords of the Middle Ages, or the planters of the West Indies, and it is even most improbable that all those oppressors of mankind ever considered their power to be either unjust or illegitimate.

If one looks into what one could call the inevitable necessities of aristocratic breeds, one soon perceives that they are considerably modified and aggravated by what has been called the principle of population.

If the aristocratic classes were by nature stationary; if they were not endowed, like all other classes, with the ability to multiply, some degree of happiness and even of equality might be compatible with a regime resulting from conquest. Once the land had been shared out between the noble families, each of them would hand down its estates, generation after generation, to its only descendant, and one can imagine that in such a situation it would not be impossible for a working class to grow and prosper peacefully alongside the conquering race.

But conquerors multiply rapidly just like plain proletarians . While the frontiers of the country are unalterable, while the number of manorial estates remains the same, - because, so as not to weaken its power, the aristocracy is careful not to divide them up and hands them down in their entirety from eldest son to eldest son, - many families spring from the younger sons and multiply in their turn. These families cannot support themselves through work, since in the eyes of the nobility work is degrading. So there is only one means of providing for them, and that means is the exploitation of the working classes. External exploitation corresponds to war, conquests, colonies. Internal exploitation corresponds to taxes, government offices, monopolies. Civilized aristocracies usually practice both forms of exploitation; primitive aristocracies are compelled to deny themselves the latter form for a very simple reason, which is that there is no working class around them to despoil. But should the resources of external exploitation also happen to be lacking, what becomes of the children born of the younger branches of those primitive aristocracies? What becomes of them? They are smothered; for it is in the nature of aristocracy to prefer death itself to work.

“In the archipelagoes of the vast Ocean, the younger sons have no share in their father’s estate. They can therefore live only off the food given them by their elders, if they remain within the family; or off what may be given them by the enslaved population, if they enter the military association of the arreoys. But, whichever of the two choices they make, they cannot hope to perpetuate their race. The fact that they are unable to hand down any property to their children and maintain them in the status in which they are born, is no doubt what drove them to make a rule of smothering them

English aristocracy, although influenced by the same instincts as those that motivate Malay aristocracy (for circumstances vary, but human nature is the same the world over), found itself in a more favorable environment, if I may say so. Facing it and under it, the English aristocracy had the most hard-working, active, persevering, energetic and, at the same time, the most docile population in the world; it methodically exploited that population.

Nothing has ever been more vigorously devised or more resolutely carried out than that exploitation. The ownership of the soil puts legislative power in the hands of the English oligarchy; through legislation, this class systematically robs industry of its riches. Those riches are used by the oligarchy to pursue the policy of encroachments abroad that has subjected forty-five colonies to Great Britain; and those colonies in turn serve as a pretext for levying heavy taxes, large armies and a powerful navy, all at the expense of industry and to the advantage of the younger branches of aristocratic families.

We must give the English oligarchy its due. In its twofold policy of internal and external exploitation, it displayed remarkable cleverness. Two words, which imply two prejudices, were all it needed to win over the very classes that bear all the burden of its policy: it called monopoly Protection and it called the colonies Markets.

Thus the existence of the British oligarchy, or at least its legislative power, is not only a curse for England, it is furthermore a permanent danger for Europe.

And if that is the case, how is it possible for France to pay no attention to the mighty struggle in which the spirit of civilization and the feudal spirit are engaged before its very eyes? How is it possible for France not to know so much as the names of those men worthy of all the blessings of mankind: Cobden, Bright, Moore, Villiers, Thompson, Fox, Wilson, and a thousand others who dared go into action and who are keeping up the struggle with admirable talent, courage, devotion and energy? It is purely a question of commercial freedom, people say. Can’t they see that free trade will deprive the oligarchy of both the resources of internal exploitation, - monopolies, – and the resources of external exploitation, - colonies, - since monopolies and colonies are so incompatible with freedom of exchange, that they are nothing other than the arbitrary limit to that freedom.

But what am I saying? If French people are vaguely aware of the fight to the death that will settle the future of man’s freedom for a long time to come , they do not seem to be in favor of the triumph of liberty. For the past few years, they have been made to feel so scared of the words freedom, competition, over-production; they have been told so often that those words imply destitution, poverty, degradation for the working classes; they have heard it repeated so often that there is an English form of economics that uses liberty as an instrument of Machiavellianism and oppression, and a French form of economics, which, under the names of philanthropy, socialism, and organization of labor, is going to restore social equality on earth, - that they have taken a horror to a doctrine that is, after all, based only on justice and common sense, and which can be summed up in this axiom: “Let people be free to exchange between themselves the fruits of their labor whenever it suits them.” – If the current campaign against liberty were conducted only by imaginative souls, who wanted to formulate science without any preparatory study, it would be no great evil. But is it not a pity to see true economists, no doubt driven by a passion for popularity, however short-lived, yielding to that affected rhetoric and pretending to believe what they assuredly do not believe, that is, that poverty, the proletariat and the sufferings of the lowest social classes are to be attributed to what is called excessive competition and over-production?

Would it not clearly be most surprising if poverty, destitution and the deprivation of products had as their cause...what? Precisely the overabundance of products? Is it not peculiar that we should be told that if people do not have enough to eat, it is because there is too much food in the world? Or that if they do not have the wherewithal to clothe themselves, it is because machines cast too many clothes onto the market? Assuredly, poverty in England is an indisputable fact; the disparity between rich and poor is striking. But why seek out such a strange cause for those phenomena, when they can be explained by so natural a cause: the systematic exploitation of the workers by the idle?

At this point I must describe the economic regime in Great Britain, as it was during the last years preceding the partial, and in some respects deceptive, reforms that the present government has submitted to Parliament since 1842.

The first thing that strikes one in our neighbors’ financial legislation, and which cannot but astonish landowners on the Continent, is the almost total absence of land tax , in a country burdened by such a heavy debt and such a vast administration.

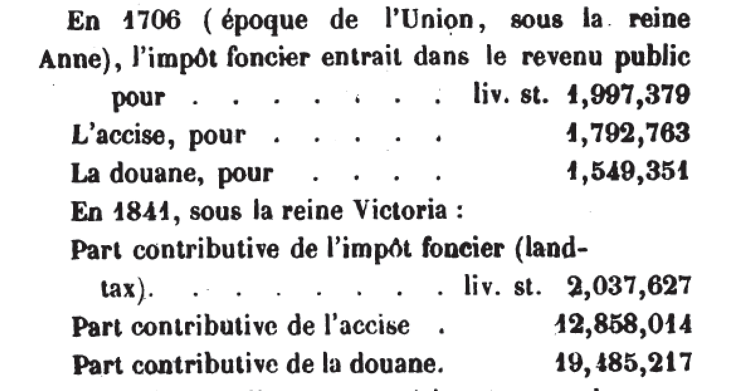

In 1706 (at the time of the Act of Union, under Queen Anne) , this was the share of public revenue made up

by land tax: £1 997 379 sterling

by excise tax: £1 792 763

by customs duty: £1 549 351

In 1841, under Queen Victoria,

share made up by land tax: £2 037 627

by excise tax: £12 858 014

by customs duty: £19 485 218

Thus, direct tax remained unchanged, while taxes on consumption increased tenfold.

And one should bear in mind that, during the same period, ground rent or landowner’s income increased by a ratio of 1 to7, so that the same estate that contributed 20 per cent of a person’s income tax under Queen Anne, today contributes less than 3 per cent.

You will also note that land tax makes up only one twenty-fifth of public revenue (£2 million out of the £50 million that constitute the overall revenue). In France, and in the whole of continental Europe, land tax makes up the largest portion of public revenue, if one adds to the annual tax the duties levied on transfers and inheritances. On the other side of the Channel, real estate is not subject to the above duties, although personal and industrial property is, and rigorously so.

One finds the same unfairness in indirect taxes. As they are uniform, instead of being graded according to the quality of the goods on which they are levied, it follows that they weigh incomparably more heavily on the poor than on the wealthy classes.

Thus pekoe tea costs 4 shillings and bohea tea 9 pence; the duty on both teas being 2 shillings, the former is taxed at a rate of 50% and the latter at a rate of 300%.

Thus refined sugar costs 71 shillings and unrefined sugar 25 shillings, so that the fixed duty of 24 shillings represents 34% for the former and 90% for the latter.

Similarly, ordinary Virginia tobacco, the poor man’s tobacco, pays 1 200% duty and Havana 105%.

The rich man’s wine gets off with 28%. The poor man’s wine pays 254%.

And so on for all the rest.

Then there is the Corn and Provisions Law, which one must fully appreciate.

The Corn Law, by banning foreign wheat or by levying on it exorbitant import duties, has as its aim to raise the price of home-grown wheat, as its pretext the protection of agriculture, and as effect an increase in income for landowners.

That the Corn Law aims to raise the price of home-grown wheat is acknowledged by all parties. By the Law of 1815, Parliament quite openly claimed that it would maintain wheat at 80 shillings per quarter; by the Law of 1828, it sought to secure a price of 70 shillings for the producers. The Law of 1842 (subsequent to Mr. Peel’s reforms, and which consequently does not concern us at this point) was calculated to prevent the price from falling below 56 shillings, which we are told is only just profitable. It is true that those Laws often failed in their objective; and, at this very moment, the farmers, who had relied on that decreed price of 56 shillings and signed their leases accordingly, are being forced to sell at 45 shillings. That is because, within the natural laws that tend to reduce all profits to a common level, there is a force that despotism cannot easily overcome.

On the other hand, it is no less obvious that the alleged protection for agriculture is a pretext. The number of farms for lease is limited; the number of farmers or potential farmers is not. Therefore, the competition existing between them forces them to be content with the barest profits to which they can confine themselves. If, as a result of the high price of cereals and livestock, farming were to become a very lucrative occupation, the landlord would not fail to raise the cost of the lease, and he would do so all the more easily as, in those circumstances, farmers would volunteer in considerable numbers.

Finally, that the landlord eventually reaps all the benefit from this monopoly can leave no one in any doubt. The surplus of the price extorted from the consumer has to go to somebody; and since it cannot stop at the farmer, it must perforce go on to the landowner.

But exactly how great is the burden that the wheat monopoly imposes on the English population?

To know the answer, one has only to compare the price of foreign wheat, at the warehouse, and the price of home-grown wheat. The difference, multiplied by the number of quarters consumed annually in England, will give the exact measure of the plunder legally carried out by the British oligarchy in this matter.

Statisticians disagree. They probably indulge in some exaggeration one way or the other, according to whether they belong to the party of the plunderers or the plundered. The authority that should inspire most confidence is no doubt that of the officers of the Board of Trade, called upon to solemnly express their views before a select committee of the House of Commons.

Sir Robert Peel, presenting the first part of his financial scheme in 1842, declared: “I believe that one should have every confidence in Her Majesty’s government and in the proposals that it sets before you, especially as the attention of Parliament was seriously drawn to these matters during the solemn enquiry of 1839”

In the same speech, the Prime Minister further said: “Mr. Deacon Hume, whose loss I am sure not one of us does not deplore, established that the country’s consumption amounts to one quarter of wheat per inhabitant.”

So the authority on which I am going to base my arguments lacks nothing, neither the competence of the man who expressed his views, nor the solemnity of the circumstances in which he was called upon to express them, nor even the official sanction of the Prime Minister of England.

On the subject with which we are dealing, the following is an extract from that remarkable exchange of question and answer:

**** Rechercher original de p.18. Intégral + références: p.431 éd.Guillaumin

Another official from the Board of Trade, Mr. MacGregor, answered:

“I consider that the taxes levied in this country on the riches produced thanks to the work and genius of its inhabitants, through restrictive and prohibitive duties, far exceed, probably by more than double, the sum total of the taxes paid to the Treasury.”

Mr. Porter, another distinguished member of the Board of Trade, well known in France for his work on statistics, testified to the same effect.

We can therefore take it as certain that the English aristocracy, through the implementation of the sole Corn and Provisions Law, robs the people of a portion of the product of its labor, or, which comes to the same thing, of a portion of the legitimately acquired satisfactions that the population could allow itself, a portion that amounts to 1 billion per year, and maybe 2 billion if one takes into account the indirect effects of that law. That is strictly speaking the share that the lawmaking aristocrats, the eldest sons, attributed to themselves.

It remained to provide for the younger sons; for, as we have seen, the aristocratic classes are no more than others bereft of the ability to multiply and, on pain of appalling family strife, they must guarantee a decent future for the younger branches of the family, - that is to say, excluding work, in other words, through theft, - since there are and there can be but two means of acquiring: by producing or by robbing.

Two fertile sources of income were made available to the younger sons : the Treasury and the colonial system. To tell the truth, those two entities are all one. Armies, a navy, in short, taxes are levied in order to conquer colonies, and colonies are maintained in order to justify the permanence of the navy, the armies or the taxes.

As long as people were able to believe that the exchanges that took place between the parent state and its colonies, by virtue of a reciprocal monopolist contract , were of a different and more advantageous nature than those that take place between free countries, the colonial system was able to find support through the nation’s misconception. But when science and experience (science being but methodical experience ) demonstrated beyond any doubt this simple truth: products are exchanged for products , it became obvious that the sugar, coffee, and cotton that one receives from abroad offer no fewer outlets for domestic industry than those same products coming from the colonies. Hence, the colonial system, which is moreover attended by so much violence and so many dangers, no longer has any reasonable or even specious motive to sustain it. It is nothing more than a pretext and an opportunity for tremendous injustice. Let us try to calculate its extent.

As far as the English population, I mean the productive class , is concerned, it gains nothing from the vast expansion of its colonial possessions. Indeed, if people are rich enough to buy sugar, cotton and timber, what does it matter to them whether they order those products from Jamaica, India, and Canada, or from Brazil, the United States and the Baltic? After all, the labor of English factory workers has to pay for the labor of the West Indian farm workers, just as it would pay for the farm labor of Northern nations. So it is madness to take into account the alleged outlets opened up to England by its colonies. The country would have those outlets even if the colonies were liberated, simply by purchasing goods there. In addition, it would have foreign outlets, of which it deprives itself by restricting its procurement of supplies to its colonies and granting them the monopoly thereof.

When the United States declared their independence, prejudice in favor of colonialism was at its height, and everybody knows that England believed its trade to be ruined. It believed this so strongly that it ruined itself beforehand in military expenses in order to retain that vast continent under its dominion. But what happened? In 1776, at the start of the War of Independence, English exports to North America amounted to £1 300 000; they totaled £3 600 000 in 1784, after American independence had been recognized; and today they add up to £12 400 000, a sum that almost equals that of the totality of England’s exports to its forty-five colonies, since that totality did not exceed £13 200 000 in 1842. – Indeed, it is difficult to see why the exchange of iron for cotton, or of cloth for flour should no longer take place between the two countries. Could it be because the citizens of the United States are now governed by a president of their choice instead of a Lord Lieutenant remunerated by the Exchequer? But what have those circumstances to do with trade? And if ever we were to appoint our own mayors and prefects, would that prevent Bordeaux wines from going to * Elbeuf and cloth made in Elbeuf from coming to Bordeaux?

Some people might say that, since the Declaration of Independence , England and the United States have mutually rejected each other’s products, which would not have happened if the colonial bond had not been severed. But those who raise that objection no doubt mean to present an argument in favor of my theory; they mean to suggest that both countries would have gained by freely exchanging the products of their soil and of their industry. May I ask why bartering wheat for iron or tobacco for cloth can be harmful according to whether the two nations who carry out the exchange are or are not politically independent of one another? – If the two great Anglo-Saxon families are acting wisely and in keeping with their true interests, in restricting exchanges between themselves, it must be because those exchanges are detrimental; and, in that case, they would also have done well to restrict them were an English Governor still in residence at the Capitol. – If, on the other hand, they acted unwisely, it means they were mistaken, it means they wrongly understood their interests, and it is difficult to see how the colonial bond could have rendered them more clear-sighted.

You should further note that the 1776 exports amounting to £1 300 000 cannot be assumed to have given England more than 20 per cent, or £260 000, profit; and is one to imagine that administering such a vast continent did not use up ten times that amount?

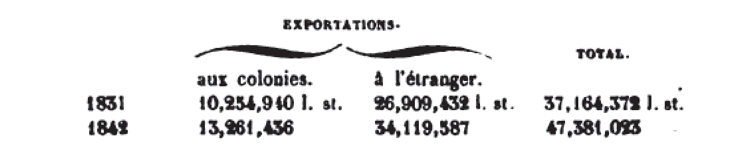

Besides, people overestimate the trade carried out by England with its colonies and especially the development of that trade. In spite of the fact that the English government compels its citizens to purchase their supplies from the colonies and settlers to purchase from the mother country, in spite of the fact that the customs barriers separating England from other nations have been prodigiously multiplied and reinforced in recent years, yet we see England’s foreign trade developing more rapidly than its colonial trade, as the following chart makes clear:

EXPORTS TOTAL

to the colonies to foreign countries

1831 £10 254 940 £26 909 432 £37 164 372

1842 £13 261 436 £34 119 577 £47 381 023

At both times, trade with the colonies only made up a little over a quarter of England’s overall trade. – The increase, over eleven years, adds up to about three million pounds. And it should be noted that the East Indies, to which the principle of free trade had been applied in the meantime, account for £1 300 000 in the increase, and Gibraltar, - which is not a source of colonial but of foreign trade, with Spain – for £600 000; which leaves a true increase in colonial trade of only £1 100 000 over a period of eleven years. During the same lapse of time, and in spite of our tariffs, exports from England to France rose from £602 688 to £3 193 939.

Thus, protected commerce progressed by 8 per cent, and impeded commerce by 450 per cent!

But if the English population did not gain, if it even lost a great deal owing to the colonial system, the same cannot be said of the younger branches of British aristocracy.

To begin with, the system requires an army, a navy, a diplomatic service, Lords Lieutenant, governors, residents, agents of all sorts and all designations. – Although it is presented as aiming to favor agriculture, trade and industry, such high offices are not, as far as I know, entrusted to farmers, merchants or manufacturers. It can be asserted that a large proportion of the heavy taxes that weigh mainly on the masses, as we have seen, is destined to pay the salary of all those agents of conquest who are none other than the younger sons of the English aristocracy .

Besides, it is a well-known fact that those noble adventurers have acquired vast estates in the colonies. They have been granted commercial protection; it is appropriate to calculate how much this costs the working classes.

Until 1825, English legislation on sugar was very complicated.

Sugar from the West Indies paid the lowest duty; sugar from Mauritius and India was subject to a higher tax. Foreign sugar was repelled by a prohibitive duty.

On July 5 1825 Mauritius was placed on an equal footing with the West Indies, as was the English part of India on August 13 1836.

The legislation thus simplified recognized only two kinds of sugar: colonial sugar and foreign sugar. The former had to pay 24 shillings and the latter 63 shillings per hundredweight.

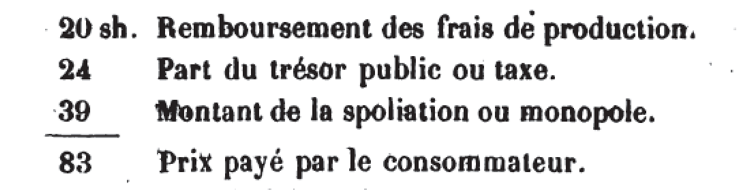

If one assumes, just for a moment, that the cost price is the same in the colonies and abroad, for example 20 shillings, the consequences of such legislation, be it for producers or for consumers, will be easily understood.

The foreign producer will not be able to present his products on the English market at less than83 shillings, that is: 20 shillings to cover production costs, and 63 shillings to meet the tax. – If colonial production happens to be insufficient to satisfy the market and if foreign sugar happens to be offered for sale, the market price (for there can be but one market price) will be 83 shillings, and, for colonial sugar, that price can be broken down as follows:

20 shillings Repayment of production costs

24 shillings Share taken by the Treasury, i.e. tax

39 shillings Amount taken by theft, i.e. monopoly

83 shillings Price paid by the consumer

It is obvious that the aim of the English law was to charge the population 83 shillings for what was worth only 20, and to share out the surplus, i.e. 63 shillings, so that the Treasury’s portion was 24 and the portion going to monopoly 39 shillings.

If things had happened in that way, if the aim of the law had been achieved, then, to know the sum total of the theft carried out by the monopolists at the expense of the population, one would need only to multiply 39 shillings by the number of hundredweight of sugar consumed in England.

But, with sugar as with corn, the law failed to a certain extent. Consumption, being limited by expensiveness, did not resort to foreign sugar, and the price of 83 shillings was never reached.

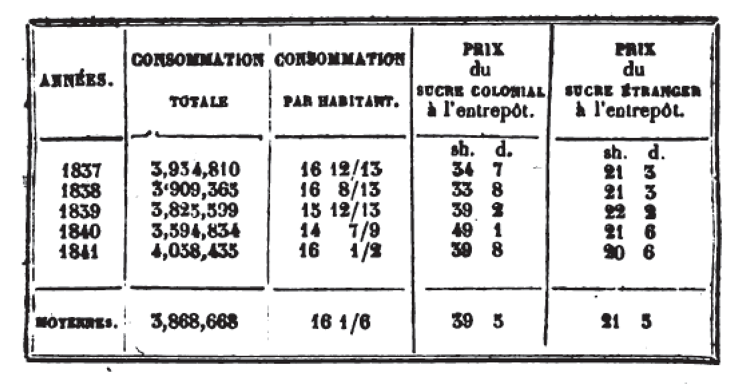

Let us leave the realm of hypotheses and look at the facts. Here they are, carefully noted down from official documents:

_________________________________________________________________________

YEARS TOTAL CONSUMPTION PRICE OF PRICE OF

CONSUMPTION PER CAPITA COLONIAL SUGAR FOREIGN SUGAR

at the warehouse at the warehouse

__________________________________________________________________________________________

shillings pence shillings pence

1837 3 954 810 16 12/13 34 7 21 3

1838 3 909 365 16 8/13 33 8 21 3

1839 3 825 599 15 12/13 36 7 22 2

1840 3 594 834 14 7/9 48 1 21 6

1841 4 058 430 15 ½ 38 8 20 6

__________________________________________________________________________________________

Averages 3 868 668 16 1/6 39 5 21 5

From the above chart, it is very easy to deduce the enormous losses inflicted by monopoly, either on the Exchequer, or on the English consumer.

Let us work it out in French currency and in round figures to make it easier for the reader to understand.

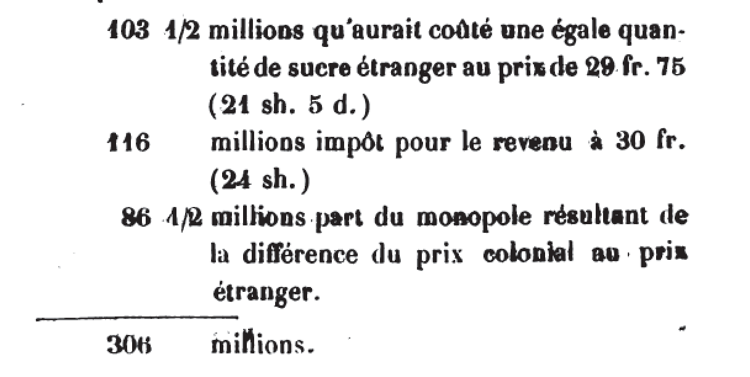

At the rate of 49 francs 20 centimes (39 shillings 5 pence), plus 30 francs’ duty (24 shillings), the average annual consumption of 3 868 000 hundredweight of sugar cost the English population the sum of 306 and a half million francs, which can be broken down as follows:

103 ½ million francs the price that an equal quantity of foreign sugar would have cost at a rate of 26.75 francs (21 shillings 5 pence)

116 million francs duty for the Inland Revenue at a rate of 30 francs (24 shillings)

86 ½ million francs share gained by the monopolists as a result of the difference between the colonial and foreign price

__________________

306 million francs

Quite clearly, under a system of equality and with a uniform duty of 30 francs per hundredweight, had the English population wanted to spend 306 million francs on that kind of consumption, for the price of 26.75 francs plus 30 francs’ duty, it could have had 5 400 000 hundredweight, or 22 kilos per person instead of 16. – On that assumption, the Treasury would have collected 162 million francs instead of 116.

Had the population contented itself with its present level of consumption, it would have saved 86 million francs per year, which would have afforded it other pleasures and opened up new outlets for its industry.

Similar calculations, which we shall spare the reader, show that the monopoly granted to forest owners in Canada costs the working classes of Great Britain, irrespective of duty , an extra 30 million.

The coffee monopoly imposes on them a surcharge of 6 500 000 francs.

Thus, on only three commodities from the colonies, over and above the natural price of the goods together with duty, a sum of 123 million francs is purely and simply taken from the consumer’s purse and paid into the pockets of the colonists, without any compensation.

I will end this dissertation, which is already too long, by quoting Mr. Porter, a member of the Board of Trade:

“In 1840, without taking into account import duty, we paid 5 million pounds more than any other nation would have paid for an equal quantity of sugar. In the same year, we exported £4 000 000’s worth to the sugar colonies ; so that we would have gained 1 million pounds by following the true principle, which is to buy on the most advantageous market, even if we had donated to the planters all the merchandise that they bought from us.”

As early as 1827, Mr. Charles Comte had had an intuition of what Mr. Porter demonstrates with figures, when he said: “If the English calculated how much merchandise they have to sell to the slave-owners in order to recover what they spend with a view to securing the latter’s custom, they would soon be convinced that the best thing to do would be to deliver their merchandise to them for nothing and thereby purchase freedom of trade.”

It seems to me that we are now in a position to appreciate the degree of freedom enjoyed by work and exchange in England, and to judge whether it is indeed to that country that one should go in order to observe the disastrous effects of open competition on the fair distribution of wealth and on equality of condition.

Let us recapitulate, and briefly sum up the facts that we have just established.

1° The elder branches of English aristocracy own the entire surface of the country.

2° Land tax has remained unchanged for one hundred and fifty years, although income from land has increased sevenfold. That tax accounts for only one twenty-fifth of public revenue.

3° Real estate is free of inheritance duty, although personal property is subject to it.

4° Indirect taxes weigh far less heavily on goods of superior quality, accessible to the rich, than on the same goods of inferior quality, available for the masses.

5° By means of the Corn Laws, those same elder branches levy a tax on the food of the masses that the best authorities set at one billion francs.

6° The colonial system, pursued on a very large scale, requires heavy taxation; and those taxes, paid almost entirely by the working classes, are also almost entirely the heritage of the younger branches of the idle classes.

7° Local taxes, such as tithes, also benefit those younger branches via the established Church.

8° If the colonial system demands the large scale setting up of armed forces, maintaining those forces in turn needs the colonial regime, and that regime leads to the monopoly system. As we have seen, on only three items, monopoly causes the English population a dead loss of 123 million francs.

I felt in duty bound to dwell at some length on setting out the above facts because they appear to me fit to dispel many a misapprehension, many a prejudice, many a blind bias. How many solutions, as obvious as they are unexpected, do they not offer to economists as well as to politicians?

And first of all, how could those modern schools of thought, who seem intent on drawing France into that system of mutual plunder , by making the country fearful of competition, I repeat, how could those schools persist in upholding that it was freedom that gave rise to pauperism in England? Say rather that it was the result of exploitation, of organized, systematic, persistent, pitiless exploitation . Isn’t that all at once a simpler, truer and more satisfactory explanation? What! Freedom leads to pauperism! So competition, free dealing, the right to exchange property that one has a right to destroy, entail an unfair distribution of wealth? Then the law of Providence must indeed be iniquitous! So we should hasten to replace it by some human law, and what a law! A law of restriction and prevention. Instead of allowing people to act, we should prevent them from acting; instead of allowing things to pass, we should prevent them from passing; instead of allowing people to exchange, we should prevent them from exchanging; instead of leaving the remuneration for work with the person who has actually done the job, we should hand it over to someone who has done nothing! So it is only on that condition that inequality of fortune between men can be avoided! “Yes”, you used to say, “Experience has shown that freedom and pauperism coexist in England.” But you will no longer be able to say so. Freedom and destitution are far from being in a relationship of cause to effect, in fact the former, freedom, does not even exist there. People are indeed free to work there, but not to enjoy the fruits of their labor. What do coexist in England are a small number of exploiters and a large number of exploited beings ; and there is no need to be a great economist to deduce that the former live in opulence and the latter in extreme poverty.

Then, if you have grasped the overall situation of Great Britain, as I have just depicted it, and the feudal spirit that presides over its economic institutions, you will be convinced that the finance and customs reform at present being implemented in that country is a matter affecting Europe and mankind in general, as well as England. It does not only involve a change in the distribution of wealth within the United Kingdom, but also a profound transformation in the country’s action abroad. Together with the unjust privileges of British aristocracy, the policies for which England has been reproached so much will obviously collapse, as will its colonial system, and its encroachments, and its armies, and its navy, and its diplomacy, in so far as they are oppressive and dangerous for mankind.

Such is the glorious triumph to which the League aspires when it demands “the total, immediate and unconditional abolition of all monopolies, of any protective duties whatsoever in favor of agriculture, industry, trade and navigation, in short absolute freedom of exchange.

Endnotes

abc